Question: undefined U Question 10 3 pts Consider a one-factor APT. A well-diversified portfolio P has beta=0.4. The expected return for the factor portfolio is 10%

undefined

undefined

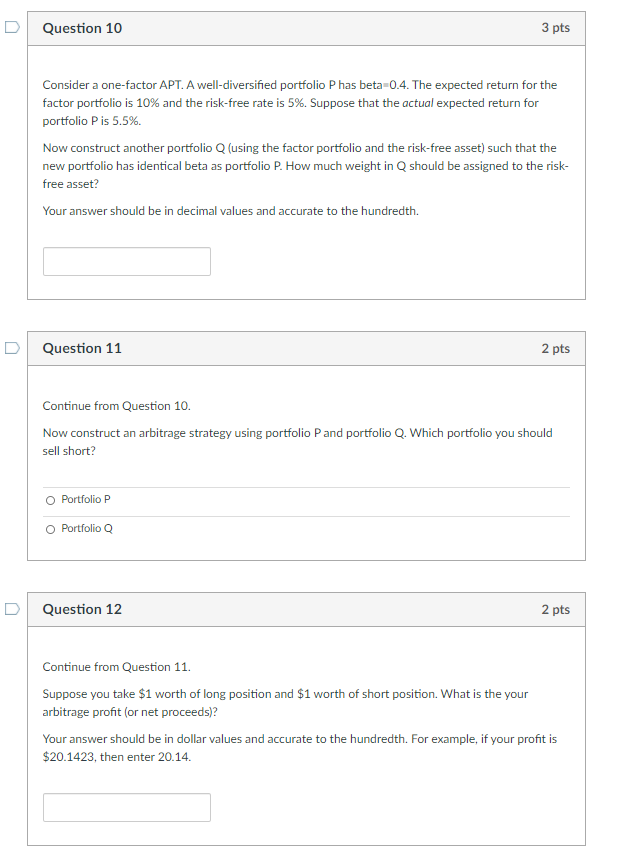

U Question 10 3 pts Consider a one-factor APT. A well-diversified portfolio P has beta=0.4. The expected return for the factor portfolio is 10% and the risk-free rate is 5%. Suppose that the actual expected return for portfolio Pis 5.5%. Now construct another portfolio Q (using the factor portfolio and the risk-free asset) such that the new portfolio has identical beta as portfolio P. How much weight in Q should be assigned to the risk- free asset? Your answer should be in decimal values and accurate to the hundredth. Question 11 2 pts Continue from Question 10. Now construct an arbitrage strategy using portfolio Pand portfolio Q. Which portfolio you should sell short? Portfolio P O Portfolio Q Question 12 2 pts Continue from Question 11. Suppose you take $1 worth of long position and $1 worth of short position. What is the your arbitrage profit (or net proceeds)? Your answer should be in dollar values and accurate to the hundredth. For example, if your profit is $20.1423, then enter 20.14. U Question 10 3 pts Consider a one-factor APT. A well-diversified portfolio P has beta=0.4. The expected return for the factor portfolio is 10% and the risk-free rate is 5%. Suppose that the actual expected return for portfolio Pis 5.5%. Now construct another portfolio Q (using the factor portfolio and the risk-free asset) such that the new portfolio has identical beta as portfolio P. How much weight in Q should be assigned to the risk- free asset? Your answer should be in decimal values and accurate to the hundredth. Question 11 2 pts Continue from Question 10. Now construct an arbitrage strategy using portfolio Pand portfolio Q. Which portfolio you should sell short? Portfolio P O Portfolio Q Question 12 2 pts Continue from Question 11. Suppose you take $1 worth of long position and $1 worth of short position. What is the your arbitrage profit (or net proceeds)? Your answer should be in dollar values and accurate to the hundredth. For example, if your profit is $20.1423, then enter 20.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts