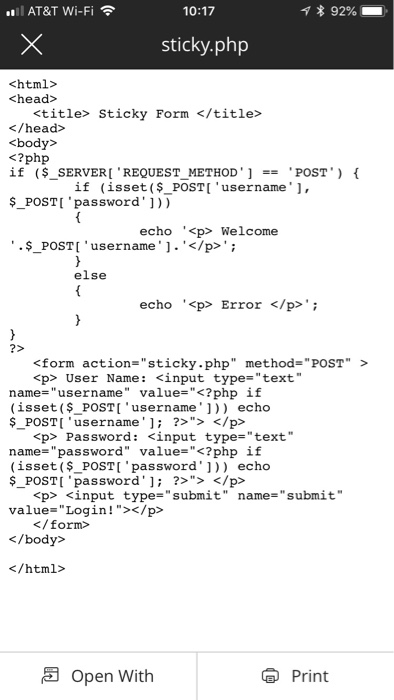

Question: Create this web application. Php or html Php code below might help Done 5 of 5 1. you are required to implement a Web application

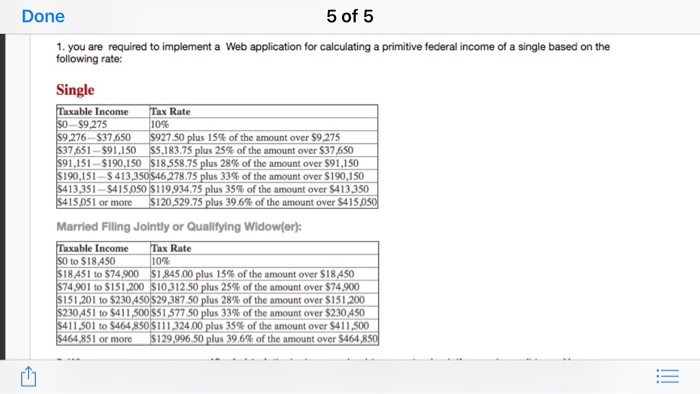

Done 5 of 5 1. you are required to implement a Web application for calculating a primitive federal income of a single based on the following rate: Single axable Income Tax Rate 10% S9 276 S37,650 S- 150 plus 15% of the amount over S9275 37,651 $9 1,150 ss. 183.75 plus 25% of the amount over $37,650 91,151--$190.150 S18558.75 plus 28% of the amount over S91.150 190.151 _ $ 41 3.35054627875 33% of the amount over $190,150 13,35 1 S4 1 5,050 S 1 1 9,934.75 plus 35% of the amount Over S4 1 3,350 5,051 or more SI 20,529.75 plus 39.6% of the amount over S415 Married Filing Jointly or Qualifying Widow(er): axable Income ax Rate 10% to $18.450 18,45 l to S74.900 S 1 845 .00 plus 1 5% of the amount over $ 1 8,450 74.901 to $151 200 S 10,31 2.50 plus 25% of the amount over S74.900 151,201 to $230,4 50529387.50 plus 28% of the amount over $151 .200 230,45 l to $41 1,50055 1,577.50 plus 33% of the amount over S230 450 1 1 ,501 to $464 ,850S 111 ,32400 plus 35% of the amount over $411 ,500 ,851 or more S1 29,996.50 pl : 39.6% of the amount over S464.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts