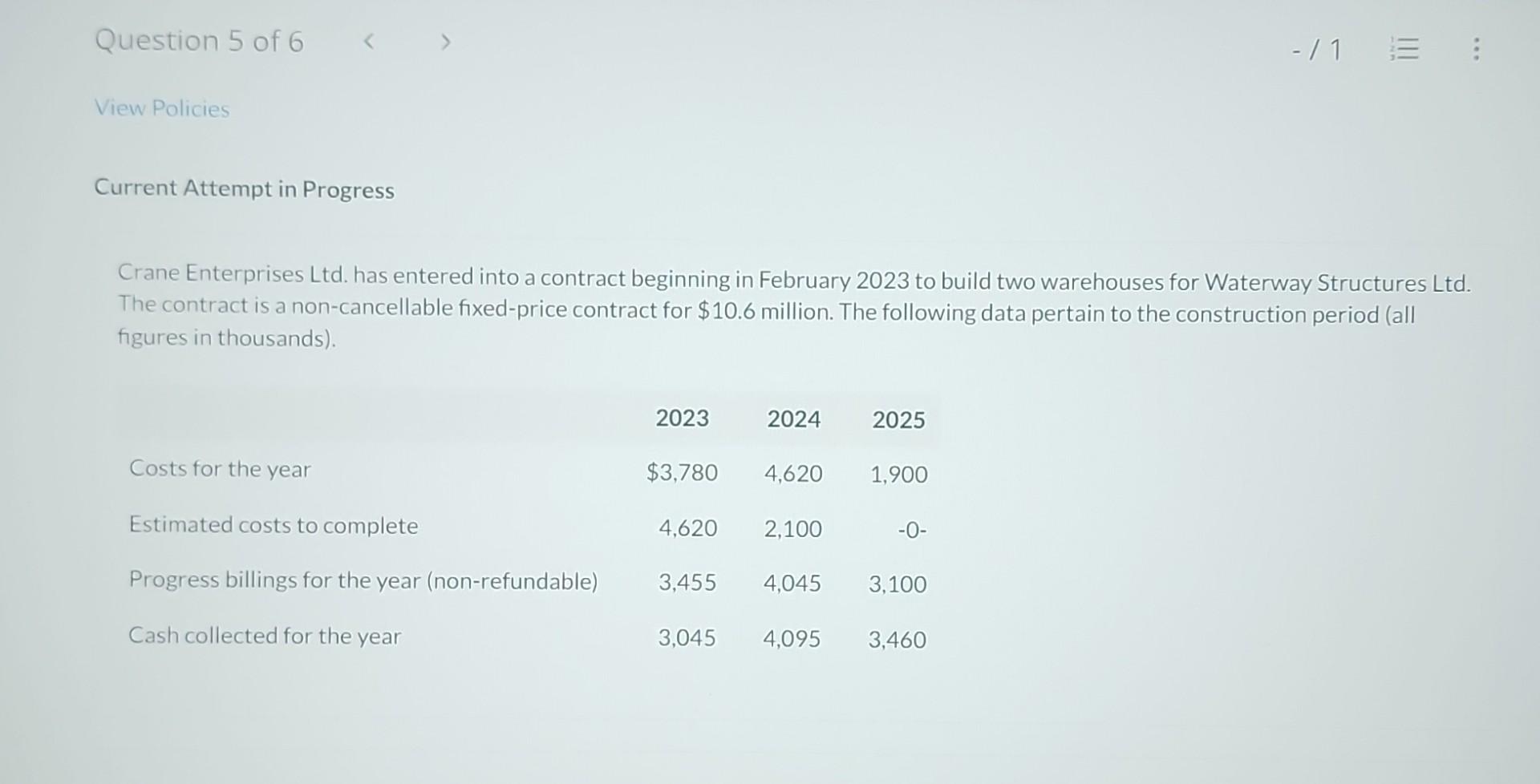

Question: Current Attempt in Progress Crane Enterprises Ltd. has entered into a contract beginning in February 2023 to build two warehouses for Waterway Structures Ltd. The

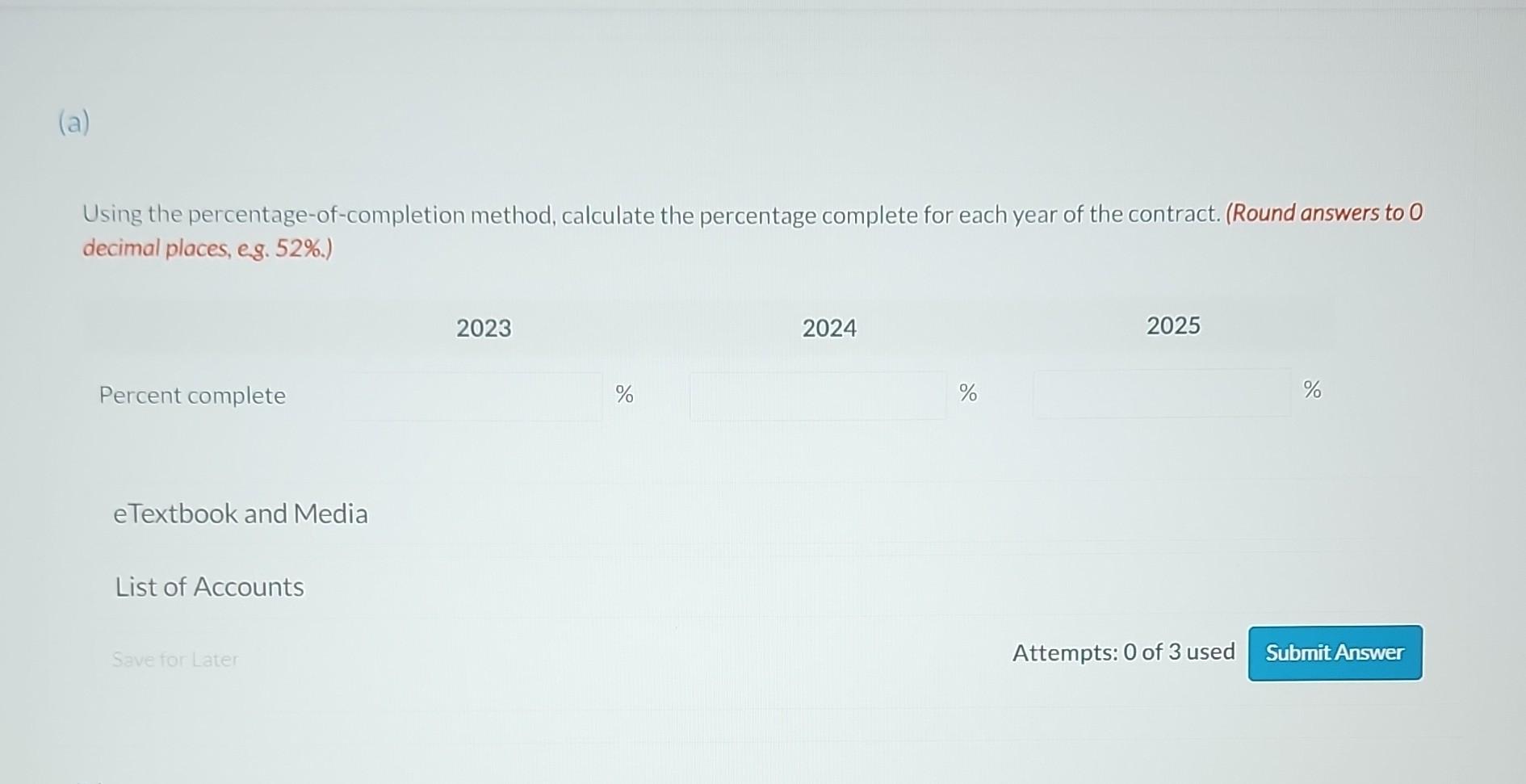

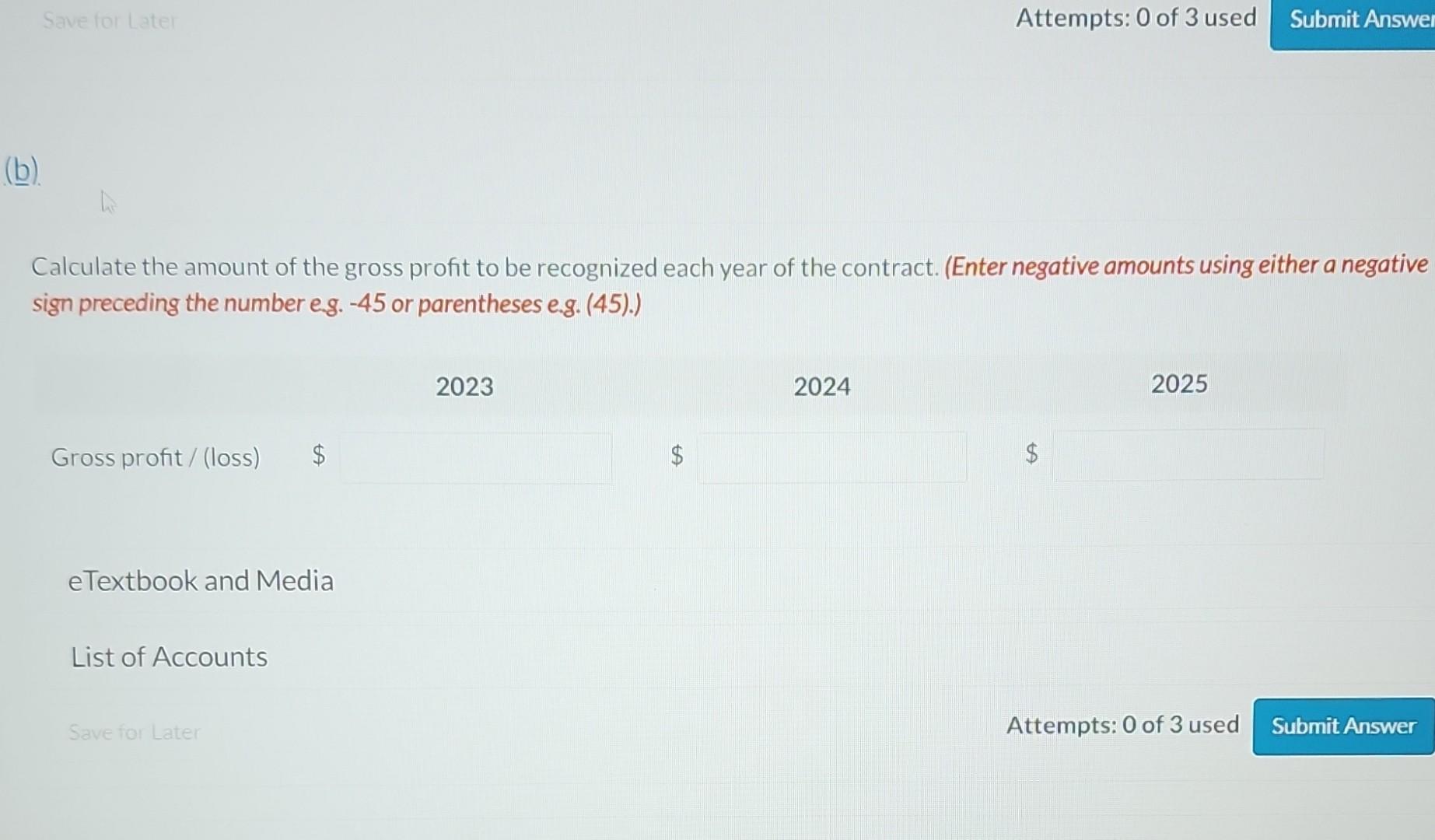

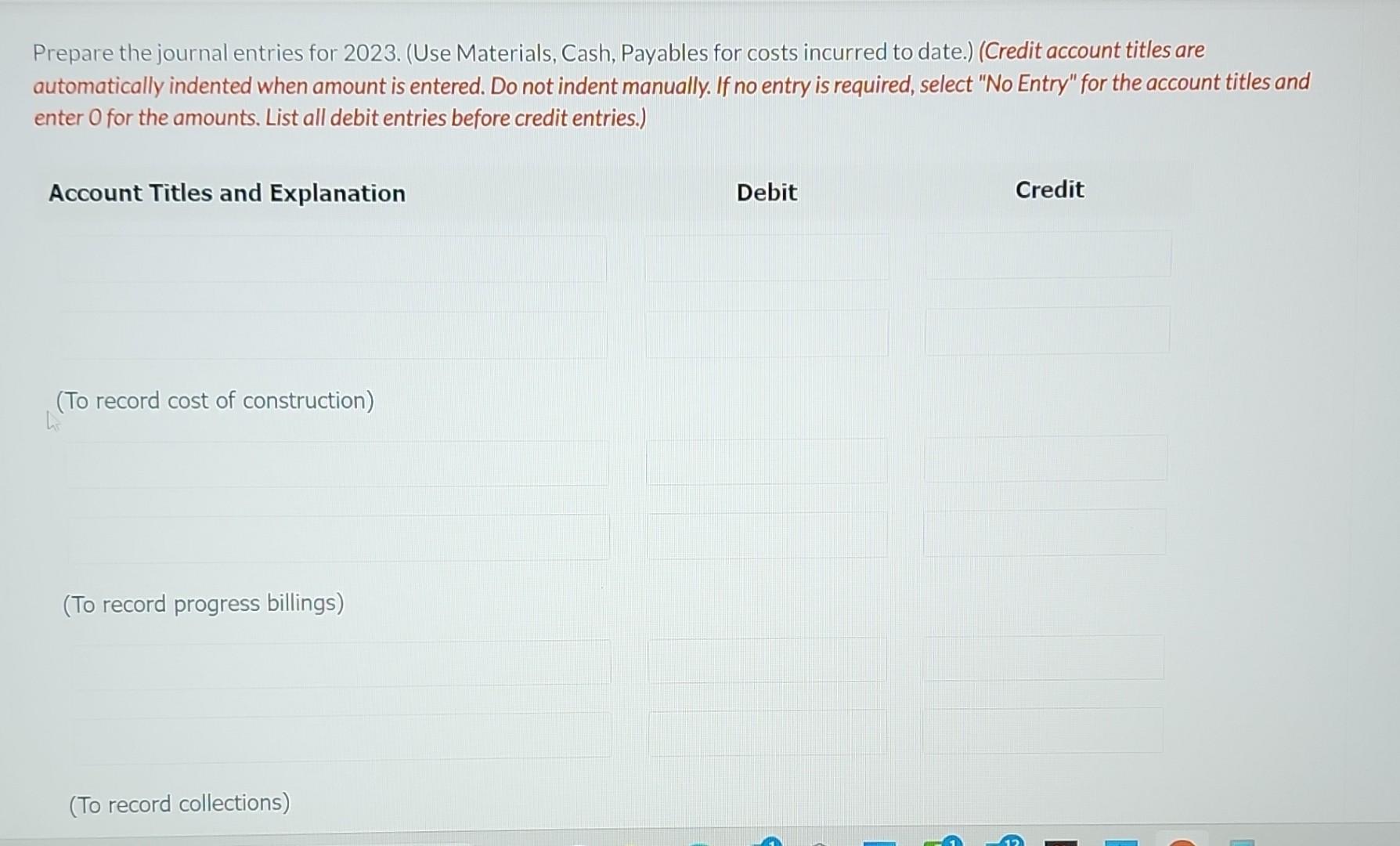

Current Attempt in Progress Crane Enterprises Ltd. has entered into a contract beginning in February 2023 to build two warehouses for Waterway Structures Ltd. The contract is a non-cancellable fixed-price contract for $10.6 million. The following data pertain to the construction period (all figures in thousands). Using the percentage-of-completion method, calculate the percentage complete for each year of the contract. (Round answers to 0 decimal places, eg. 52\%.) Calculate the amount of the gross profit to be recognized each year of the contract. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Prepare the journal entries for 2023. (Use Materials, Cash, Payables for costs incurred to date.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) (To record revenues) (To record construction expenses) Prepare the journal entries for 2024. (Use Materials, Cash, Payables for costs incurred to date.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) (To record revenues) (To record construction expenses) What is the balance in the Contract Asset/Liability account at December 31. 2023 and 2024? Show how the construction contract would be reported on the SFP for the year ended December 31. 2024. (List Current assets in order of liquidity.) Show how the construction contract would be reported on the income statement for the year ended December 31, 2024. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts