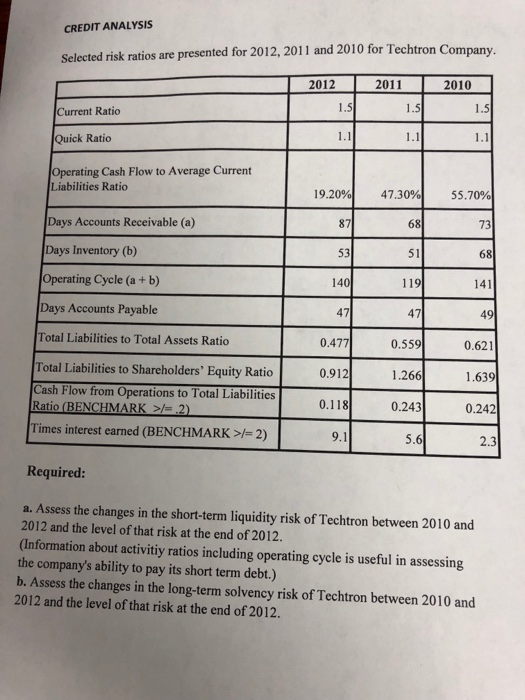

Question: CREDIT ANALYSIS Selected risk ratios are presented for 2012, 2011 and 2010 for Techtron Conm 2012 2011 2010 1.5 Current Ratio Quick Ratio Operating Cash

CREDIT ANALYSIS Selected risk ratios are presented for 2012, 2011 and 2010 for Techtron Conm 2012 2011 2010 1.5 Current Ratio Quick Ratio Operating Cash Flow to Average Current Liabilities Ratio 19.20% 47.30% 68 51 119 47 0.559 55.70% 73 68 141 49 0.621 1.639 0.242 2.3 Days Accounts Receivable (a) Days Inventory (b) Operating Cycle (a+ b) Days Accounts Payable Total Liabilities to Total Assets Ratio 53 14 47 0.477 0.912 0.118 9.1 Total Liabilities to Shareholders' Equity Ratio Cash Flow from Operations to Total Liabilities 0.243 Times interest earned (BENCHMARK>2) 5.6 Required: a. Assess the changes in the short-term liquidity risk of Techtron between 2010 and 2012 and the level of that risk at the end of 2012. (Information about activitiy ratios including operating cycle is useful in assessing the company's ability to pay its short term debt.) b. Assess the changes in the long-term solvency risk of Techtron between 2010 and 2012 and the level of that risk at the end of 2012

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts