Question: Demonstrate the risk return trade off with different asset classes and label appropriately with commentary. [7] (b) Demonstrate the concept of efficient frontier and

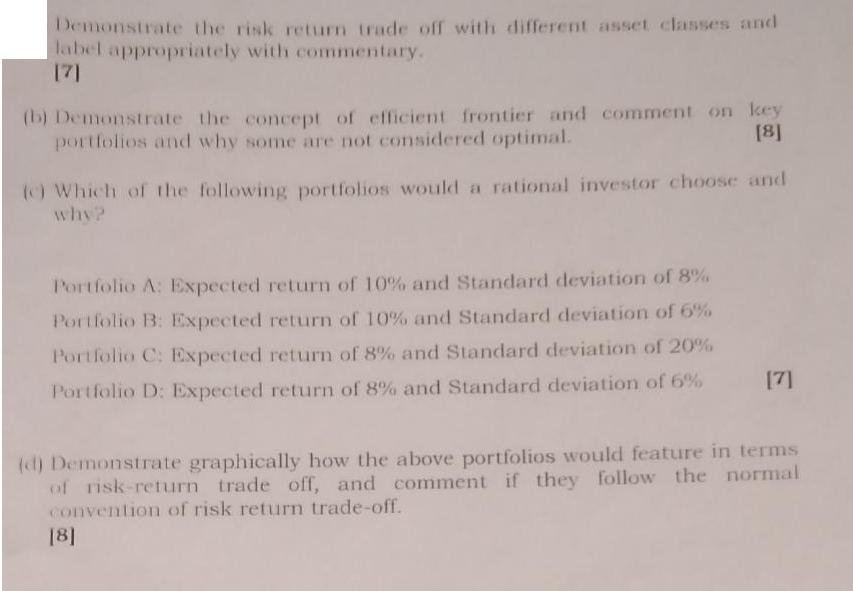

Demonstrate the risk return trade off with different asset classes and label appropriately with commentary. [7] (b) Demonstrate the concept of efficient frontier and comment on key [8] portfolios and why some are not considered optimal. (c) Which of the following portfolios would a rational investor choose and why? Portfolio A: Expected return of 10% and Standard deviation of 8% Portfolio B: Expected return of 10% and Standard deviation of 6% Portfolio C: Expected return of 8% and Standard deviation of 20% Portfolio D: Expected return of 8% and Standard deviation of 6% [7] (d) Demonstrate graphically how the above portfolios would feature in terms of risk-return trade off, and comment if they follow the normal convention of risk return trade-off. [8]

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Answer i Risk Return tradeoff suggest that potential return rises with a increase amount of risk Therefore risk averse entitles low potential level of ... View full answer

Get step-by-step solutions from verified subject matter experts