Question: CPA_Far practice problem can you help me explain the answer ? thank you FAR F1 Conceptual Framework and Financial Reporting MCQ-00216 Ocean Corp.'s comprehensive insurance

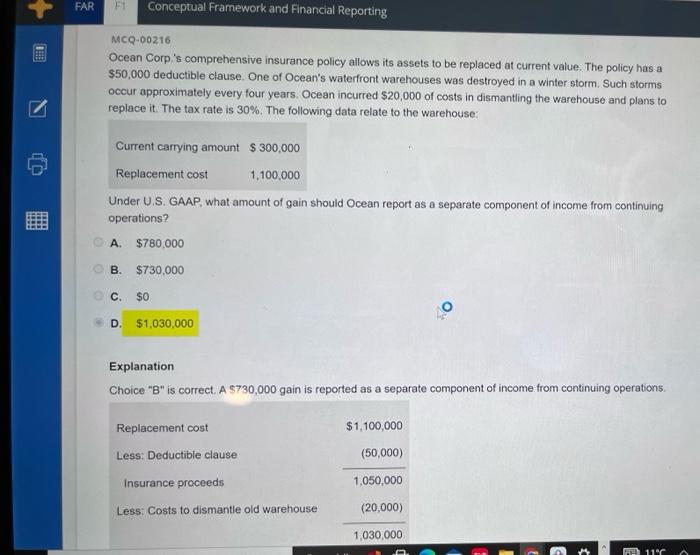

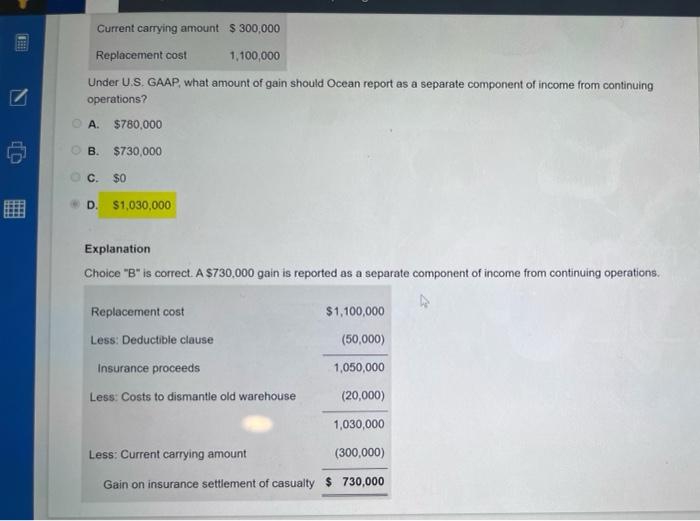

FAR F1 Conceptual Framework and Financial Reporting MCQ-00216 Ocean Corp.'s comprehensive insurance policy allows its assets to be replaced at current value. The policy has a $50,000 deductible clause. One of Ocean's waterfront warehouses was destroyed in a winter storm. Such storms occur approximately every four years. Ocean incurred $20,000 of costs in dismantling the warehouse and plans to replace it. The tax rate is 30%. The following data relate to the warehouse: Current carrying amount $300,000 Replacement cost 1,100,000 Under U.S. GAAP, what amount of gain should Ocean report as a separate component of income from continuing operations? A. $780,000 B. $730,000 C. $0 D. $1,030,000 Explanation Choice "B" is correct. A $730,000 gain is reported as a separate component of income from continuing operations. Replacement cost $1,100,000 Less: Deductible clause - (50,000) Insurance proceeds 1,050,000 Less: Costs to dismantle old warehouse (20,000) 1,030,000. 117 Current carrying amount $ 300,000 Replacement cost 1,100,000 Under U.S. GAAP, what amount of gain should Ocean report as a separate component of income from continuing operations? A. $780,000 B. $730,000 C. $0 D. $1,030,000 Explanation Choice "B" is correct. A $730,000 gain is reported as a separate component of income from continuing operations. Replacement cost $1,100,000 (50,000) Less: Deductible clause Insurance proceeds 1,050,000 Less: Costs to dismantle old warehouse (20,000) 1,030,000 Less: Current carrying amount (300,000) Gain on insurance settlement of casualty $ 730,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts