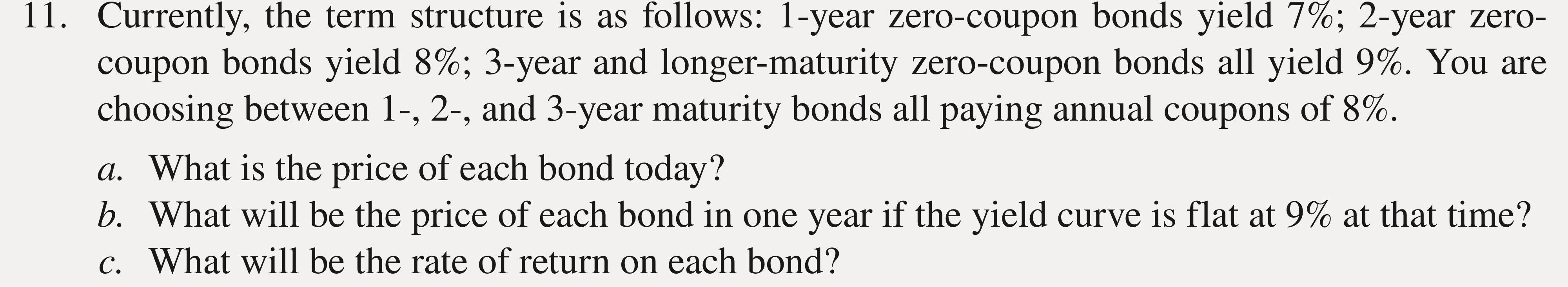

Question: Currently, the term structure is as follows: 1 - year zero - coupon bonds yield 7 % ; 2 - year zerocoupon bonds yield 8

Currently, the term structure is as follows: year zerocoupon bonds yield ; year zerocoupon bonds yield ; year and longermaturity zerocoupon bonds all yield You are choosing between and year maturity bonds all paying annual coupons of

a What is the price of each bond today?

What will be the price of each bond in one year if the yield curve is flat at at that time?

What will be the rate of return on each bond?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock