Question: D Microsoft Womx Chapter 3: An: D ??? PM-Box' D Text x 3 x la Syllabus & Sch u.edu/bbcswebdav/pid-584 7875-dt-content-rid-22291 8801/courses/FIN 306,VA-U2018/Chapter%203 CHAPTER 3-15 2013

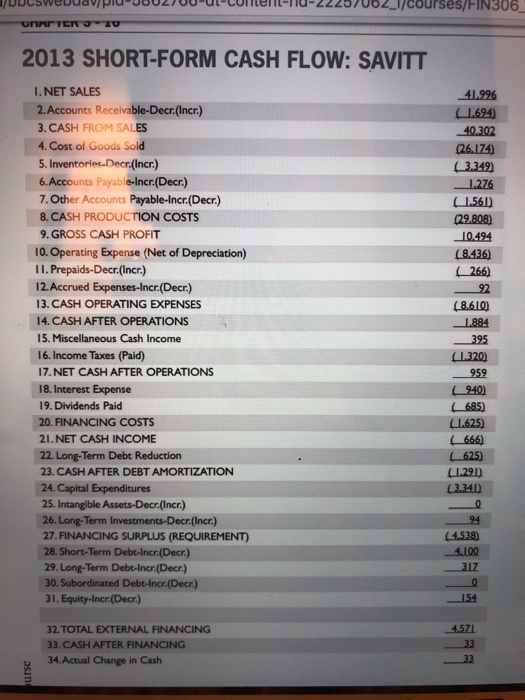

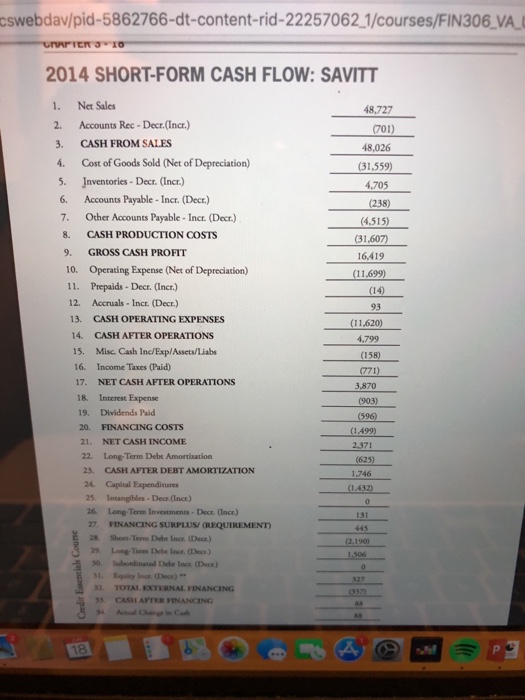

D Microsoft Womx Chapter 3: An: D ??? PM-Box' D Text x 3 x la Syllabus & Sch u.edu/bbcswebdav/pid-584 7875-dt-content-rid-22291 8801/courses/FIN 306,VA-U2018/Chapter%203 CHAPTER 3-15 2013 AND 2014 CASH FLOW INTERPRETATION Analyze the 2013 and 2014 cash flows using the shor-form cash flow tatements and the ratio analysis. Using the following questions as a guide: 1. How did SHCE's net cash after operations change from the prior year? What specific income statement and balance sheet factors contributed to any change in net cash after operations? 2. How did SHCE cover its financing costs and debt amortization? 3. How much did SHCE spend for investing activities and how were these funded? 4. Did SHCE have a financing surplus or requirement? How was any surplus used and any requirement met 5. Based on the 2014 cash flow results, what should we be thinking about as SHCE moves into 2015? 80s Fs 3 4 5 7 8 9 0 D Microsoft Womx Chapter 3: An: D ??? PM-Box' D Text x 3 x la Syllabus & Sch u.edu/bbcswebdav/pid-584 7875-dt-content-rid-22291 8801/courses/FIN 306,VA-U2018/Chapter%203 CHAPTER 3-15 2013 AND 2014 CASH FLOW INTERPRETATION Analyze the 2013 and 2014 cash flows using the shor-form cash flow tatements and the ratio analysis. Using the following questions as a guide: 1. How did SHCE's net cash after operations change from the prior year? What specific income statement and balance sheet factors contributed to any change in net cash after operations? 2. How did SHCE cover its financing costs and debt amortization? 3. How much did SHCE spend for investing activities and how were these funded? 4. Did SHCE have a financing surplus or requirement? How was any surplus used and any requirement met 5. Based on the 2014 cash flow results, what should we be thinking about as SHCE moves into 2015? 80s Fs 3 4 5 7 8 9 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts