Question: dAssignmentOwerviow.aspxihomeworkid - 6 8 7 6 8 4 1 5 1 Brian Velasco 0 4 / 7 6 / 2 5 8 : 2 0

dAssignmentOwerviow.aspxihomeworkid

Brian Velasco : PM

Question

Pat of

Completed: of My seors: pts

Save

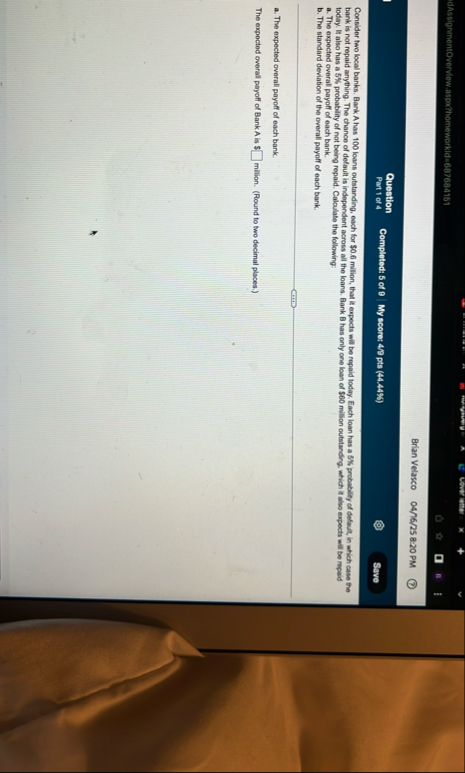

Consider two local banks. Barki A has loans outstanding, each for $ milion, that it expects will be repaid today. Each loan has a probabily of defuet, in which case the bark is not repaid anything. The chance of default is independent across all the loans. Bank B has only one lown of $ million outstanding. which it albo expects will be repsid today. It also has a probability of not being repaid. Calculate the following:

a The expected overal payoff of each bank.

b The standard deviation of the overall payoff of each bank.

a The expected overall payoff of each bank.

The expected overall payoff of BankA is $ milion. Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock