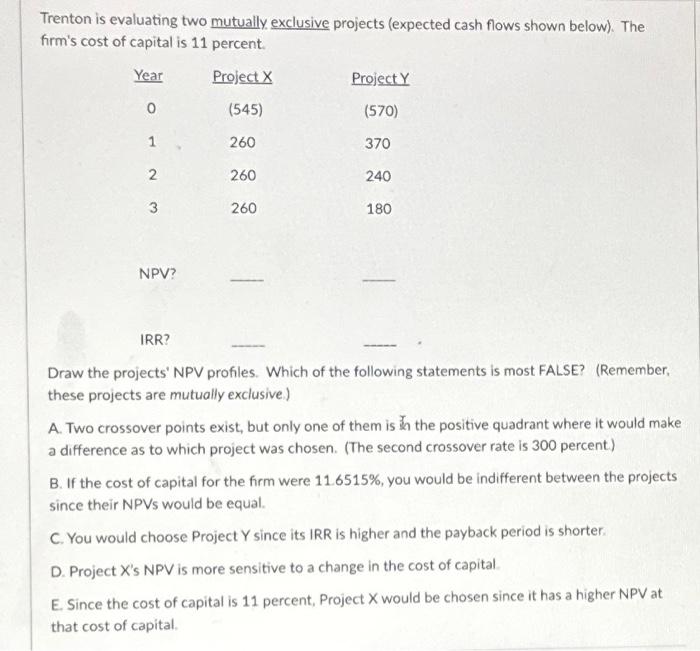

Question: Trenton is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 11 percent. Year Project X (545) 0

Trenton is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 11 percent. Draw the projects' NPV profiles. Which of the following statements is most FALSE? (Remember, these projects are mutually exclusive.) A. Two crossover points exist, but only one of them is $ the positive quadrant where it would make a difference as to which project was chosen. (The second crossover rate is 300 percent) B. If the cost of capital for the firm were 11.6515%, you would be indifferent between the projects since their NPVs would be equal. C. You would choose Project Y since its IRR is higher and the payback period is shorter. D. Project X's NPV is more sensitive to a change in the cost of capital. E. Since the cost of capital is 11 percent, Project X would be chosen since it has a higher NPV at that cost of capital. Trenton is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 11 percent. Draw the projects' NPV profiles. Which of the following statements is most FALSE? (Remember, these projects are mutually exclusive.) A. Two crossover points exist, but only one of them is $ the positive quadrant where it would make a difference as to which project was chosen. (The second crossover rate is 300 percent) B. If the cost of capital for the firm were 11.6515%, you would be indifferent between the projects since their NPVs would be equal. C. You would choose Project Y since its IRR is higher and the payback period is shorter. D. Project X's NPV is more sensitive to a change in the cost of capital. E. Since the cost of capital is 11 percent, Project X would be chosen since it has a higher NPV at that cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts