Question: D Question 22 3 pts Consider a one-factor APT with the market portfolio (M) as the systematic risk factor. Suppose that the expected return on

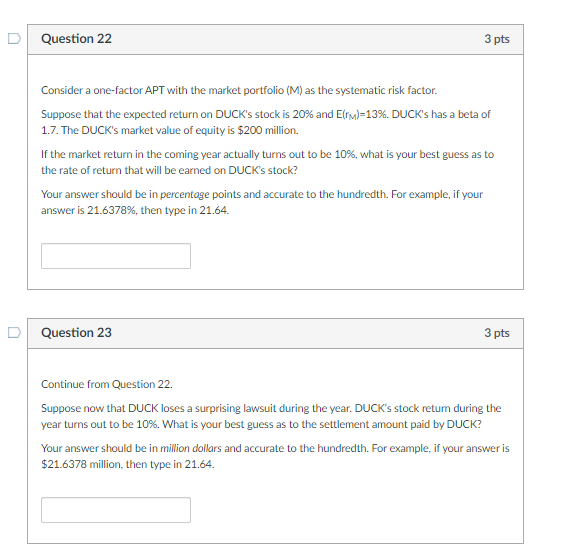

D Question 22 3 pts Consider a one-factor APT with the market portfolio (M) as the systematic risk factor. Suppose that the expected return on DUCK's stock is 20% and E(rm)=13%. DUCK's has a beta of 1.7. The DUCK's market value of equity is $200 million. If the market return in the coming year actually turns out to be 10%, what is your best guess as to the rate of return that will be earned on DUCK's stock? Your answer should be in percentage points and accurate to the hundredth. For example, if your answer is 21.6378%, then type in 21.64. Question 23 3 pts Continue from Question 22. Suppose now that DUCK loses a surprising lawsuit during the year. DUCK's stock retum during the year turns out to be 10%. What is your best guess as to the settlement amount paid by DUCK? Your answer should be in million dollars and accurate to the hundredth. For example, if your answer is $21.6378 million, then type in 21.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts