Question: Design and develop a Visual Basic program to compute the income tax for one resident of Ohio using the tax table below ( as published

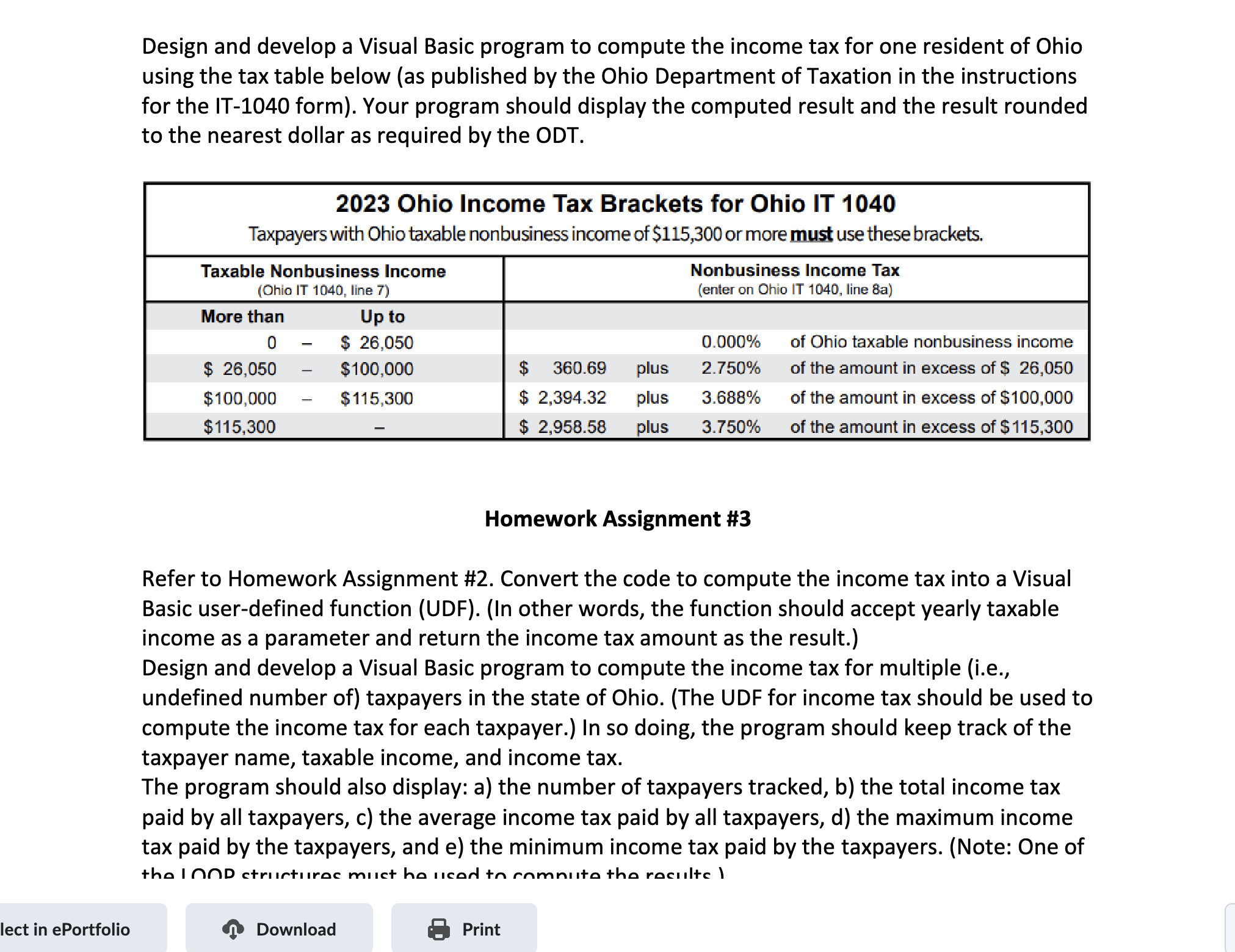

Design and develop a Visual Basic program to compute the income tax for one resident of Ohio

using the tax table below as published by the Ohio Department of Taxation in the instructions

for the ITformYour program should display the computed result and the result rounded

to the nearest dollar as required by the ODT.

Homework Assignment #

Refer to Homework Assignment #Convert the code to compute the income tax into a Visual

Basic userdefined function UDFIn other words, the function should accept yearly taxable

income as a parameter and return the income tax amount as the result.

Design and develop a Visual Basic program to compute the income tax for multiple ie

undefined number oftaxpayers in the state of Ohio. The UDF for income tax should be used to

compute the income tax for each taxpayer.In so doing, the program should keep track of the

taxpayer name, taxable income, and income tax.

The program should also display: athe number of taxpayers tracked, bthe total income tax

paid by all taxpayers, cthe average income tax paid by all taxpayers, dthe maximum income

tax paid by the taxpayers, and ethe minimum income tax paid by the taxpayers. Note: One of

the LOOP structures must be used to compute the results.

answer this with VISUAL BASIC CODE, explain the outputs, explain the inputs, copy and paste the code, dumb down the code also. describe the steps and describe the user interface such as using textboxes Design and develop a Visual Basic program to compute the income tax for one resident of Ohio using the tax table below as published by the Ohio Department of Taxation in the instructions for the IT form Your program should display the computed result and the result rounded to the nearest dollar as required by the ODT.

begintabularcccccccc

hline multicolumnrbegintabularl

Ohio Income Tax Brackets for Ohio IT

Taxpayers with Ohio taxable nonbusiness income of $ or more must use these brackets.

endtabular

hline multicolumnlTaxable Nonbusiness Income Ohio IT line & multicolumnrNonbusiness Income Tax enter on Ohio IT line a

hline More than & & Up to & & & & &

hline & & $ & & & & & of Ohio taxable nonbusiness income

hline $ & & $ & $ & & plus & & of the amount in excess of $

hline $ & & $ & & & plus & & of the amount in excess of $

hline $ & & square & & & plus & & of the amount in excess of $

hline

endtabular

Homework Assignment #

Refer to Homework Assignment # Convert the code to compute the income tax into a Visual Basic userdefined function UDFIn other words, the function should accept yearly taxable income as a parameter and return the income tax amount as the result.

Design and develop a Visual Basic program to compute the income tax for multiple ie undefined number of taxpayers in the state of Ohio. The UDF for income tax should be used to compute the income tax for each taxpayer. In so doing, the program should keep track of the taxpayer name, taxable income, and income tax.

The program should also display: a the number of taxpayers tracked, b the total income tax paid by all taxpayers, c the average income tax paid by all taxpayers, d the maximum income tax paid by the taxpayers, and e the minimum income tax paid by the taxpayers. Note: One of

lect in ePortfolio

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock