Question: Could you please help me to answer the part A questions! Thank you very much! FINANCIAL STATEMENTS-2014 (A )From attached financial statements (pages 4,5&6) 1.

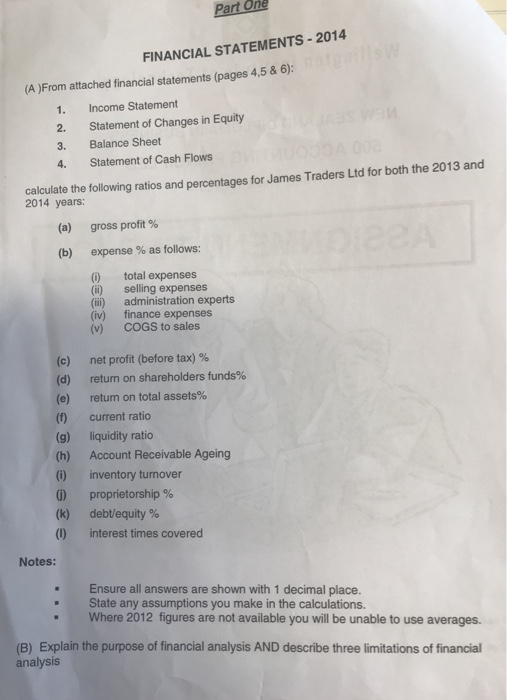

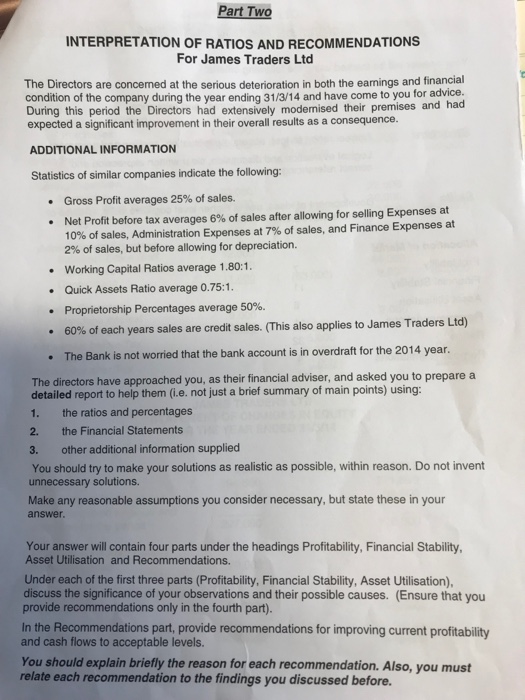

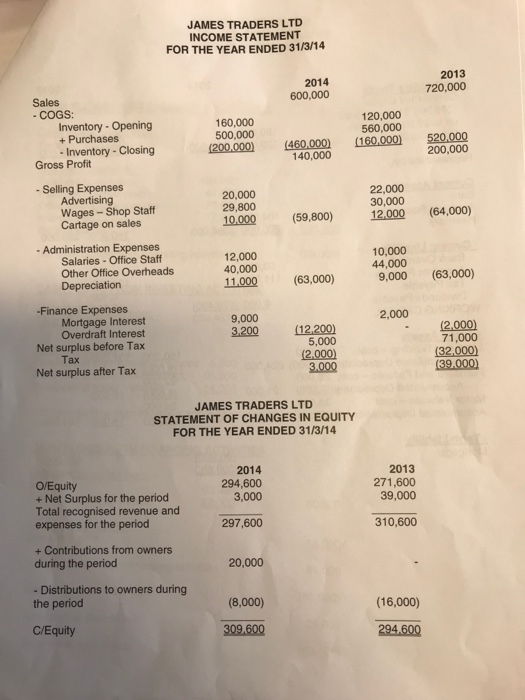

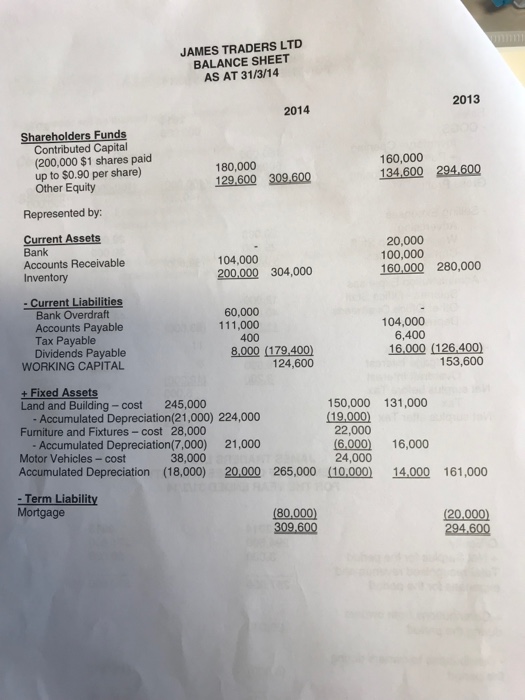

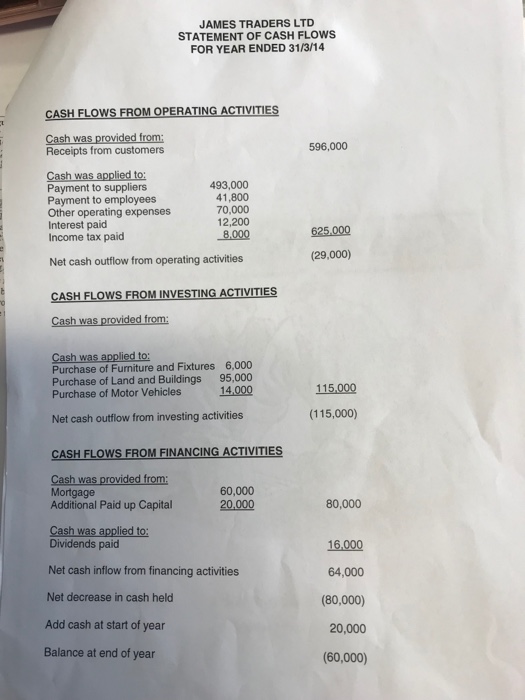

FINANCIAL STATEMENTS-2014 (A )From attached financial statements (pages 4,5&6) 1. 2. 3. 4. Income Statement Statement of Changes in Equity Balance Sheet Statement of Cash Flows Traders Ltd for both the 2013 and calculate the following ratios and percentages for James 2014 years: (a) gross profit % (b) expense % as follows: (i) total expenses (ii) selling expenses (i) administration experts (iv) finance expenses (v) COGS to sales (c) net profit (before tax) % (d) retum on Shareholders funds% (e) retum on total assets% () current ratio (9) liquidity ratio (h) Account Receivable Ageing (i) inventory turnover (k) (1) proprietorship % debt/equity % interest times covered Notes: Ensure all answers are shown with 1 decimal place. State any assumptions you make in the calculations. Where 2012 figures are not available you will be unable to use averages. (B) Explain the purpose of financial analysis AND describe three limitations of financial analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts