Question: Current Attempt in Progress Farmer Ned is trying to decide whether he should rebuild the engine on his current combine or whether he should invest

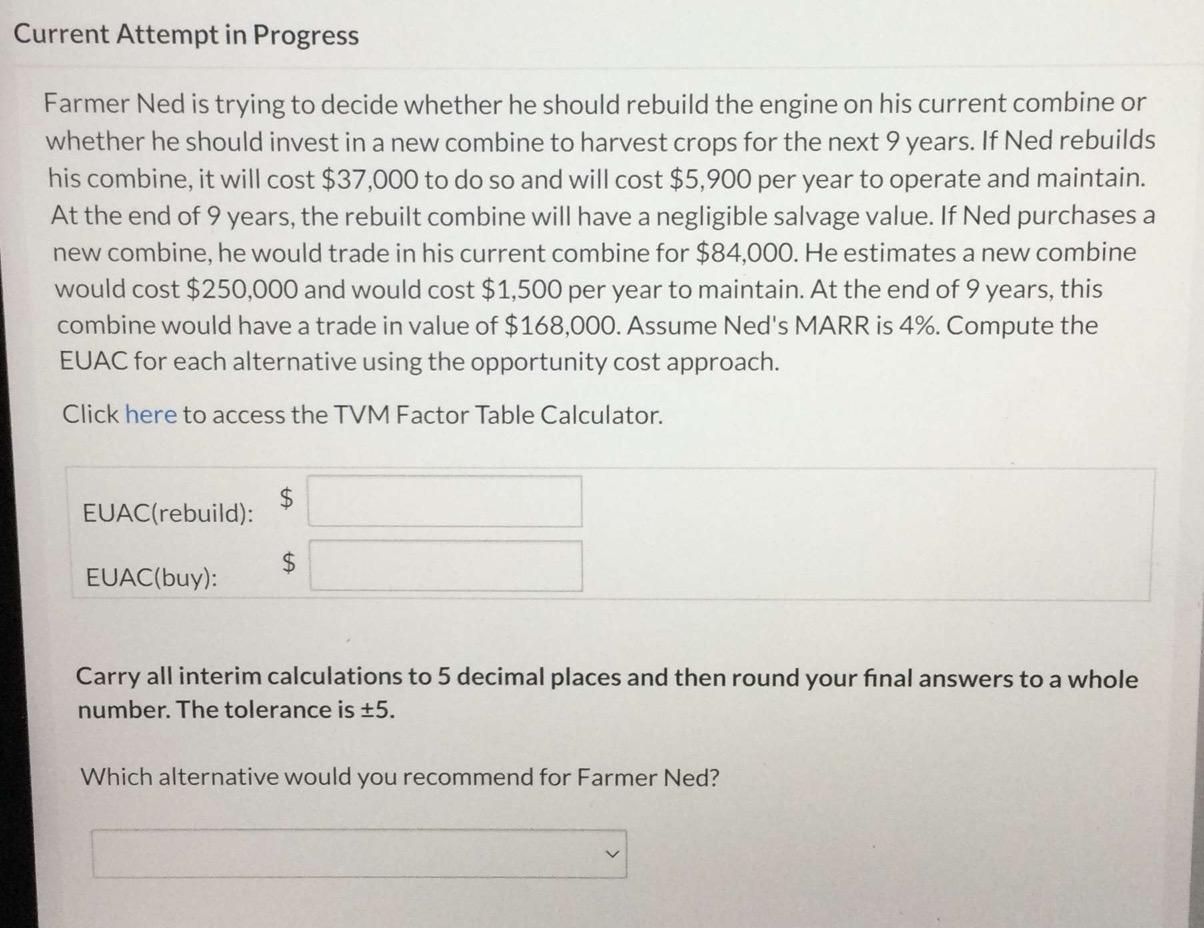

Current Attempt in Progress Farmer Ned is trying to decide whether he should rebuild the engine on his current combine or whether he should invest in a new combine to harvest crops for the next 9 years. If Ned rebuilds his combine, it will cost $37,000 to do so and will cost $5,900 per year to operate and maintain. At the end of 9 years, the rebuilt combine will have a negligible salvage value. If Ned purchases a new combine, he would trade in his current combine for $84,000. He estimates a new combine would cost $250,000 and would cost $1,500 per year to maintain. At the end of 9 years, this combine would have a trade in value of $168,000. Assume Ned's MARR is 4%. Compute the EUAC for each alternative using the opportunity cost approach. Click here to access the TVM Factor Table Calculator. $ EUAC(rebuild): $ EUAC(buy): Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is +5. Which alternative would you recommend for Farmer Ned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts