Question: Determine the requested binomial tree option pricing model inputs given the information below and the assumption of a 360-day year: $ Spot price of

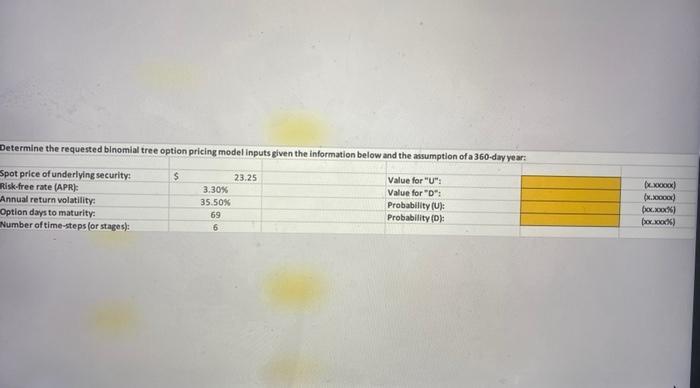

Determine the requested binomial tree option pricing model inputs given the information below and the assumption of a 360-day year: $ Spot price of underlying security: Risk-free rate (APR): Value for "U": Value for "D": Probability (U): Probability (D): Annual return volatility: Option days to maturity: Number of time-steps (or stages): 3.30% 35.50% 69 6 23.25 (xXxxxxxxx) (x.xxxxxx) (xx.xxxx) bxx.xx00%)

Step by Step Solution

There are 3 Steps involved in it

It appears that you want to calculate the binomial tree option pricing model inputs given the information on the image Lets go through each required i... View full answer

Get step-by-step solutions from verified subject matter experts