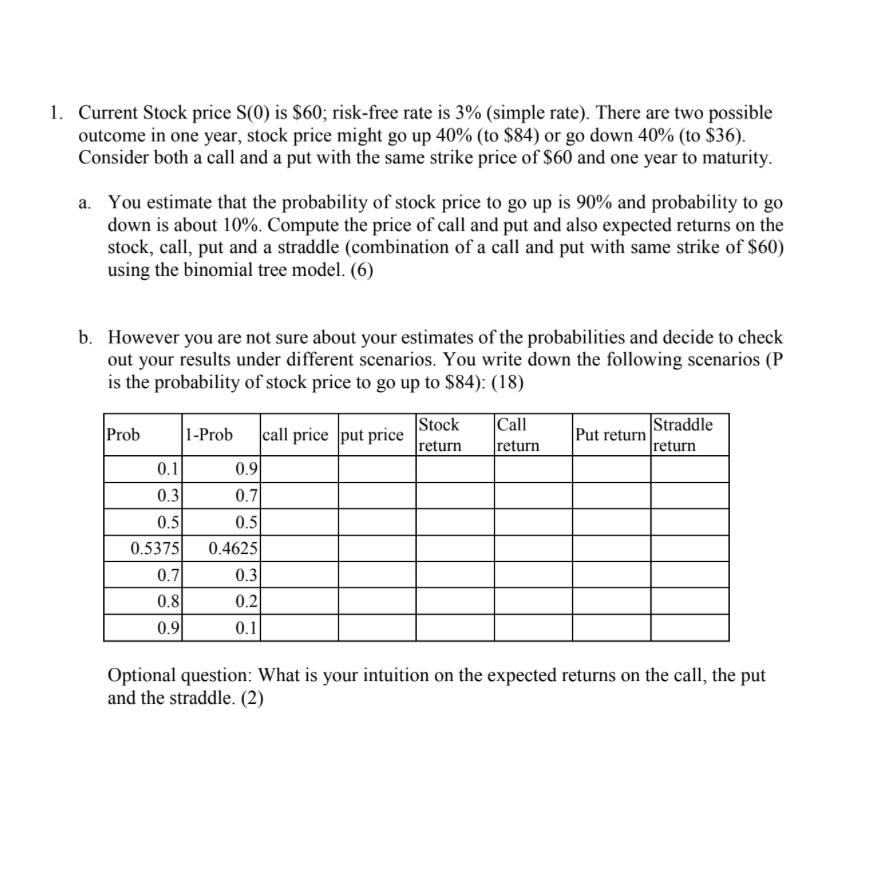

Question: Current Stock price S ( 0 ) is $ 6 0 ; risk - free rate is 3 % ( simple rate ) . There

Current Stock price is $; riskfree rate is simple rate There are two possible outcome in one year, stock price might go up to $ or go down to $ Consider both a call and a put with the same strike price of $ and one year to maturity.

a You estimate that the probability of stock price to go up is and probability to go down is about Compute the price of call and put and also expected returns on the stock, call, put and a straddle combination of a call and put with same strike of $ using the binomial tree model.

b However you are not sure about your estimates of the probabilities and decide to check out your results under different scenarios. You write down the following scenarios is the probability of stock price to go up to $:

tableProbProb,call price,put price,tableStockreturntableCallreturnPut return,tableStraddlereturn

Optional question: What is your intuition on the expected returns on the call, the put and the straddle.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock