Question: Data Window Help 65% Tue 12:30 AM 0 Excel File Edit View Insert Format Tools AutoSave HES OFF Excel Project-SUM20 Q Home Insert Draw Page

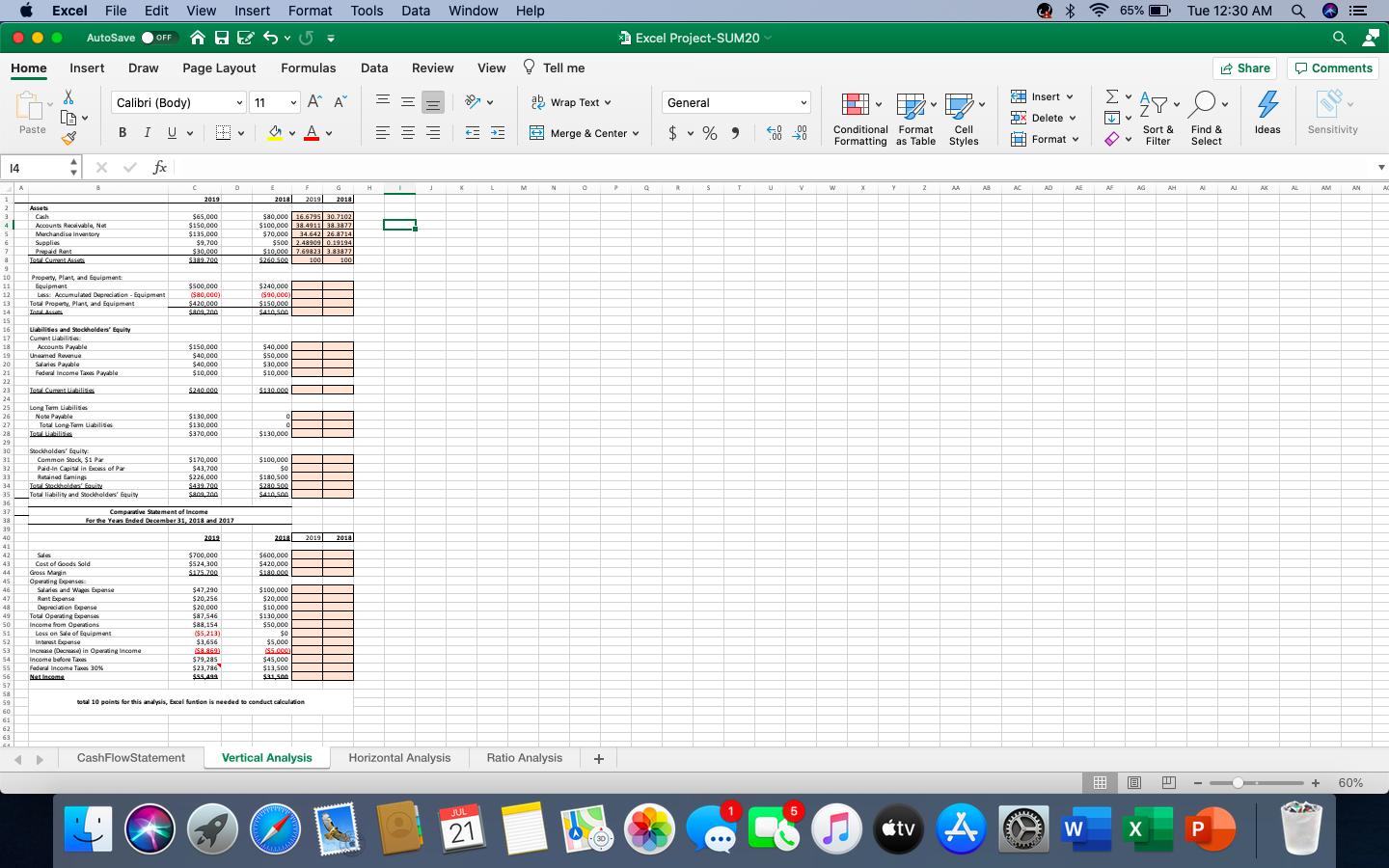

Data Window Help 65% Tue 12:30 AM 0 Excel File Edit View Insert Format Tools AutoSave HES OFF Excel Project-SUM20 Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Insert X LE Calibri (Body) 11 V AP Wrap Text General U PA WE AY Ou 5 V DX Delete Paste B I U V Merge & Center v V $ % ) Ideas .00 > 0 Conditional Format Formatting as Table Cell Styles Sensitivity Sort & Filter Format Find & Select 14 fx H K M N O P R S W X Y z AA AB AC AD AE AF AG AH AL AJ AK AL AM AN AC D A 8 G 1 2019 2018 2019 2018 2 Aaset 3 $65,000 $80,000 16.6295 30.2102 4 Accounts Receivable, Net $150,000 $100,000 28.40131221877 S Merchandise in watery $135,000 $70,000 34.642 26.8714 6 Supplies $9,700 $500 2.48909 0.19194 2 Prepaid Rand $30,000 $10.000 7.69823 3.83872 Teolumns $289.700 $260.500 100 100 9 10 Property, Plant, and Equipment 11 Equipment $500,000 $240,000 12 Less: Accumulated Depreciation - Equipment ($80,000) ($90,000) Total Property, plant, and Equipment $420,000 $150,000 14 san 200 SASA 15 Liabilities and Sockholders' Equity 17 Cum Libilities 18 Accounts Payable $150,000 $40,000 19 Unaamad Revenue $40,000 $50,000 20 Salais Payable $40,000 $30,000 21 Federal income To Payable $10,000 $10,000 22 23 Tool Cummilis $240.000 S130.000 24 25 Long Tam bilities 26 Note Payable $130,000 0 27 Tool Long-Term abilities $130,000 0 28 Toca Libilities $370,000 $130,000 29 30 Stockholders' Equity 31 Common Stock $1 Pa $170,000 $100,000 32 Paid in Capital in Excess of Par $43,700 $0 33 Retained aning $226,000 $180,500 34 Tool Sabadell S422 200 $0.500 35 Total liability and Stockholders' Equity sana, 200 SA 500 36 32 Comparative Statement of Income 38 For the Year Ended December 11, 2018 and 2017 39 40 2011 2010 2010 41 42 $700,000 $600,000 43 Cost of Goods Sold $524,300 $420,000 Gross Margin $125.200 $180.000 45 Operating Expenses 46 Salaries and Wap pense $47,290 $100,000 47 Rent $20,256 $20,000 48 Depreciation Expanse $20,000 $10,000 49 Total Operating Expand $87,546 $130,000 SO Income from Owions $88,154 $50,000 S1 Lesson Site of Equipment so $0 52 interest Expanse $3,656 $5,000 53 increase (O) in Operating income 5.000 54 Income before To $79,285 $45,000 SS Federal income To 30% $23,786 $13,500 56 Netincem $55.499 $21.500 57 Sa 59 Bosal 10 points for this analysis, Excel funtion is needed to conduct calculation 60 62 63 CashFlowStatement Vertical Analysis Horizontal Analysis Ratio Analysis + B 60% JUL 5 21 tv W P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts