Question: D Question 7 You purchase a call option for $5.45 with 18 months to expiration on a stock you expect to increase 25.00%. The strike

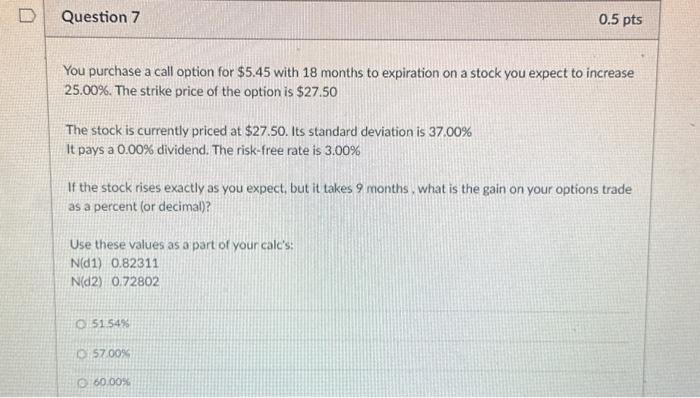

D Question 7 You purchase a call option for $5.45 with 18 months to expiration on a stock you expect to increase 25.00%. The strike price of the option is $27.50 The stock is currently priced at $27.50. Its standard deviation is 37.00% It pays a 0.00% dividend. The risk-free rate is 3.00% If the stock rises exactly as you expect, but it takes 9 months, what is the gain on your options trade as a percent (or decimal)? Use these values as a part of your calc's: N(d1) 0.82311 N(d2) 0.72802 51.54% 0.5 pts 57.00% 60.00%

You purchase a call option for $5.45 with 18 months to expiration on a stock you expect to increase 25.00%. The strike price of the option is $27.50 The stock is currently priced at $27.50. Its standard deviation is 37.00% It pays a 0.00% dividend. The risk-free rate is 3.00% If the stock rises exactly as you expect, but it takes 9 months, what is the gain on your options trade as a percent (or decimal)? Use these values as a part of your calc's: N(d1)0.82311 N(d2)0.72802 5154% 57.007 60.00%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock