Question: DARDENN BUSINESS PUBLISHING UV5137 DEVELOPING FINANCIAL INSIGHTS: USING A FUTURE VALUE (FV) AND A PRESENT VALUE (PV) APPROACH Base Case Starting Point Most everyone is

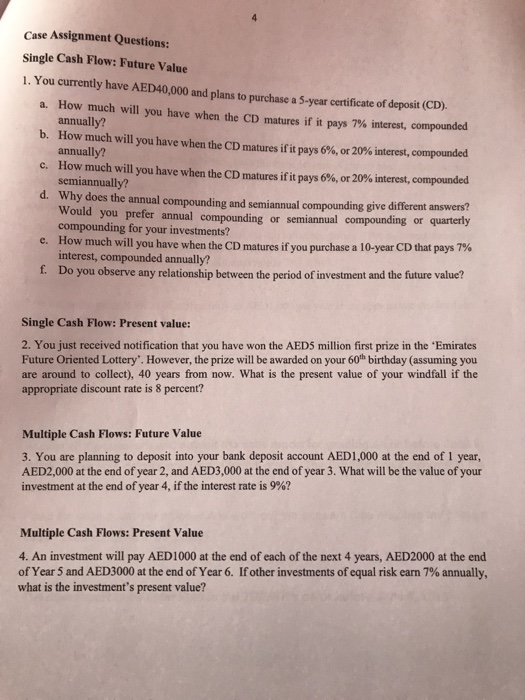

DARDENN BUSINESS PUBLISHING UV5137 DEVELOPING FINANCIAL INSIGHTS: USING A FUTURE VALUE (FV) AND A PRESENT VALUE (PV) APPROACH Base Case Starting Point Most everyone is familiar with the concept that money placed in a savings account will annually will grow to become S550 (ie,S500 1.10) after one year, Think about the numerical example just depicted. It took three sequential calculations to grow to a larger amount as the years pass if the money in that account earns interest at a pecified annual compounded rate. For example, $500 invested in a savings account that earns 10% interest compounded sos (ie., SSSO 1.10) after two years, and S665.50 (ie., S605 x 1.10) after three years. arrive at the $665.50 answer-one calculation for each year involved. If the question had been posed as involving 12 years or even 25 years, a multitude of tedious, repetitive calculations would have been required. Is there a shortcut? Yes. If we take the 1.10 multiplier amount from each of the three parenthetical notations above and simply multiply them together-1.10x 1.10 x 1.10-we get a numerical factor of 1.331. So, if some reference book could provide us with the 1.331 multiplier as being applicable to a 10% situation over three years, all we would have to do is take the initial $500 amount put into the savings account and multiply it by 1.331 to get the very same answer as above $665.50. Are there reference materials that provide such multipliers for a variety of interest and years combinations? Yes, there are, and they are referred to as future value (FV) factors. Such reference materials are useful because no matter the initial amount invested, a specified combination of time and interest will always have the same multiplier effect. Thus, future value factor tables are readily available, depicting a number of possible different interest rates along one axis and a number of different years along the other. In fact, Exhibit 1 presents just such a The 1.10 multiplier comes from the fact that mone year there will be 1000% of that year's starting monetary amount plus an additional 10% due to a year's worth of interest having been accumulated at a 10% rate. Thus, 100% +10%-110%, which converts to an arithmetic multiplier of 1.10. This case explores cash flows on an annual basis. Appendix 1 explains what to do when cash flows occur ona monthly or quarterly basis. This case was prepared by Professor Mark Haskins. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2011 by the University of Virgina Darden School Foundation, Charlottesville, VA. Al rights reserved. To order copies, send an email to esspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means-electronic, mechanical, photocopying recording, or otherwise-without the permission of the Darden School Foundation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts