Question: current solution of this question is wrong.Please solve in detail 7.39 Two fixtures are being considered for a particular job in a manufacturing firm. The

current solution of this question is wrong.Please solve in detail

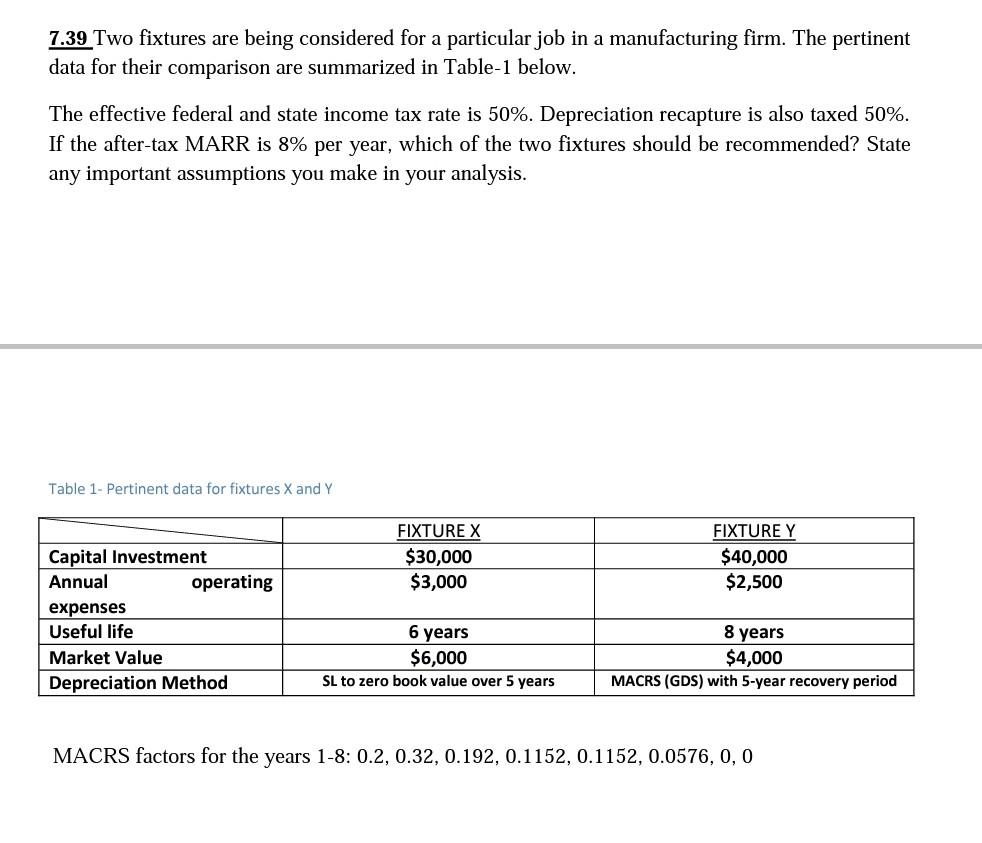

7.39 Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in Table-1 below. The effective federal and state income tax rate is 50%. Depreciation recapture is also taxed 50%. If the after-tax MARR is 8% per year, which of the two fixtures should be recommended? State any important assumptions you make in your analysis. Table 1- Pertinent data for fixtures X and Y MACRS factors for the years 18:0.2,0.32,0.192,0.1152,0.1152,0.0576,0,0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts