Question: CPA_Far practice problem can you help me explain the answer? thank you ! FAR F1 Conceptual Framework and Financial Reporting Coffey Corp.'s trial balance of

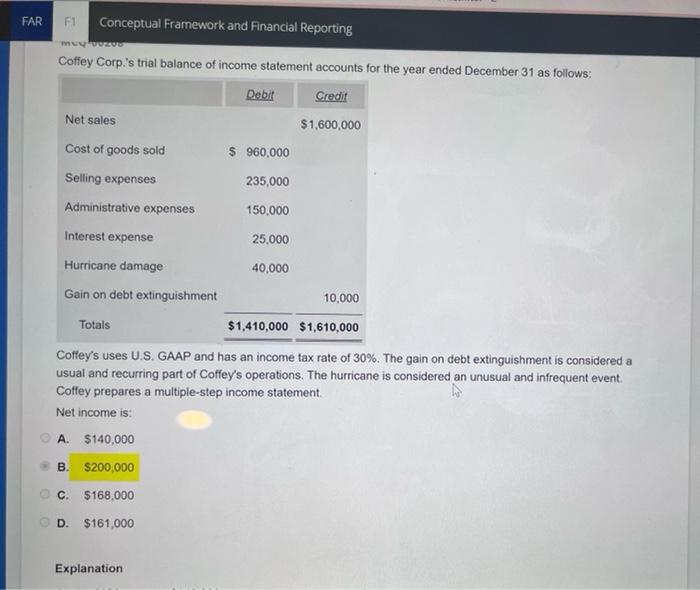

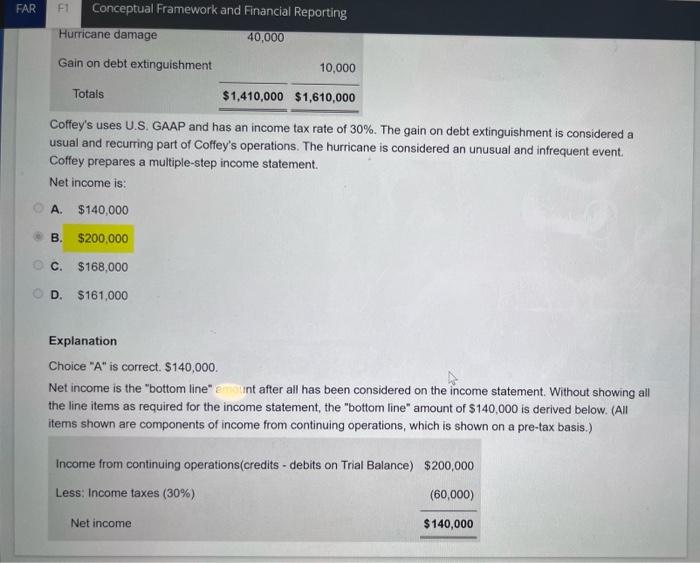

FAR F1 Conceptual Framework and Financial Reporting Coffey Corp.'s trial balance of income statement accounts for the year ended December 31 as follows: Debit Credit Net sales $1,600,000 Cost of goods sold $ 960,000 Selling expenses 235,000 Administrative expenses 150,000 Interest expense 25,000 Hurricane damage 40,000 Gain on debt extinguishment 10,000 Totals $1,410,000 $1,610,000 Coffey's uses U.S. GAAP and has an income tax rate of 30%. The gain on debt extinguishment is considered a usual and recurring part of Coffey's operations. The hurricane is considered an unusual and infrequent event. Coffey prepares a multiple-step income statement. Net income is: A. $140,000 B. $200,000 C. $168,000 D. $161,000 Explanation FAR O O F1 Conceptual Framework and Financial Reporting Hurricane damage 40,000 Gain on debt extinguishment 10,000 Totals $1,410,000 $1,610,000 Coffey's uses U.S. GAAP and has an income tax rate of 30%. The gain on debt extinguishment is considered a usual and recurring part of Coffey's operations. The hurricane is considered an unusual and infrequent event. Coffey prepares a multiple-step income statement. Net income is: A. $140,000 B. $200,000 C. $168,000 D. $161,000 Explanation Choice "A" is correct. $140,000. Net income is the "bottom line" amount after all has been considered on the income statement. Without showing all the line items as required for the income statement, the "bottom line" amount of $140,000 is derived below. (All items shown are components of income from continuing operations, which is shown on a pre-tax basis.) Income from continuing operations(credits - debits on Trial Balance) $200,000 Less: Income taxes (30%) (60,000) Net income $140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts