Question: D O V E R I N T E R N AT I O N A L E C O N O M I C

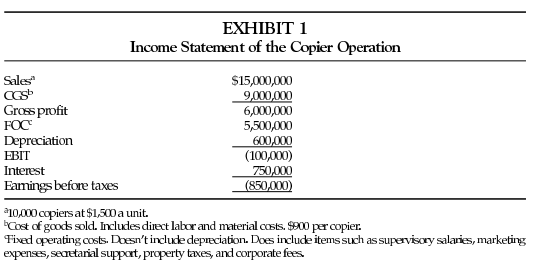

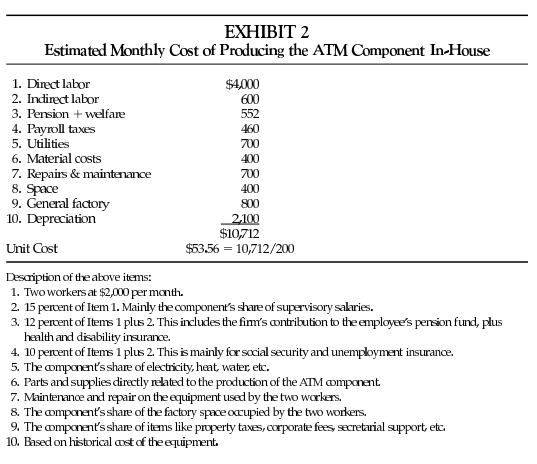

D O V E R I N T E R N AT I O N A L E C O N O M I C F U N D A M E N T A L S Carol Downing is CEO of Dover Intemational, a firm whose annual sales in the most recent year, 1996, exceeded $900 million. The company produces a wide range of business equipment including copiers, automatic teller machines, vaults, and offioe equipment such as desks and filing cabinets. Downing is a firm believer in creating an environment of open communication; she encourages Dover executives to "express themselves" and believes that all suggestions-even her own-need to be critically aralyzed if correct decisions are to be readhed. A few years ago, for example, there was widespiead industry concem at a time when Dover was corsidering a major expansion that Amenican office equipment suppliers would lose market share to Japanese competitors, Downing, after carefully listening to the arguments on both sides, decided that this fear was unfounded and gave her approval to the costly expansion. She was especially swayed by the observation that Japanese firms would find it difficult to compete with American conpanies such as Dover which have a langer network of direct sales and service. History has shown that her decision was the correct one. She is quick to point out, though, that she was greatly aided by many insightful comments received during the evaluation process. Consistent with her philosophy of open communication, Downing periodically likes to have lundeen retreats with three to six Dover executives. Topics range from the very heavy (Should we grow by aoquisition?) to the very light (How can the office Christmas party be improved?). Today's retreatinvolves three issues of varying importance an offer by a piesent customer to buy 4,000 copiers at a reduced prioe, the excess demand that exists for one of Dover's offioe products; and a proposal to use an outside vendor to supply a component used in the production of automatic teller madines. THE COPIER PROBLEM The firm reoently has reoeived an offer from a very large petroleum oorporation to purdhase 4,000 copiers at $1,200 a unit, which is 20 percent under the usual price of $1,500. On one hand, the offer is quite weloome. Dover's copier operation is the only anea of the firm that experienced a loes during the last three months. Copier sales are down and significant excess capacity exists in this part of the firm' scperation. In fact, Dover could fill the petroleum company's onder with no strain on its production facilities. The company's duief acoountant, Timothy Wiles, is "the other hand." Wiles is adamant that accepting the offer is a "losing proposition," He cites as evidence the most reoent inoome statement of the copier operation. (See Exhibit 1.) He notes that unit sales price has been $1,500, and the information in Exhibit 1 indicates that unit or average cost is $1,585. Wiles' argument is that tosell these copiers at a price of $1,200 will only "put the copier operation even moIe in the red" since this price is well below the operation's average cost. Mark Thatcher is a finanoe officer and is sheptical of Wiles' argument. Thatcher believes that what is needed is an estimate of the marginal or incemental cost incurred if 4,000 additional copiers are produced. He is not convinced that Wiles' numbers capture such costs. AN EXCESS-DEMAND PROBLEM Production of the fim's executive desk cannot keep up with demand. Operating at capacity, Dover can marufacture about 18,000 desks per year, and orders on an annual basis total 20,000 . Thus, capacity is 10 peroent less than the amount demanded. Management is confident that demand will remain strong, Service-sector employment, which includes a relatively large proportion of offioe workers, is expected to increase. In addition, overseas demand for the product is strong and growing. Management is oonsidening two options for dealing with the exoess demand: raise price or increase capacity without dhanging unit price. Don Rountree, a marketing executive, has put together some numbers on the impact of a price increase. He estimates that a 20 peroent price increase will lower orders by 10 percent, thus eliminating the exoess demand. When asked where he got the estimate, Rountree explains it is based on the firm's experience during 1994 . The price of the desk was increased by 10 percent, yet unit sales were only down 2 peroent from the previous year. "This infomation," Rountree continues, "suggests that every 10 peroent increase in our price causes a mere 2 peroent deciease in unit sales." In order to be conservative and because he realizes that this is only one year's information, Rountree decided to assume that every 10 peroent increase would cause a dirop of 5 peroent in unit sales. This estimate, therefore, indicates that a 20 peroent price increase will lower the amount demanded by 10 percent, that is, the yearly quantity demanded is predicted to drop from 20,000 to 18,000 . Margaret Williamson, one of the fim's economists, is slueptical of this evidenoe and thinks that the drop in unit sales will be "mudn more" than these numbers suggest. She points out that customers are quite price oonscious and that reasonable substitutes for the desk are made by other fims. She also notes that 1994 was a very strong year for the economy and especially the office fumiture industry. "Plus," she continues, "in 1994 nearly all oompetitors raised prioes because of substantially higher material costs. What we're analyzing here is a price hike while our competitors keep theirs constant." Thatcher agrees with Williamson and thinks that it makes more sense to expand capacity, He has worked up a set of numbers on sudh an expansion assuming a 10 -year time period, the firm's typical planning horizon for a project of this type. Thatcher claims that the present value of the yearly cash flows is \$14 million, or nearly 100 peroent more than the up-front oost of $7.6 million, These mumbers, therefore, suggests that Dower would make a rather large eoconomic profit from an expansion, Williamson finds these numbers "interesting" but questions Thatcher's unit sales projections. Thatdher defends these forecasts by noting that he's assuming no dhanges in unit price or existing demand. "There's no pie-in-the-sky here," he claims. "Marketing feels that the demand increase for the desks is quite permanent. And, besides, all the information we have indicates that our competitors are operating at or near capacity also." A "MAKE OR BUY" DECISION Plant 2 is used primarily tomanufacture automatic teller machines (ATMs). The plant typically purdhases most of the required parts and manufactures the remainder in-house. One part currently done in-house is a component of the ATMYs keyboard, and 200 of these are used each month. A vendor has offered to sell Dower this component for $40 a unit. The production engineer estimates that it costs $53.56 a unit to produce the component in-house. (See Exhibit 2) Thus, his numbers imply a savings of $13.56 per unit if a vendor is used, for a total savings of $2,712 per month or $32,544 per year. Wiles is quick to noke that the analysis suggests that two workers may be laid off if the vendor is used. He argues that it is "simply not good business" to do so no matter what the numbers show. First, it would go against the company philosophy of promoting a team atmosphere. Second, it would reduce the range of skills at the plant and could also cieate significant morale problems sinoe the workers area rather tightly knit group. "In any event," he points out, "even if the vendor is used I'll bet that we could reemploy the workers somewhere else, especially if we doose to expand desk production." a 10,000 copiers at $1,500 a unit. "Cost of goods sold. Includes direct labor and material costs. $900 per copier. Tixed operating costs. Doesn't include depreciation. Does include items such as supervisory salanies, marketing expenses, secuetarial support, property taxes, and corporate fees. Description of the above items: 1. Two workers at $2,000 per month. 2. 15 percont of Item 1 . Mainly the component's share of supervisory salaries. 3. 12 percent of Items 1 plus 2 . This includes the firm's contribution to the employee's pension fund, plus health and disability insurance. 4. 10 percent of Items 1 plus 2 . This is mainly for social security and unemployment insurance. 5. The component's share of electricity, heat, water, etc. 6. Parts and supplies directly related to the production of the ATM component 7. Maintenance and repair on the equipment used by the two workers. 8. The component's share of the factory space occupied by the two norkers. 9. The component's share of items like property taves, corporate fees, secretarial support, etc. 10. Based on historical cost of the equipment. 7. Last year Dover spent $40,000 to install an access road to a potential plant site. This plant site may well be used if management decides to expand production of the executive desk. How relevant is this $40,000 to any decision that management must make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts