Question: CREATE A NEW COMPANY Having just completed your second year of college studying business and accounting, you are looking for summer employment when you run

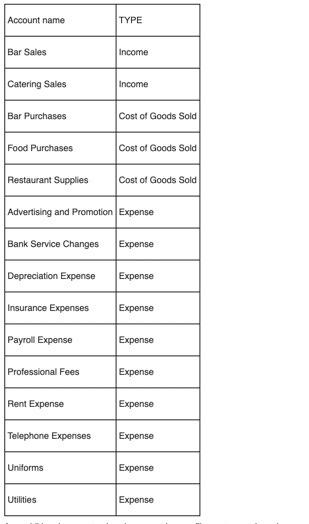

CREATE A NEW COMPANY Having just completed your second year of college studying business and accounting, you are looking for summer employment when you run across an ad from a Jessica Gil, a local CPA, who is in need of part-time help. After an hour-long interview you get the job and are anxious to apply your newfound knowledge accounting to help a business gain success. Jessica has just taken on a new client, Boston Catering, a catering firm located in Cambridge, Massachusetts, that provides catering services to businesses in the Cambridge and Boston area. So far they have been manually keeping their accounting records but wish to convert to QuickBooks Accountant starting July 1, the beginning of their fiscal year. Jessica would like you to spearhead this offort by creating a QuickBooks Accountant file containing their existing customers, vendors, and employees and then entering their business events in July The company's federal tax ID is 99-2158715 and state tax ID is 4513-41. They are located at 305 Hampshire Street, Cambridge, MA 02139 with a phone number 617-555-2806. The company is organized as a corporation and sells both services and products. They do not sell products online, do charge sales tax of 5% on all items which is paid to the Massachusetts Department of Revenue, but do not create estimates and do not use sales receipts because all products and services are invoiced. Statements and progress invoices are not used but they do wish to use QuickBooks Accountant to manage the bills they owe They do not print checks but do keep track of inventory (change standard inventory account to food inventory) and accept credit cards. Customers of this catering business are billed a fixed fee, but the company wants to keep track of hourly employees' hours so they have chosen to track time in QuickBooks Accountant. They will need a chart of accounts and will starting using QuickBooks Accountant 7/1/2010. The company's existing bank account is with Bank of America in Cambridge. The 6/30/2010 statement reveals an ending balance of $8,345. You decide to use the following income and expense accounts: Account name TYPE Bar Sales Income Catering Sales Income Bar Purchases Cost of Goods Sold Food Purchases Cost of Goods Sold Restaurant Supplies Cost of Goods Sold Advertising and Promotion Expense Bank Service Changes Expense Depreciation Expense Expense Insurance Expenses Expense Payroll Expense Expense Professional Fees Expense Rent Expense Expense Telephone Expenses Expense Uniforms Expense Utilities Expense CREATE A NEW COMPANY Having just completed your second year of college studying business and accounting, you are looking for summer employment when you run across an ad from a Jessica Gil, a local CPA, who is in need of part-time help. After an hour-long interview you get the job and are anxious to apply your newfound knowledge accounting to help a business gain success. Jessica has just taken on a new client, Boston Catering, a catering firm located in Cambridge, Massachusetts, that provides catering services to businesses in the Cambridge and Boston area. So far they have been manually keeping their accounting records but wish to convert to QuickBooks Accountant starting July 1, the beginning of their fiscal year. Jessica would like you to spearhead this offort by creating a QuickBooks Accountant file containing their existing customers, vendors, and employees and then entering their business events in July The company's federal tax ID is 99-2158715 and state tax ID is 4513-41. They are located at 305 Hampshire Street, Cambridge, MA 02139 with a phone number 617-555-2806. The company is organized as a corporation and sells both services and products. They do not sell products online, do charge sales tax of 5% on all items which is paid to the Massachusetts Department of Revenue, but do not create estimates and do not use sales receipts because all products and services are invoiced. Statements and progress invoices are not used but they do wish to use QuickBooks Accountant to manage the bills they owe They do not print checks but do keep track of inventory (change standard inventory account to food inventory) and accept credit cards. Customers of this catering business are billed a fixed fee, but the company wants to keep track of hourly employees' hours so they have chosen to track time in QuickBooks Accountant. They will need a chart of accounts and will starting using QuickBooks Accountant 7/1/2010. The company's existing bank account is with Bank of America in Cambridge. The 6/30/2010 statement reveals an ending balance of $8,345. You decide to use the following income and expense accounts: Account name TYPE Bar Sales Income Catering Sales Income Bar Purchases Cost of Goods Sold Food Purchases Cost of Goods Sold Restaurant Supplies Cost of Goods Sold Advertising and Promotion Expense Bank Service Changes Expense Depreciation Expense Expense Insurance Expenses Expense Payroll Expense Expense Professional Fees Expense Rent Expense Expense Telephone Expenses Expense Uniforms Expense Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts