Question: Current Attempt in Progress Your answer is partially correct. An inexperienced accountant prepared this condensed income statement for Blue Spruce Corp., a retail firm that

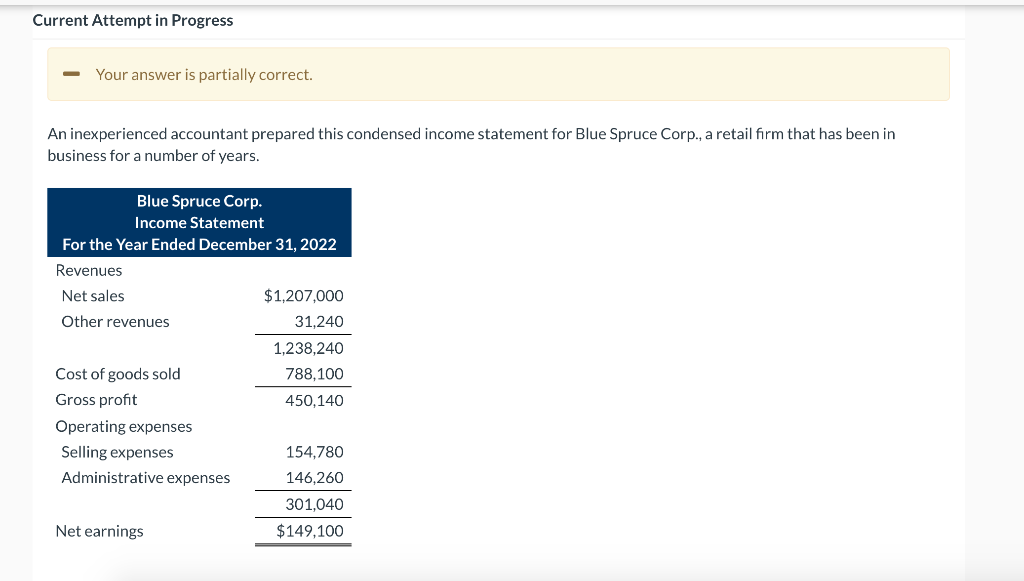

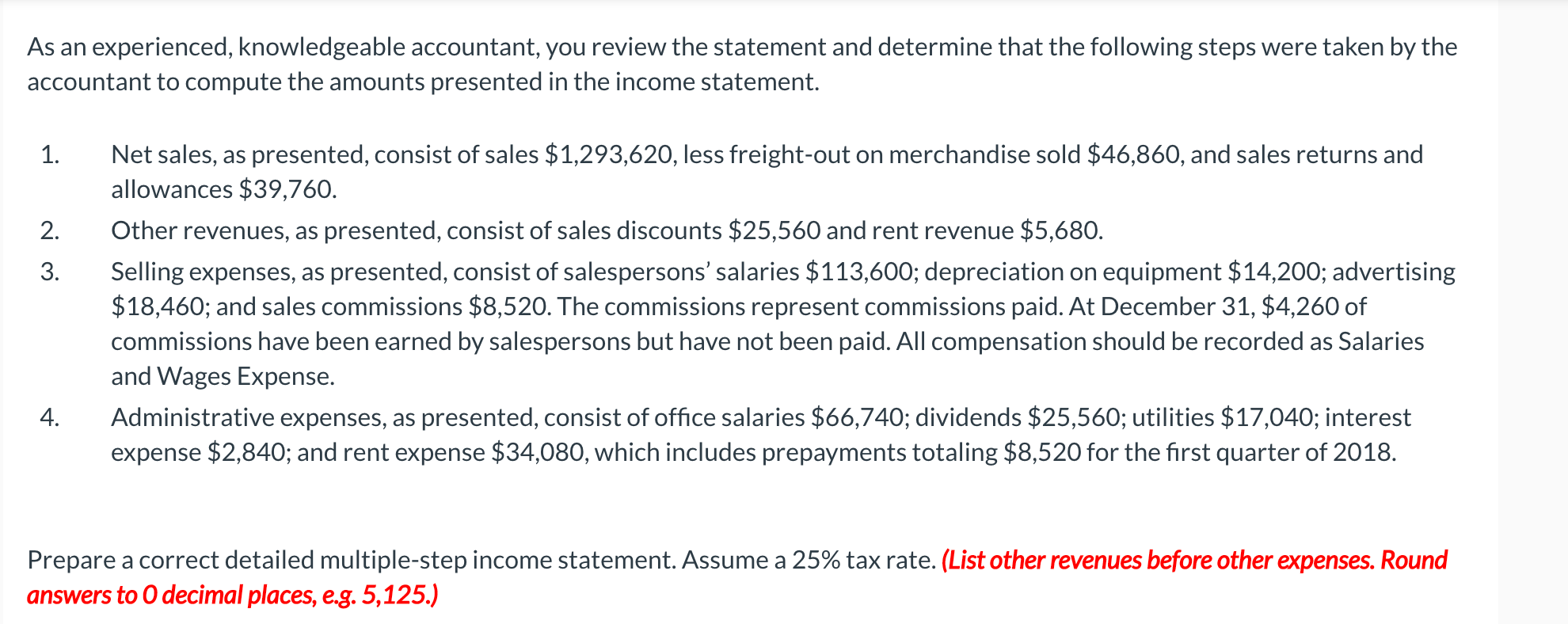

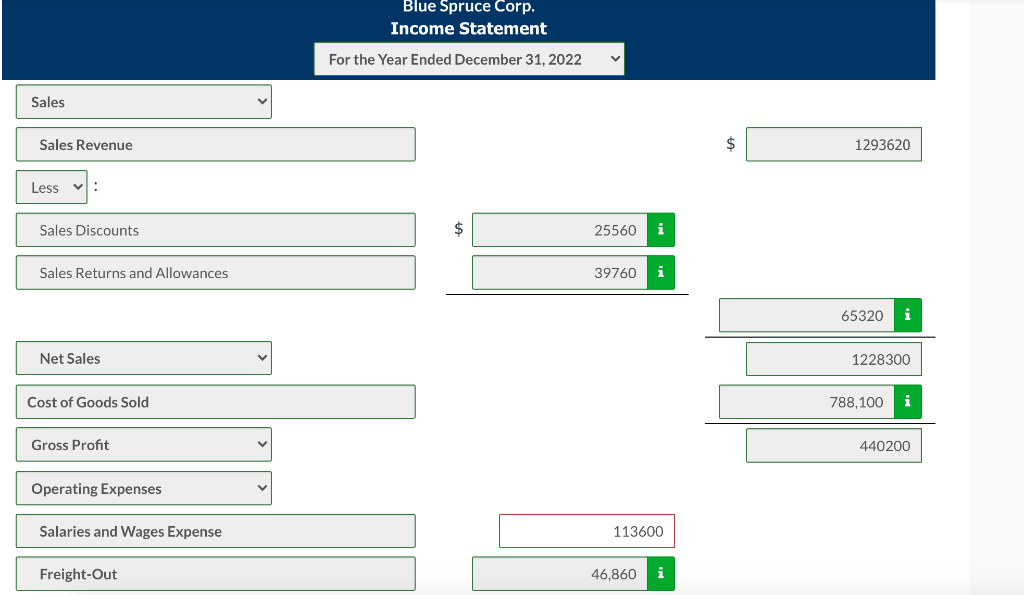

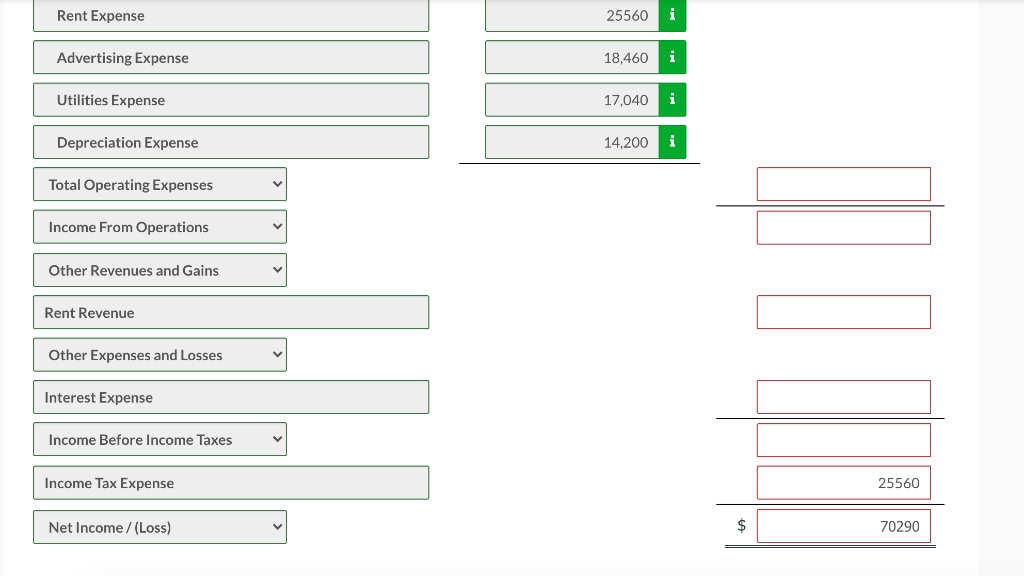

Current Attempt in Progress Your answer is partially correct. An inexperienced accountant prepared this condensed income statement for Blue Spruce Corp., a retail firm that has been in business for a number of years. Blue Spruce Corp. Income Statement For the Year Ended December 31, 2022 Revenues Net sales $1,207,000 Other revenues 31,240 1,238,240 Cost of goods sold 788,100 Gross profit 450,140 Operating expenses Selling expenses 154,780 Administrative expenses 146,260 301,040 Net earnings $149,100 As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement. 1. 2. 3. Net sales, as presented, consist of sales $1,293,620, less freight-out on merchandise sold $46,860, and sales returns and allowances $39,760. Other revenues, as presented, consist of sales discounts $25,560 and rent revenue $5,680. Selling expenses, as presented, consist of salespersons' salaries $113,600; depreciation on equipment $14,200; advertising $18,460; and sales commissions $8,520. The commissions represent commissions paid. At December 31, $4,260 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. Administrative expenses, as presented, consist of office salaries $66,740; dividends $25,560; utilities $17,040; interest expense $2,840; and rent expense $34,080, which includes prepayments totaling $8,520 for the first quarter of 2018. 4. Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses. Round answers to O decimal places, e.g. 5,125.) Blue Spruce Corp. Income Statement For the Year Ended December 31, 2022 V Sales Sales Revenue $ 1293620 Less Sales Discounts $ 25560 i Sales Returns and Allowances 39760 65320 i Net Sales 1228300 Cost of Goods Sold 788,100 i Gross Profit 440200 Operating Expenses Salaries and Wages Expense 113600 Freight-Out 46,860 Rent Expense 25560 i Advertising Expense 18,460 Utilities Expense 17,040 i Depreciation Expense 14,200 i Total Operating Expenses Income From Operations Other Revenues and Gains Rent Revenue Other Expenses and Losses Interest Expense Income Before Income Taxes Income Tax Expense 25560 Net Income /(Loss) $ 70290

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts