Question: Data Window Help 84% Sun 11:07 PM Q Excel File Edit View Insert Format Tools AutoSave BESU- Excel Project-SUM20 Q Page Layout Formulas Data Review

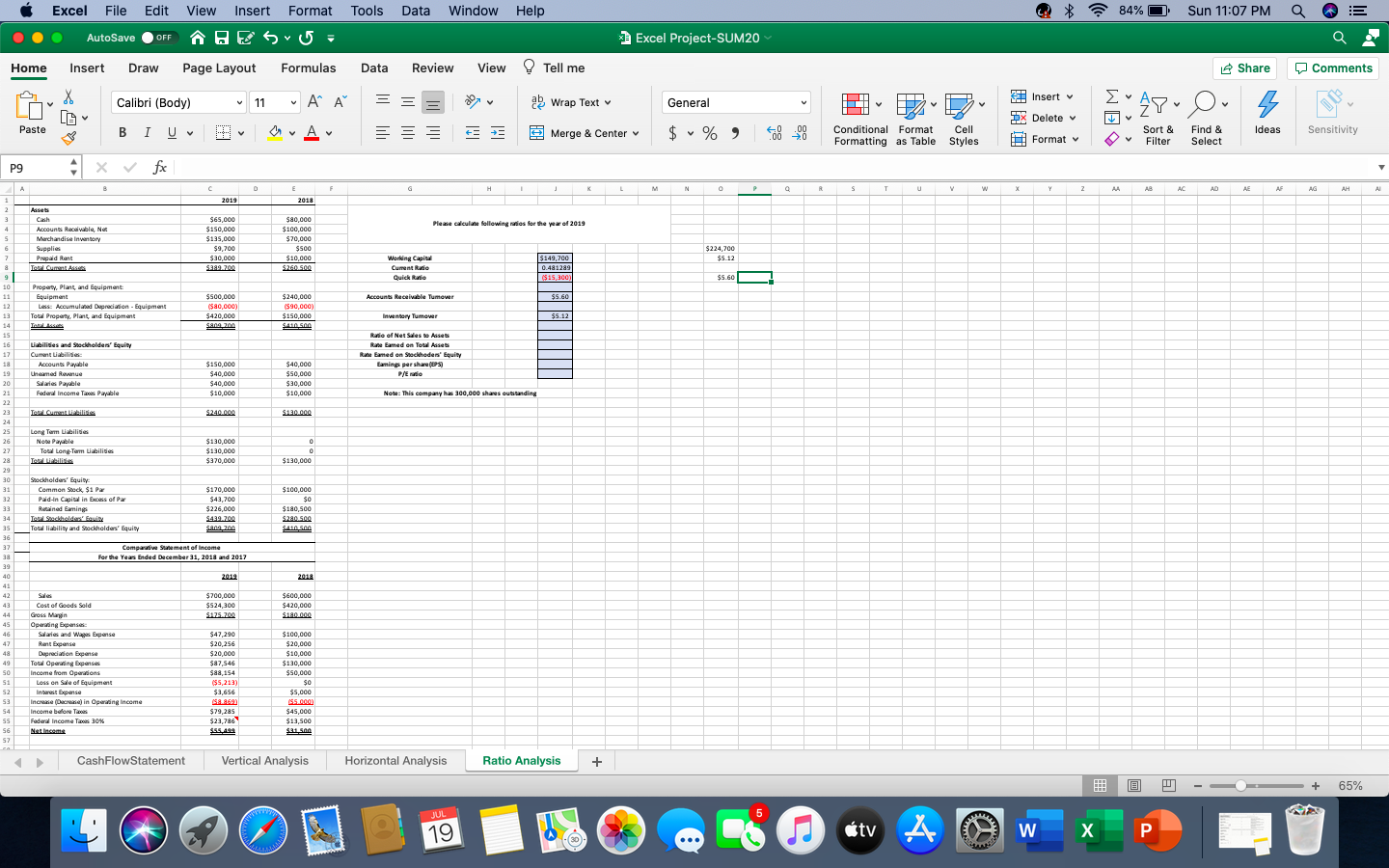

Data Window Help 84% Sun 11:07 PM Q Excel File Edit View Insert Format Tools AutoSave BESU- Excel Project-SUM20 Q Page Layout Formulas Data Review View Tell me Share Comments Insert X LE 11 V Ai Wrap Text General U PA WE 48- 0 5 V DX Delete .00 BIU E V Ideas $ % Merge & Center v 8 28 Conditional Format Formatting as Table Cell Styles Sort & Filter Sensitivity Format Find & Select fx E F G H K L M N O P Q s T U V w X Y z AA AB AC AD AE AF AG AH AL 50 OFF Home Insert Draw Calibri (Body) Paste P9 B 2019 2 Aase 3 Cash $65,000 4 Accounts Receivable, Ne $150,000 s Merchandise intory 6 Supplies $9,700 2 Prepaid Rent $30,000 8 Teolar $299.200 9 10 Property, plant, and Equipment Equipment $500,000 12 LessAccumulated precion Equipment $80,000) 13 Total Property, Plant, and Equipment $420,000 Toal S00 15 16 Liabilities and Stockholders' Equity 17 Current Liabilities: 18 Accounts Payable $150,000 19 Unemad Rumu $40,000 20 Salais Payable $40,000 21 Federal income To Payable $10,000 2018 Please calculae following us for the vow of 2019 $80,000 $100,000 $70,000 $500 $10,000 $260.500 $224,700 $5.12 Working Capital Cument Rana Quick Ratio $149,700 0.481289 ($15,300) $5.60 Accounts Receivable Tumower $5.60 $240,000 ($90,000 $150,000 SA 500 Inventory Tumewer $5.12 Rate of Net Siesta Asset Rare Eamed on Total Assess Rare Eamed on Schede Equity Baming pershan (5) PE $40,000 $50,000 $30,000 $10,000 Note: This company has 300,000 shares outstanding $240.000 S120.000 Long Term Liabilities Notable Total Long-Tam abilities $130,000 $130,000 $370,000 0 0 $130,000 23 24 25 26 27 28 29 30 31 32 33 34 35 Stockholders' Equity Common Stock $1 Par Paid-in Capital in Excess of Par Retained Gaming Tool Stockholders' Foui Total liability and Stockholders' Equity $170,000 $43,700 $226,000 $439.200 sana, 200 $100,000 $0 $180,500 $280.500 s.com 37 38 39 Companive Sument of income for the Yeas Ended December 31, 2018 and 2017 40 2012 $700,000 $524,300 $125.200 $600,000 $420,000 S180.000 42 43 44 45 46 47 48 49 50 51 52 53 54 SS 56 52 Cost of Goods Sold Gross Margin Owings Salaries and Wages Expense Rantane Depreciation Expanse Total Opwing Expenses Income from Opowions Lesson Sale of Equipment can weer | Increase (case) in Operating income Income before Federal Income To 30% Neticama $47,290 $20,256 $20,000 $87,546 $88,154 $5,213) We $3,656 $100,000 $20,000 $10,000 $130,000 $50,000 $0 $5,000 S5.000 $45,000 $13,500 SELS $79,285 $23,786 Cash FlowStatement Vertical Analysis Horizontal Analysis Ratio Analysis + + 65% JUL 5 VA 19 tv 4 W X P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts