Question: Could you please solve this question? Thank you. Consider a market with a risk-free interest rate of 3%. Suppose you have a short position in

Could you please solve this question? Thank you.

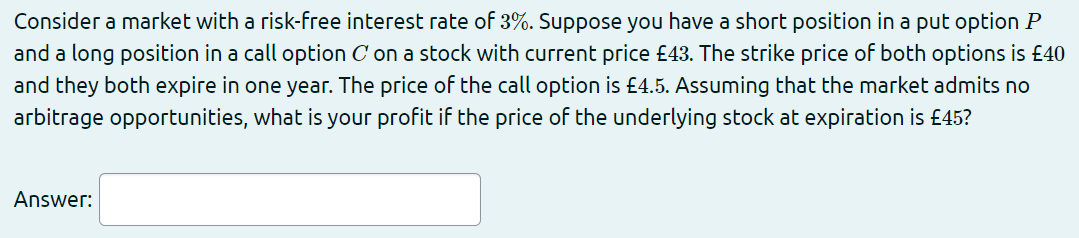

Consider a market with a risk-free interest rate of 3%. Suppose you have a short position in a put option P and a long position in a call option C on a stock with current price 43. The strike price of both options is 40 and they both expire in one year. The price of the call option is 4.5. Assuming that the market admits no arbitrage opportunities, what is your profit if the price of the underlying stock at expiration is 45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts