Question: Data File Available: As discussed in Section 8.3, the Markowitz model uses the variance of the portfolio as the measure of risk. However, variance includes

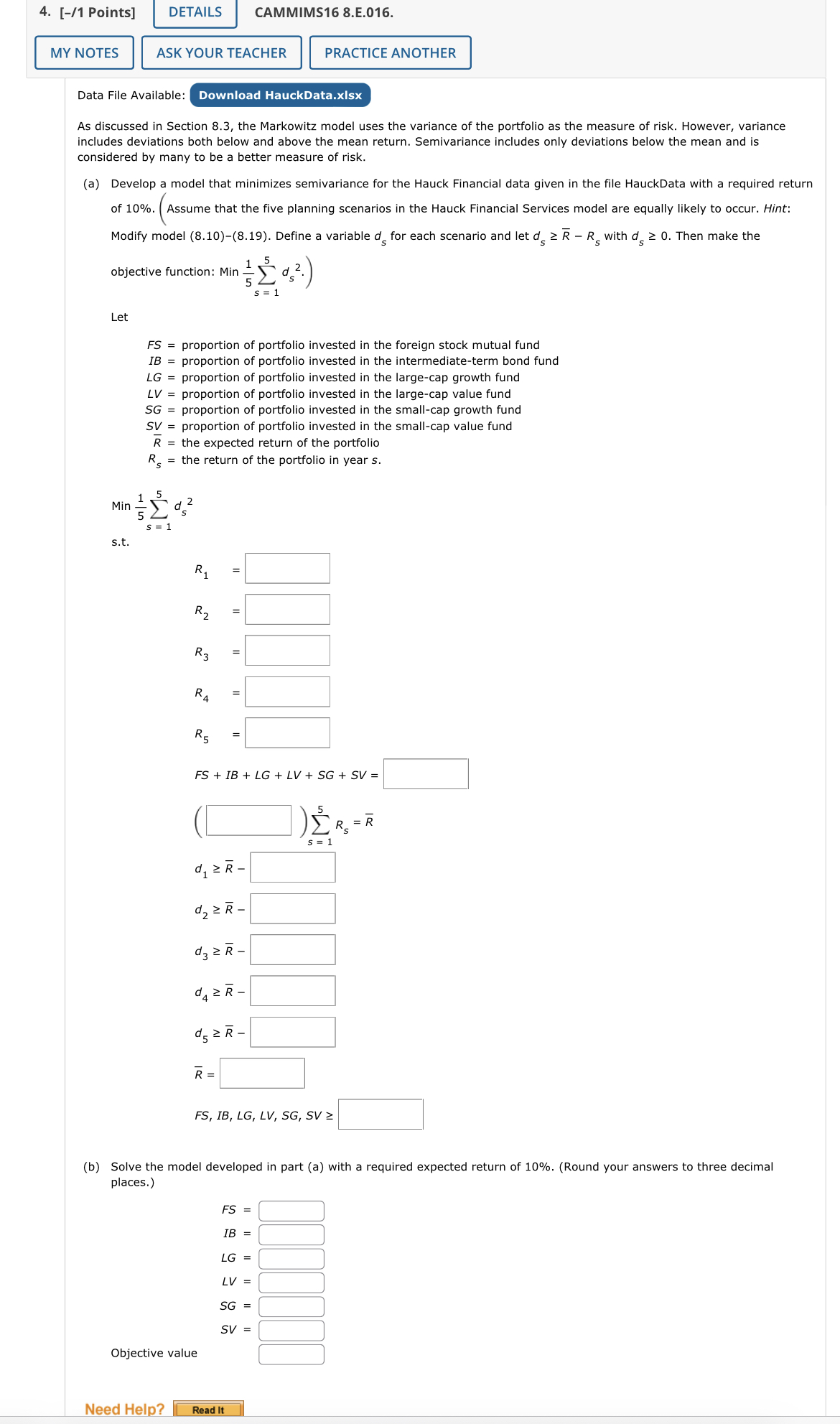

Data File Available: As discussed in Section 8.3, the Markowitz model uses the variance of the portfolio as the measure of risk. However, variance includes deviations both below and above the mean return. Semivariance includes only deviations below the mean and is considered by many to be a better measure of risk. (a) Develop a model that minimizes semivariance for the Hauck Financial data given in the file HauckData with a required ret of 10%. (Assume that the five planning scenarios in the Hauck Financial Services model are equally likely to occur. Hint: Modify model (8.10)-(8.19). Define a variable ds for each scenario and let dsRRs with ds0. Then make the objective function: Min51s=15ds2.) Let FS= proportion of portfolio invested in the foreign stock mutual fund IB= proportion of portfolio invested in the intermediate-term bond fund LG= proportion of portfolio invested in the large-cap growth fund LV= proportion of portfolio invested in the large-cap value fund SG= proportion of portfolio invested in the small-cap growth fund SV= proportion of portfolio invested in the small-cap value fund R= the expected return of the portfolio Rs= the return of the portfolio in year s. Min51s=15ds2 s.t. R1=R2=R3=R4=R5=FS+IB+LG+LV+SG+SV=()s=15Rs=Rd1Rd2Rd3Rd4Rd5RR=FS,IB,LG,LV,SG,SV (b) Solve the model developed in part (a) with a required expected return of 10%. (Round your answers to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts