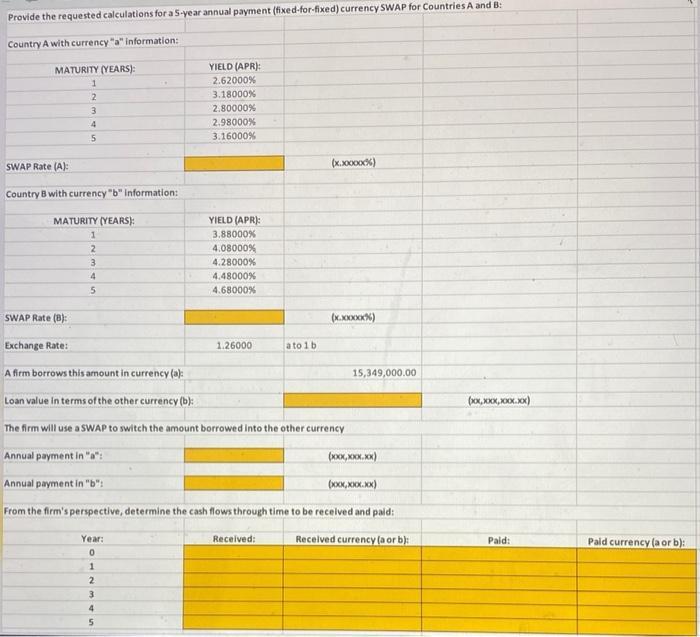

Question: Provide the requested calculations for a 5-year annual payment (fixed-for-fixed) currency SWAP for Countries A and B: Country A with currency a information: MATURITY

Provide the requested calculations for a 5-year annual payment (fixed-for-fixed) currency SWAP for Countries A and B: Country A with currency "a" information: MATURITY (YEARS): 1 2 3 4 5 SWAP Rate (A): Country B with currency "b" information: MATURITY (YEARS): 1 2 3 4 5 YIELD (APR): 2.62000% 3.18000% 2.80000% 2.98000% 3.16000% 1 2 3 4 5 YIELD (APR): 3.88000% 4.08000% 4.28000% 4.48000% 4.68000% SWAP Rate (B): Exchange Rate: A firm borrows this amount in currency (a): Loan value in terms of the other currency (b): The firm will use a SWAP to switch the amount borrowed into the other currency Annual payment in "a": 1.26000 (x.xxxxxx%) a to lb Received: (x.xxxxxx%) (xxxxxxxxxxx) Annual payment in "b": (xXxxXx,xxxXx.xx) From the firm's perspective, determine the cash flows through time to be received and paid: Year: Received currency (a or b): 0 15,349,000.00 (xxx,xxxx,xxxx.xxx) Paid: Paid currency (a or b):

Step by Step Solution

There are 3 Steps involved in it

To calculate the cash flows for a 5year annual payment fixedforfixed currency swap between Country A currency a and Country B currency b well use the ... View full answer

Get step-by-step solutions from verified subject matter experts