Question: Could you please find the Solution for this question . Problem 4) Wilson Security has received a contract to provide additional security for corporate and

Could you please find the Solution for this question .

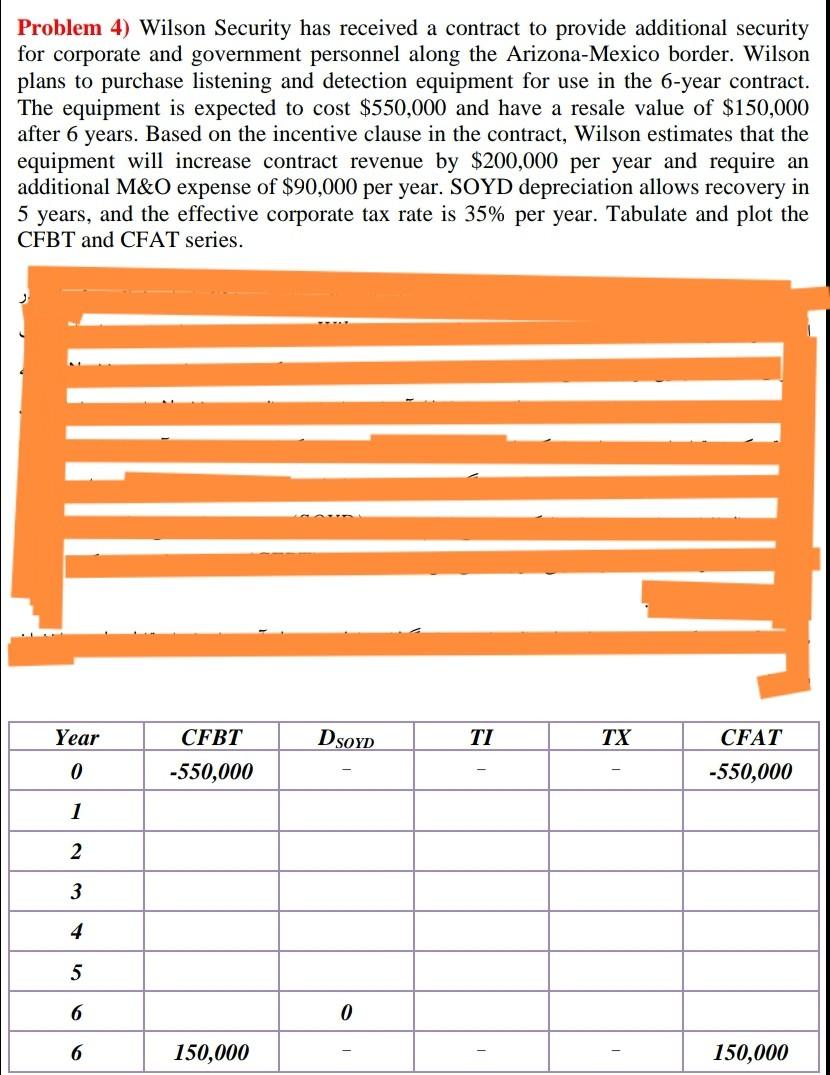

Problem 4) Wilson Security has received a contract to provide additional security for corporate and government personnel along the Arizona-Mexico border. Wilson plans to purchase listening and detection equipment for use in the 6-year contract. The equipment is expected to cost $550,000 and have a resale value of $150,000 after 6 years. Based on the incentive clause in the contract, Wilson estimates that the equipment will increase contract revenue by $200,000 per year and require an additional M&O expense of $90,000 per year. SOYD depreciation allows recovery in 5 years, and the effective corporate tax rate is 35% per year. Tabulate and plot the CFBT and CFAT series. Year DSOYD TI TX CFBT -550,000 CFAT -550,000 0 1 2 3 4 5 6 0 6 150,000 150,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts