Question: Could you help me to solve this problem, thank you so much! Calculate the total net operating capital for 2017 and 2018. *Note: This requires

Could you help me to solve this problem, thank you so much!

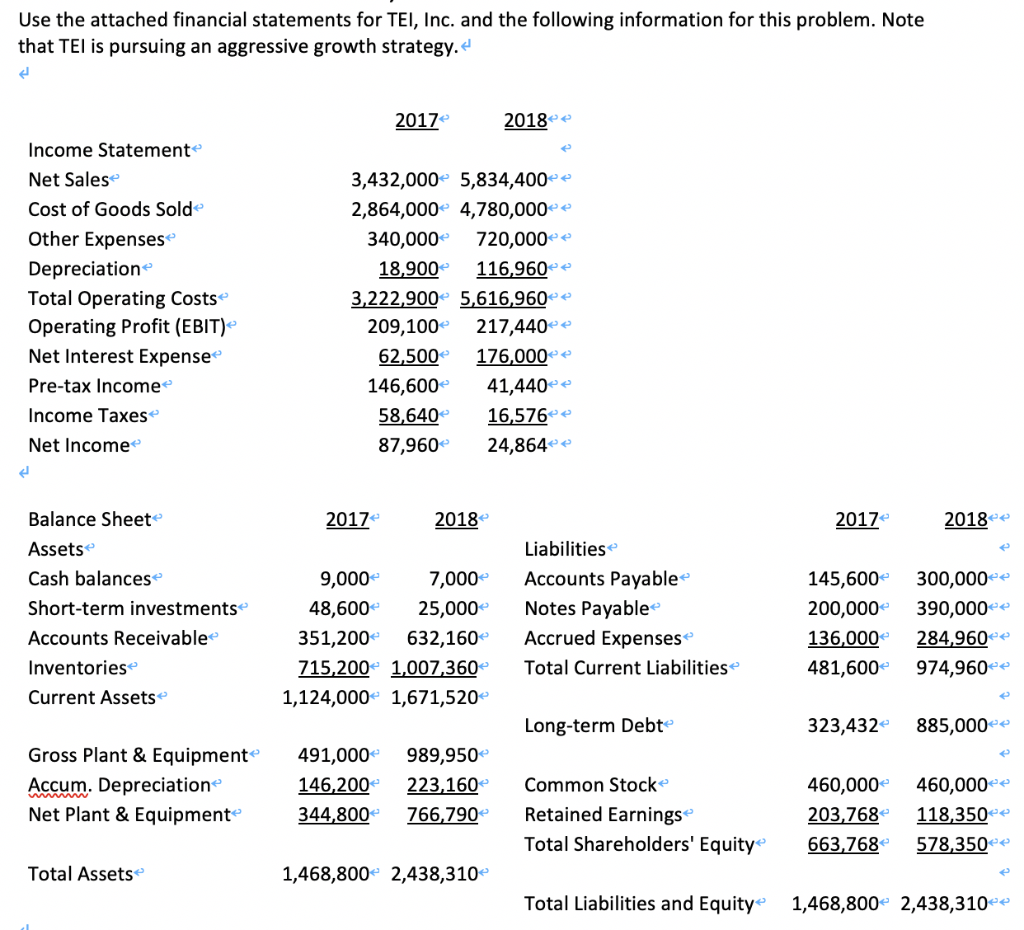

- Calculate the total net operating capital for 2017 and 2018. *Note: This requires first finding NOWC (Oper Current Assets Operating Current Liabilities) for each year and then adding net fixed assets for each year.

- Calculate NOPAT for 2017 and 2018

- Calculate Free Cash Flow for 2018

- Calculate the Return on Invested Capital (ROIC) for 2017 and 2018 (Note: ROIC=NOPAT/Total Net Operating Capital (NOC)) *Note: NOC is the ending balance at the end of each year, not the investment in NOC, or difference, for the year.

- When is it acceptable for a company to have negative FCF? Based on your results for ROIC above, and considering a WACC of 9.5% for TEI, has this company added value with its aggressive growth? Why or why not?

Use the attached financial statements for TEI, Inc. and the following information for this problem. Note that TEl is pursuing an aggressive growth strategy.d 2017 2018- Income Statement Net Sales Cost of Goods Sold Other Expenses Depreciation Total Operating Costs Operating Profit (EBIT) Net Interest Expense* Pre-tax Income Income Taxes Net Income 3,432,000 5,834,400- 2,864,000 4,780,000* 340,000 720,000 18,900 116,960 3,222.900 5,616,960 209,100* 217,440 62,500 176,000 e 146,600e41,440 58,64016,576e 87,960 24,864-e 2017 Balance Sheet Assets Cash balances Short-term investments Accounts Receivable Inventories Current Assetse 2018 2017e 2018e Liabilities 9,000 7,000 Accounts Payable* 48,600 25,000 Notes Payable 351,200 632,160 Accrued Expenses 715,200 1,007.360 Total Current Liabilities 145,600 300,000 200,000 390,000+ 136,000 284,960e 481,600 974,960 1,124,000* 1,671,520 Long-term Debt 323,432 885,000+ Gross Plant & Equipment 491,000 989,950e 146,200 223,160 Common Stock Accum. Depreciation Net Plant & Equipment 460,000 460,000 e 203,768 118,350e 344,800 766,790 Retained Earningse Total Shareholders' Equity 663.768 578,350 Total Assets 1,468,800 2,438,310* Total Liabilities and Equity 1,468,800* 2,438,310 Use the attached financial statements for TEI, Inc. and the following information for this problem. Note that TEl is pursuing an aggressive growth strategy.d 2017 2018- Income Statement Net Sales Cost of Goods Sold Other Expenses Depreciation Total Operating Costs Operating Profit (EBIT) Net Interest Expense* Pre-tax Income Income Taxes Net Income 3,432,000 5,834,400- 2,864,000 4,780,000* 340,000 720,000 18,900 116,960 3,222.900 5,616,960 209,100* 217,440 62,500 176,000 e 146,600e41,440 58,64016,576e 87,960 24,864-e 2017 Balance Sheet Assets Cash balances Short-term investments Accounts Receivable Inventories Current Assetse 2018 2017e 2018e Liabilities 9,000 7,000 Accounts Payable* 48,600 25,000 Notes Payable 351,200 632,160 Accrued Expenses 715,200 1,007.360 Total Current Liabilities 145,600 300,000 200,000 390,000+ 136,000 284,960e 481,600 974,960 1,124,000* 1,671,520 Long-term Debt 323,432 885,000+ Gross Plant & Equipment 491,000 989,950e 146,200 223,160 Common Stock Accum. Depreciation Net Plant & Equipment 460,000 460,000 e 203,768 118,350e 344,800 766,790 Retained Earningse Total Shareholders' Equity 663.768 578,350 Total Assets 1,468,800 2,438,310* Total Liabilities and Equity 1,468,800* 2,438,310

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts