Question: Create a three-year Pro Forma income statement for Disney. Thank you. CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) 2018 2017 2016 Revenues:

Create a three-year Pro Forma income statement for Disney. Thank you.

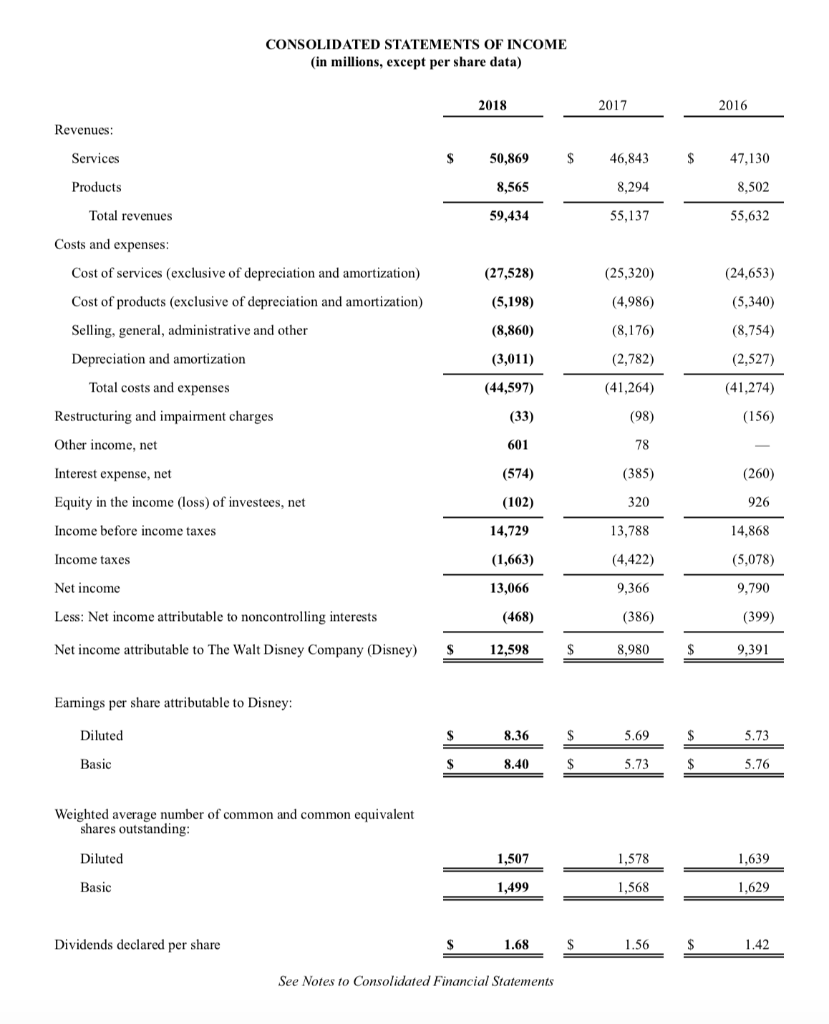

CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) 2018 2017 2016 Revenues: Services 50,869 $ 46,843 $ 47,130 Products 8,565 8,294 8,502 Total revenues 59,434 55,137 55,632 Costs and expenses: Cost of services (exclusive of depreciation and amortization) (27,528) (25,320) (24,653) (5,198) (4,986) (5,340) Cost of products (exclusive of depreciation and amortization) Selling, general, administrative and other Depreciation and amortization (8,860) (8,176) (8,754) (2,527) (3,011) (2,782) (41,264) (44,597) Total costs and expenses Restructuring and impairment charges (41,274) (156) (33) (98) Other income, net 601 78 Interest expense, net (574) (385) (260) Equity in the income (loss) of investees, net (102) 320 926 Income before income taxes 14,729 13,788 14,868 Income taxes (1,663) (4,422) (5,078) Net income 13,066 9,366 9,790 Less: Net income attributable to noncontrolling interests (468) (386) (399) Net income attributable to The Walt Disney Company (Disney) $ 8,980 $ 9,391 Earnings per share attributable to Disney: Diluted $ 8.36 $ $ 5.69 5.73 $ $ 5.73 5.76 Basic 8.40 Weighted average number of common and common equivalent shares outstanding: Diluted 1,507 1,578 1,639 Basic 1,499 1,568 1,629 Dividends declared per share $ 1.68 $ 1.56 $ 1.42 See Notes to Consolidated Financial Statements CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) 2018 2017 2016 Revenues: Services 50,869 $ 46,843 $ 47,130 Products 8,565 8,294 8,502 Total revenues 59,434 55,137 55,632 Costs and expenses: Cost of services (exclusive of depreciation and amortization) (27,528) (25,320) (24,653) (5,198) (4,986) (5,340) Cost of products (exclusive of depreciation and amortization) Selling, general, administrative and other Depreciation and amortization (8,860) (8,176) (8,754) (2,527) (3,011) (2,782) (41,264) (44,597) Total costs and expenses Restructuring and impairment charges (41,274) (156) (33) (98) Other income, net 601 78 Interest expense, net (574) (385) (260) Equity in the income (loss) of investees, net (102) 320 926 Income before income taxes 14,729 13,788 14,868 Income taxes (1,663) (4,422) (5,078) Net income 13,066 9,366 9,790 Less: Net income attributable to noncontrolling interests (468) (386) (399) Net income attributable to The Walt Disney Company (Disney) $ 8,980 $ 9,391 Earnings per share attributable to Disney: Diluted $ 8.36 $ $ 5.69 5.73 $ $ 5.73 5.76 Basic 8.40 Weighted average number of common and common equivalent shares outstanding: Diluted 1,507 1,578 1,639 Basic 1,499 1,568 1,629 Dividends declared per share $ 1.68 $ 1.56 $ 1.42 See Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts