Question: Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return for the following financial assets and identify the security that had the best

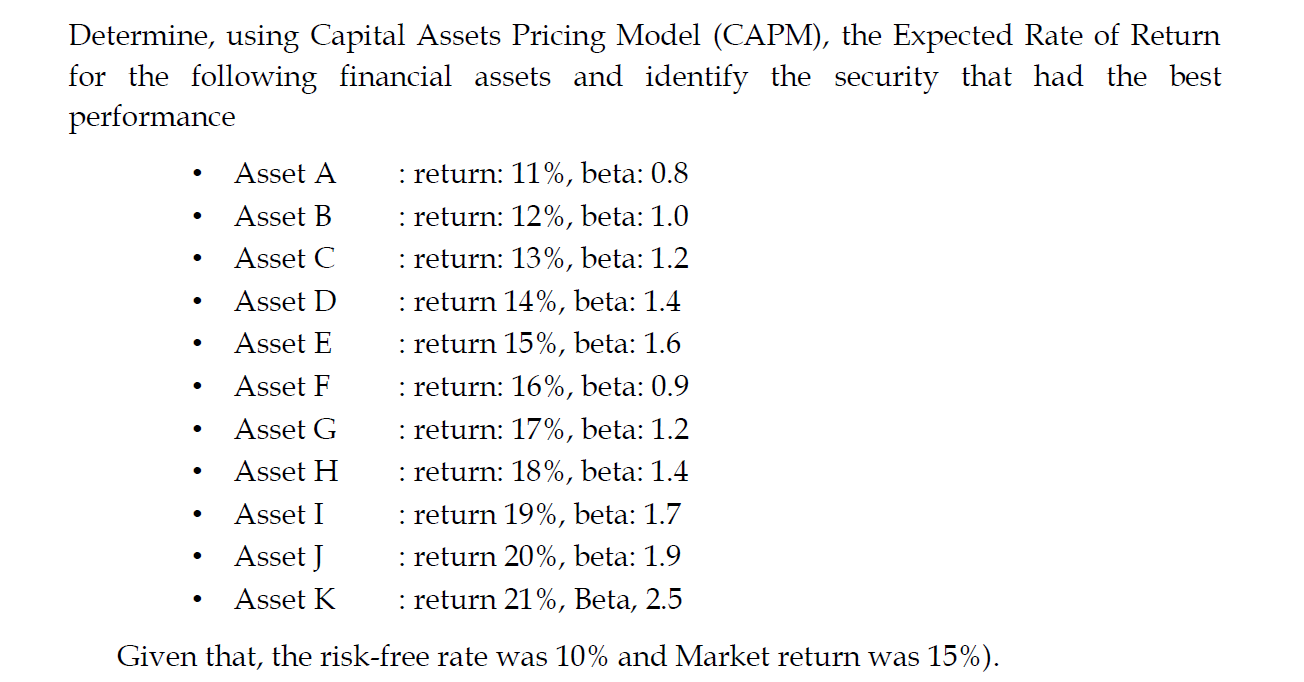

Determine, using Capital Assets Pricing Model (CAPM), the Expected Rate of Return for the following financial assets and identify the security that had the best performance Asset A Asset B Asset C Asset D . Asset E : return: 11%, beta: 0.8 : return: 12%, beta: 1.0 : return: 13%, beta: 1.2 : return 14%, beta: 1.4 : return 15%, beta: 1.6 : return: 16%, beta: 0.9 : return: 17%, beta: 1.2 : return: 18%, beta: 1.4 : return 19%, beta: 1.7 : return 20%, beta: 1.9 : return 21%, Beta, 2.5 Asset F Asset G Asset H Asset I Asset J Asset K . . Given that, the risk-free rate was 10% and Market return was 15%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts