Question: could you please answer question #11 and 12 Problem #11 (3 points) A taxpayer received a parcel of land as a gift. At the time

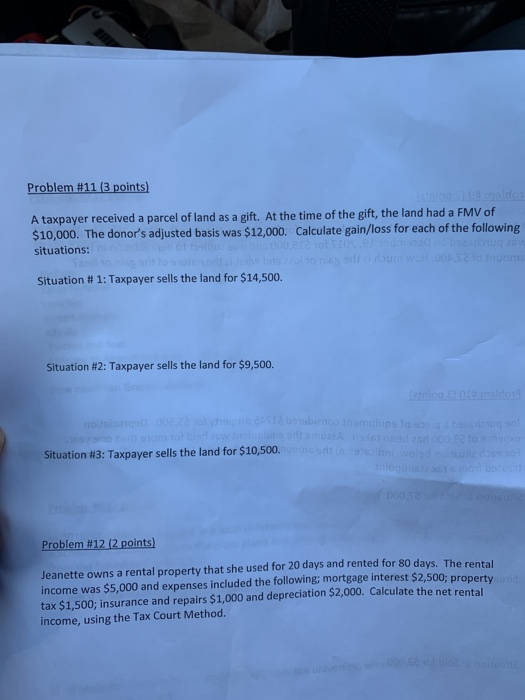

Problem #11 (3 points) A taxpayer received a parcel of land as a gift. At the time of the gift, the land had a FMV of $10,000. The donor's adjusted basis was $12,000. Calculate gain/loss for each of the following situations: Situation # 1: Taxpayer sells the land for $14,500. Situation #2: Taxpayer sells the land for $9,500. t no tomo afinanto Situation #3: Taxpayer sells the land for $10,500. son ng as 002 to 2 b ini wolonelu 59 10 Inlogge 16 Problem #12 (2 points) Jeanette owns a rental property that she used for 20 days and rented for 80 days. The rental income was $5,000 and expenses included the following; mortgage interest $2,500; property tax $1.500; insurance and repairs $1,000 and depreciation $2,000. Calculate the netre income, using the Tax Court Method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts