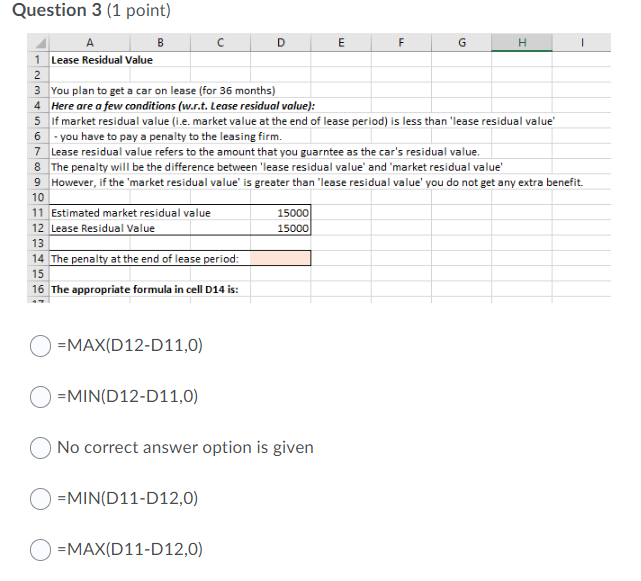

Question: D F G H Question 3 (1 point) E 1 Lease Residual Value 2 3 You plan to get a car on lease (for 36

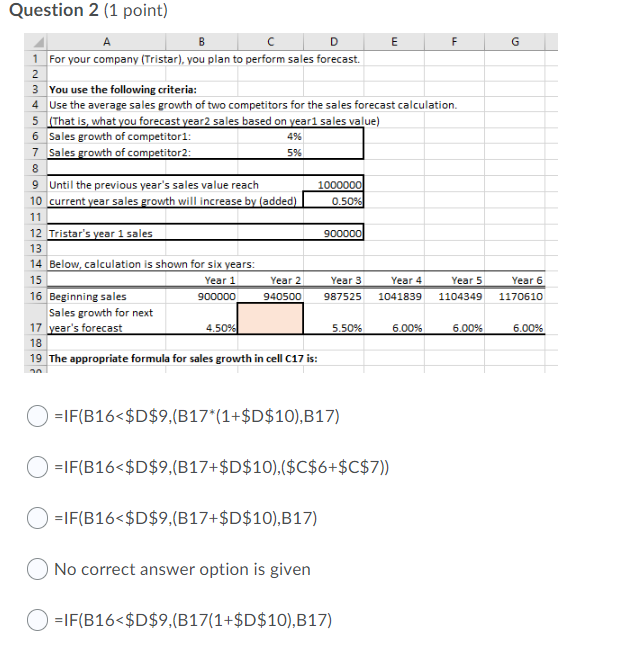

D F G H Question 3 (1 point) E 1 Lease Residual Value 2 3 You plan to get a car on lease (for 36 months) 4 Here are a few conditions (w.r.t. Lease residual value): 5 If market residual value (i.e. market value at the end of lease period) is less than 'lease residual value' 6 - you have to pay a penalty to the leasing firm. 7 Lease residual value refers to the amount that you guarntee as the car's residual value. 8 The penalty will be the difference between 'lease residual value' and 'market residual value 9 However, if the 'market residual value' is greater than "lease residual value' you do not get any extra benefit. 10 11 Estimated market residual value 12 Lease Residual Value 15000 13 14 The penalty at the end of lease period: 15 16 The appropriate formula in cell 014 is: 15000 =MAX(D12-D11,0) =MIN(D12-D11,0) No correct answer option is given =MIN(D11-D12,0) =MAX(D11-D12,0) B D F G Question 2 (1 point) A E 1 For your company (Tristar), you plan to perform sales forecast. 2. 3 You use the following criteria: 4 Use the average sales growth of two competitors for the sales forecast calculation 5 (That is what you forecast year2 sales based on year1 sales value) 6 Sales growth of competitori: 7 Sales growth of competitor2: 596 8 9 Until the previous year's sales value reach 1000000 10 current year sales growth will increase by (added) 0.50% 11 12 Tristar's year 1 sales 900000 13 14 Below, calculation is shown for six years: 15 Year 1 Year 2 Year 3 Year 4 16 Beginning sales 900000 940500 987525 1041839 Sales growth for next 17 year's forecast 4.50% 5.50% 6.00% 18 19 The appropriate formula for sales growth in cell C17 is: Year 5 1104349 Year 6 1170610 6.00% 6.00% =IF(B16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts