Question: CPA_Far practice problem can you help me explain the answer for me. thank you! FAR F1 Conceptual Framework and Financial Reporting MCQ-00210 Adam Corp. uses

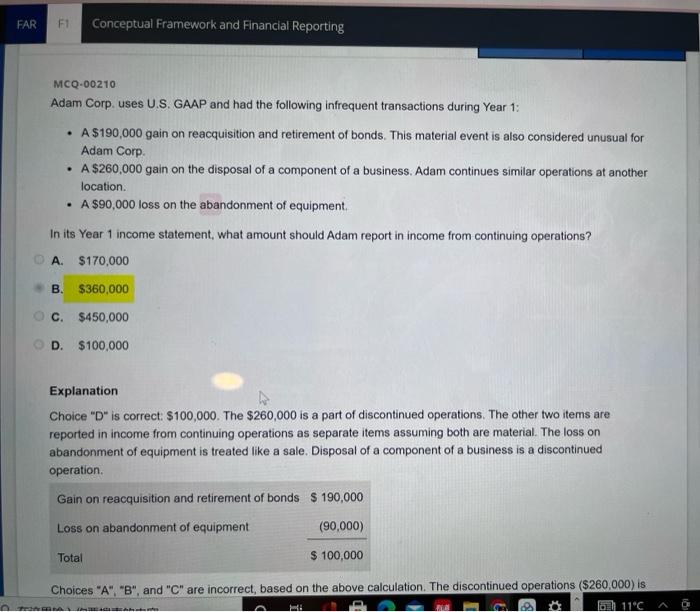

FAR F1 Conceptual Framework and Financial Reporting MCQ-00210 Adam Corp. uses U.S. GAAP and had the following infrequent transactions during Year 1: . A $190,000 gain on reacquisition and retirement of bonds. This material event is also considered unusual for Adam Corp. A $260,000 gain on the disposal of a component of a business. Adam continues similar operations at another location. A $90,000 loss on the abandonment of equipment. In its Year 1 income statement, what amount should Adam report in income from continuing operations? A. $170,000 B. $360,000 C. $450,000 D. $100,000 Explanation Choice "D" is correct: $100,000. The $260,000 is a part of discontinued operations. The other two items are reported in income from continuing operations as separate items assuming both are material. The loss on abandonment of equipment is treated like a sale. Disposal of a component of a business is a discontinued operation. Gain on reacquisition and retirement of bonds $ 190,000 Loss on abandonment of equipment (90,000) Total $ 100,000 Choices "A", "B", and "C" are incorrect, based on the above calculation. The discontinued operations ($260,000) is Mi 2 11C VSE KI V

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts