Question: Desperately need help on this earning per share question. I need to calculate BOTH basic EPS and dialuted EPS. There is a lot of information

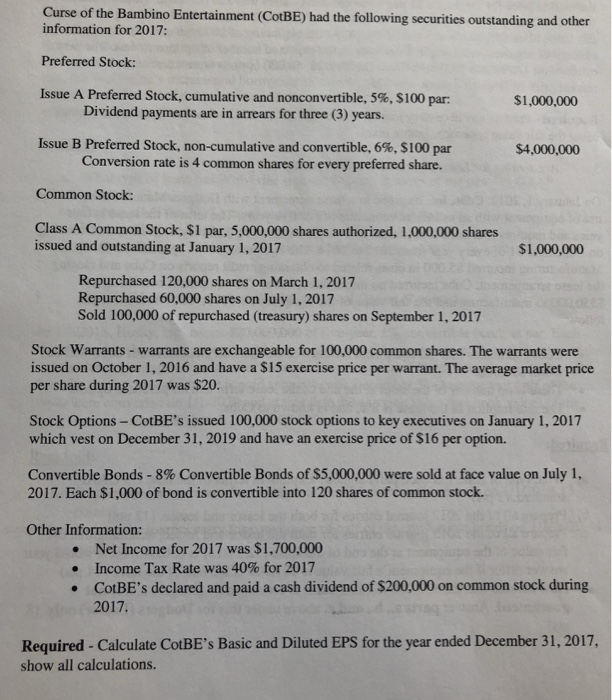

Curse of the Bambino Entertainment (CotBE) had the following securities outstanding and other information for 2017: Preferred Stock: Issue A Preferred Stock, cumulative and nonconvertible, 5%, $100 par Issue B Preferred Stock, non-cumulative and convertible, 6%, S 100 par $1,000,000 Dividend payments are in arrears for three (3) years. $4,000,000 Conversion rate is 4 common shares for every preferred share. Common Stock: Class A Common Stock, $1 par, 5,000,000 shares authorized, 1,000,000 shares issued and outstanding at January 1, 2017 $1,000,000 Repurchased 120,000 shares on March 1, 2017 Repurchased 60,000 shares on July 1, 2017 Sold 100,000 of repurchased (treasury) shares on September 1, 2017 Stock Warrants - warrants are exchangeable for 100,000 common shares. The warrants were issued on October 1, 2016 and have a $15 exercise price per warrant. The average market price per share during 2017 was $20. Stock Options-CotBE's issued 100,000 stock options to key executives on January 1, 2017 which vest on December 31, 2019 and have an exercise price of $16 per option. Convertible Bonds-8% Convertible Bonds of $5,000,000 were sold at face value on July 1, 2017. Each $1,000 of bond is convertible into 120 shares of common stock Other Information: . . Net Income for 2017 was $1,700,000 Income Tax Rate was 40% for 2017 CotBE's declared and paid a cash dividend of $200,000 on common stock during 2017. Required - Calculate CotBE's Basic and Diluted EPS for the year ended December 31, 2017, show all calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts