Question: could you help me answer this question, thank you Current Attempt in Progress The two following separate cases show the financial position of a parent

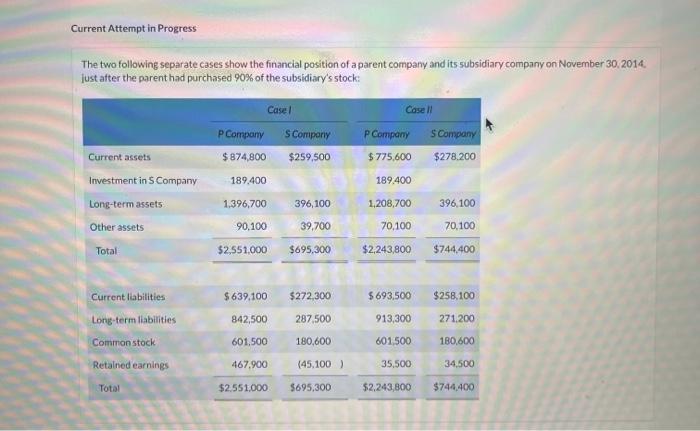

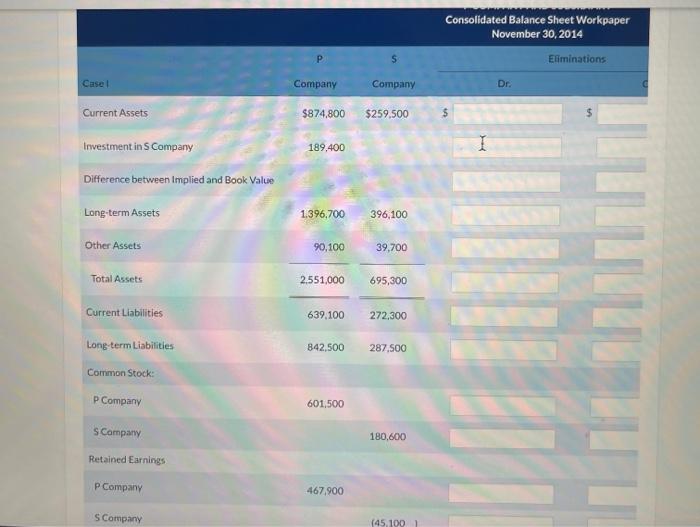

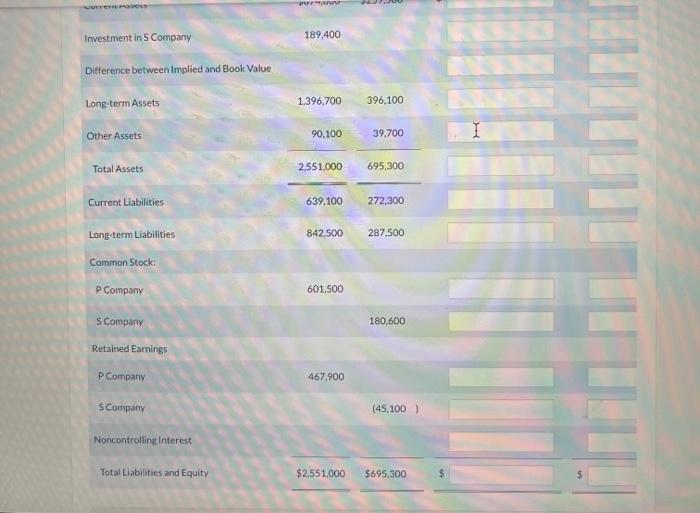

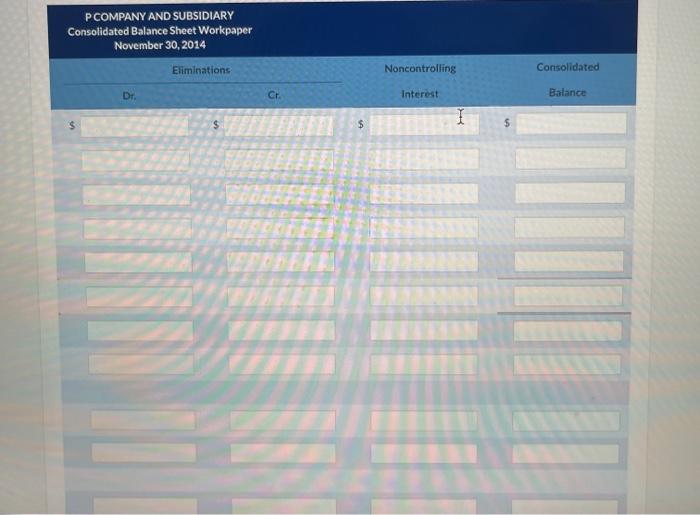

Current Attempt in Progress The two following separate cases show the financial position of a parent company and its subsidiary company on November 30,2014 . just atter the parent had purchased 90% of the subsidiary's stock: Consolidated Balance Sheet Workpaper November 30, 2014 Difference between Implied and Book Value Long-term Assets 1,396,700396,100 Common Stock: Retained Earnings Investment in 5 Company 189,400 Difterence between Implied and Book Value Long-term Assets 1,396,700396,100 Other Assets Total Assets Current Liabilities 639,100272,300 Long term Liabilities 842,500287,500 Common Stock: PCompany 601,500 SCompany 180,600 Retained Earnings PCompany 467,900 5 companr (45,100) Noncontrolling Interest Total Liabilities and Equity PCOMPANY AND SUBSIDIARY Consolidated Balance Sheet Workpaper November 30,2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts