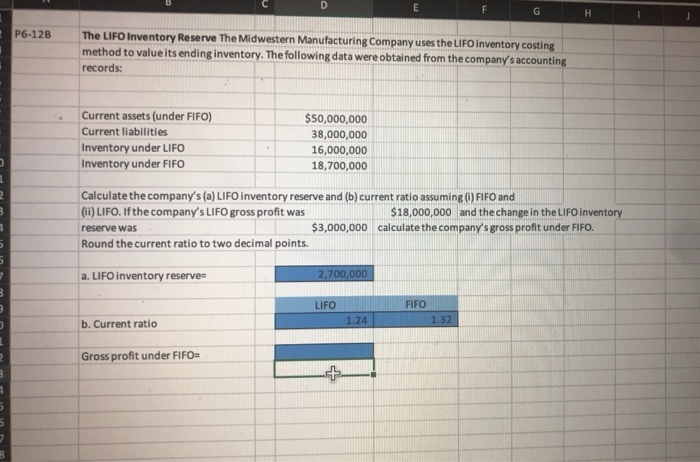

Question: D E G H P6-12B The LIFO Inventory Reserve The Midwestern Manufacturing Company uses the LIFO inventory costing method to value its ending inventory. The

D E G H P6-12B The LIFO Inventory Reserve The Midwestern Manufacturing Company uses the LIFO inventory costing method to value its ending inventory. The following data were obtained from the company's accounting records: Current assets (under FIFO) Current liabilities Inventory under LIFO Inventory under FIFO $50,000,000 38,000,000 16,000,000 18,700,000 1 Calculate the company's (a) LIFO inventory reserve and (b) current ratio assuming (FIFO and (i) LIFO. If the company's LIFO gross profit was $18,000,000 and the change in the LIFO inventory reserve was $3,000,000 calculate the company's gross profit under FIFO. Round the current ratio to two decimal points. U a. LIFO inventory reserve 2,700,000 LIFO FIFO b. Current ratio 1.24 1.32 Gross profit under FIFO= 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts