Question: Question 2: Arbitrage when put-call parity does not hold (15 points) A put option (on a stock) that expires in a year has a strike

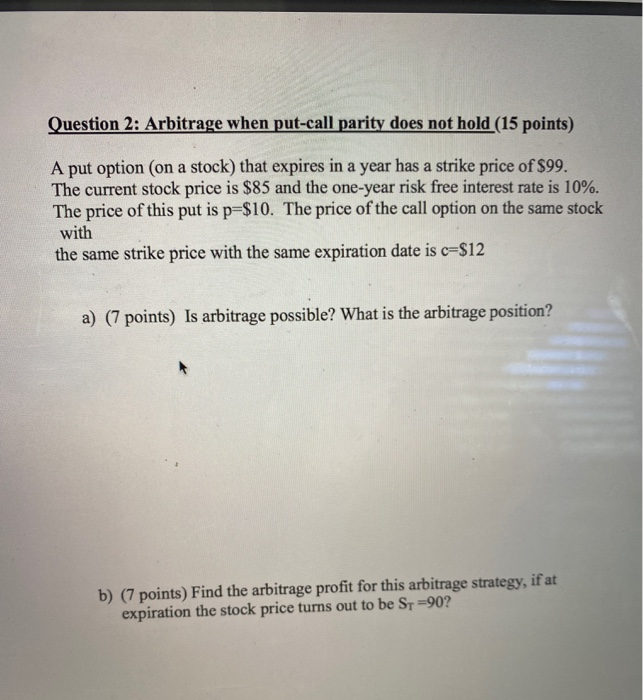

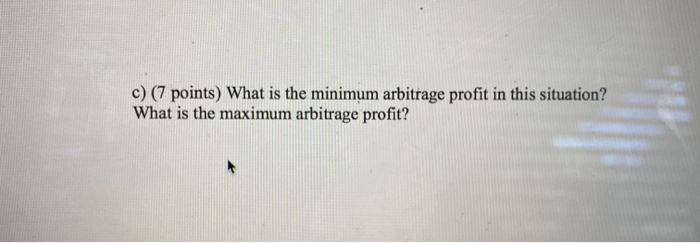

Question 2: Arbitrage when put-call parity does not hold (15 points) A put option (on a stock) that expires in a year has a strike price of $99. The current stock price is $85 and the one-year risk free interest rate is 10%. The price of this put is p=$10. The price of the call option on the same stock with the same strike price with the same expiration date is c=$12 a) (7 points) Is arbitrage possible? What is the arbitrage position? b) (7 points) Find the arbitrage profit for this arbitrage strategy, if at expiration the stock price turns out to be St=90? c) (7 points) What is the minimum arbitrage profit in this situation? What is the maximum arbitrage profit? Question 2: Arbitrage when put-call parity does not hold (15 points) A put option (on a stock) that expires in a year has a strike price of $99. The current stock price is $85 and the one-year risk free interest rate is 10%. The price of this put is p=$10. The price of the call option on the same stock with the same strike price with the same expiration date is c=$12 a) (7 points) Is arbitrage possible? What is the arbitrage position? b) (7 points) Find the arbitrage profit for this arbitrage strategy, if at expiration the stock price turns out to be St=90? c) (7 points) What is the minimum arbitrage profit in this situation? What is the maximum arbitrage profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts