Question: could you answer question a , b , c , d and e You are starting up your own business as a corporation with 6

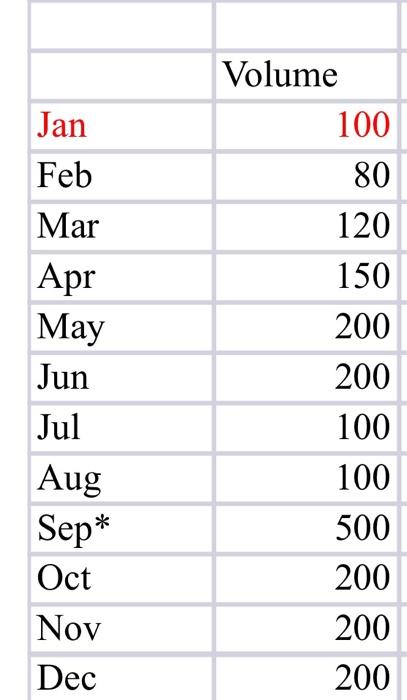

You are starting up your own business as a corporation with share capital. Each of you invests 3AR 40,000 cash in yoor thates, with each share having a value of $4h100. Your ageement is that at the end of the vear pou will ditribute earningi theauch a dividend of SAR 4 per thare, if your carh balance is more than 50s of the initial balance invested. The operation you are starting up is a online store, and you are planting to sell sousehold coods home desien pieces. Sioce you are a new husiness, you are starting with the same kind of mug that is decoeated to with the cuttomer name in callegraphic style writie, for this cask. Their alaty is SAA 5,000 a month. importanely, the calligapher has speleped a special type of font that makes your mugs veique, and har spent about 1 moeth worts of work doing so. You alio have hired a website developer, 5AR 10,000 a month, but all other tasks (distributien, rales manageme-t, adminitration and warehouse) are taken care of by you as the owner team. To itare your muge and run operatices, you have rented a small ipace for SAR 10,000 a menth, inclusve of ufilties. Howeret, vou have purchased eguipment for the calleprophy, warehouse and all other operations of SAR 60,000 . All equipment is eapected to be useful foe 5 years, and be evenly vsed theoughout this time period The mug you purchale from a susplier ahepad, tort per mugh inchefing kipping. SAE 2. Ves thange 34012 per mug with a regular font and sAt 16 per mug with the special foot. in the frit pear of operations, these ace monthly sales volume figures: fanc 100 Febe 80 Mar: 120 Apr. 150 May: 200 lune: 200 fut: 100 Auz 100 Septi 300 lintl 100 regular, plas 600 special order from a locat school] Dct: 200 Nav: 200 Deci 200 The business used the special font for the special order and charged sacis per magy. unce this was a bulk order Actociling to this, a new cortomer requested a special erder of 1000 mugh, paid upfroet, to be delivered in lanuary of the next year. The business ako parys tent eptront for a year from 1 july to 30 june. Firally, the business is currently thinbing about purchaning land to build their premines on the land. Follow the regular accounting oycle and set-up the accounting recording accordindy. Prepare tieancial statement ples basic notes for the financial vear 1 ant lo 11 Dec, it lne with ifits, and atvise en the following: a) Accoeding to IFRS, how thould they deal mith the rent payment? Explain pour choices in yose own words. b) According to Ifa5, how thould they deal with the specially developed caligraphy fisen? c] The bunineis wants atrice on whether to fellow Nitoric cost or tevaluatien for the Gend a is thieking to buy and al other assets it deals with. Accordere to IFRS, provide comprehenshe advice on how they can apply the revaluation appeosch, t at all d) Bared on year 1 , what is the business's wotainable erwwth cate? e) The butinest thinks about atedining another, related, busitess that will alate over the uales function in a buiy shopping zone (new Dinyah development in flupath). This is a iuctestifully running buineis whove owher wants to meve on to a new virtare. A kas had stable protics over the previous three yeaes, around 545501 per yeat. On the basis of IFRS, advise how to aooroach the acquinition. if at al. Volume \begin{tabular}{|l|r|} \hline Jan & 100 \\ \hline Feb & 80 \\ \hline Mar & 120 \\ \hline Apr & 150 \\ \hline May & 200 \\ \hline Jun & 200 \\ \hline Jul & 100 \\ \hline Aug & 100 \\ \hline Sep* & 500 \\ \hline Oct & 200 \\ \hline Nov & 200 \\ \hline Dec & 200 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts