Question: derivatives securities, please provide correct answer Question 5 0.0/6.0 points (graded) Consider a stock, XYZ, which pays no dividends over the next year. The current

derivatives securities, please provide correct answer

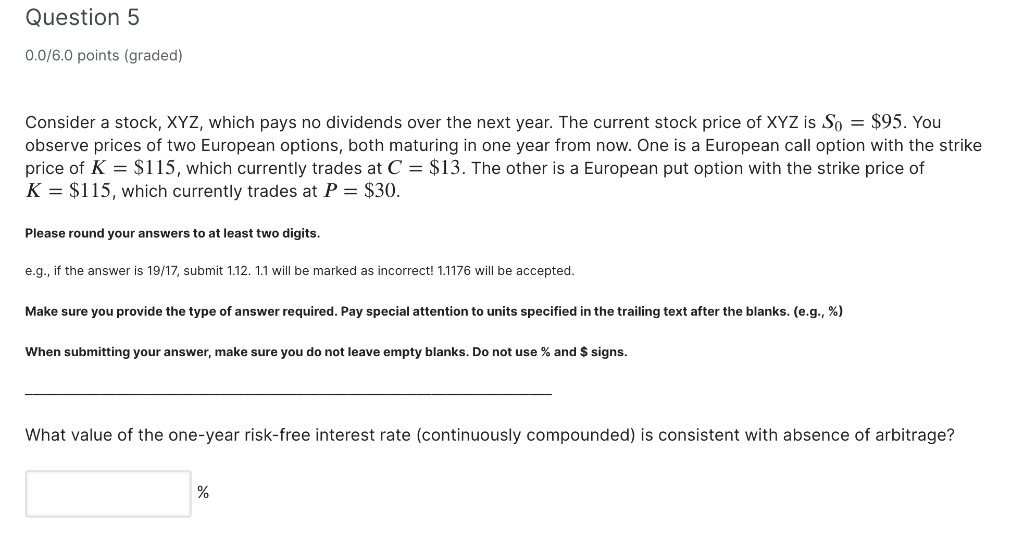

Question 5 0.0/6.0 points (graded) Consider a stock, XYZ, which pays no dividends over the next year. The current stock price of XYZ is So = $95. You observe prices of two European options, both maturing in one year from now. One is a European call option with the strike price of K = $115, which currently trades at C = $13. The other is a European put option with the strike price of K = $115, which currently trades at P = $30. Please round your answers to at least two digits. e.g., if the answer is 19/17, submit 1.12. 1.1 will be marked as incorrect! 1.1176 will be accepted. Make sure you provide the type of answer required. Pay special attention to units specified in the trailing text after the blanks. (e.g., %) When submitting your answer, make sure you do not leave empty blanks. Do not use % and $ signs. What value of the one-year risk-free interest rate (continuously compounded) is consistent with absence of arbitrage? %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts