Question: Develop a level-0 DFD. Level-0 DFD should have minimum 2 data stores, 3 process, 1 source and 1 sink Develop a level-1 DFD by decomposing

Develop a level-0 DFD. Level-0 DFD should have minimum 2 data stores, 3 process, 1 source and 1 sink

Develop a level-1 DFD by decomposing one process in level-0 DFD. The level-1 DFD should have minimum 2 data stores and 2 processes

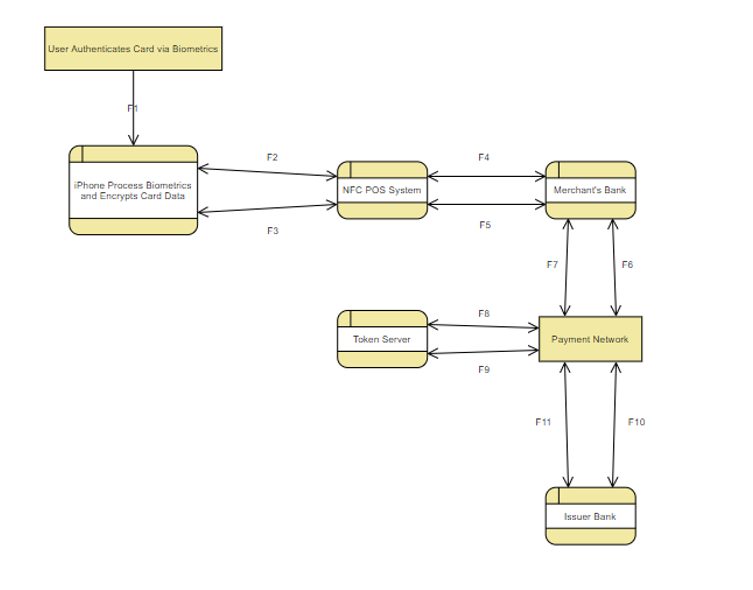

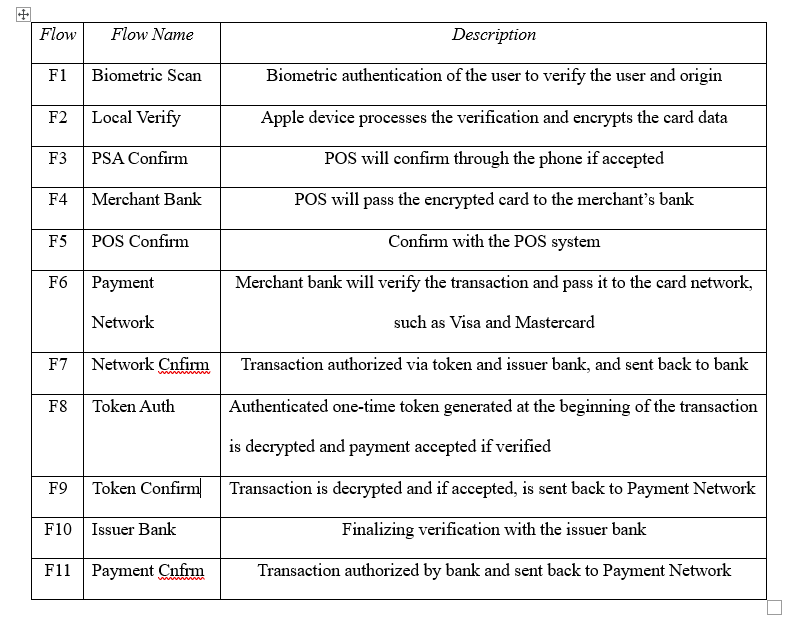

Below is a framework Apple Pay generally adheres by to process a user's transaction. The model shows 11 different transaction data flows, 5 processes, as well as 2 sources/sinks. It starts at the biometric authentication of the user to verify the user and origin. Then the Apple device processes the verification and encrypts the card data, sending it to the point-of-sale system. If it verifies correctly, the POS will confirm through the phone it was accepted. Then the POS will pass the encrypted card to the merchant's bank, where it will verify and confirm with the POS system. From there, the merchant bank will verify the transaction and pass it to the card User Authenticates Card via Biometrics F2 F4 iPhone Process Biometrics and Encrypts Card Data NFC POS System Merchant's Bank FS F3 F7 FB FB Token Server Payment Network F9 F11 F10 Issuer Bank + Flow Flow Name Description F1 Biometric Scan Biometric authentication of the user to verify the user and origin F2 Local Verify Apple device processes the verification and encrypts the card data F3 PSA Confirm POS will confirm through the phone if accepted F4 Merchant Bank POS will pass the encrypted card to the merchant's bank F5 POS Confirm Confirm with the POS system F6 Payment Merchant bank will verify the transaction and pass it to the card network, Network such as Visa and Mastercard F7 Network Cnfirm Transaction authorized via token and issuer bank, and sent back to bank F8 Token Auth Authenticated one-time token generated at the beginning of the transaction is decrypted and payment accepted if verified F9 Token Confirm Transaction is decrypted and if accepted, is sent back to Payment Network F10 Issuer Bank Finalizing verification with the issuer bank F11 Payment Cnfim Transaction authorized by bank and sent back to Payment Network Below is a framework Apple Pay generally adheres by to process a user's transaction. The model shows 11 different transaction data flows, 5 processes, as well as 2 sources/sinks. It starts at the biometric authentication of the user to verify the user and origin. Then the Apple device processes the verification and encrypts the card data, sending it to the point-of-sale system. If it verifies correctly, the POS will confirm through the phone it was accepted. Then the POS will pass the encrypted card to the merchant's bank, where it will verify and confirm with the POS system. From there, the merchant bank will verify the transaction and pass it to the card User Authenticates Card via Biometrics F2 F4 iPhone Process Biometrics and Encrypts Card Data NFC POS System Merchant's Bank FS F3 F7 FB FB Token Server Payment Network F9 F11 F10 Issuer Bank + Flow Flow Name Description F1 Biometric Scan Biometric authentication of the user to verify the user and origin F2 Local Verify Apple device processes the verification and encrypts the card data F3 PSA Confirm POS will confirm through the phone if accepted F4 Merchant Bank POS will pass the encrypted card to the merchant's bank F5 POS Confirm Confirm with the POS system F6 Payment Merchant bank will verify the transaction and pass it to the card network, Network such as Visa and Mastercard F7 Network Cnfirm Transaction authorized via token and issuer bank, and sent back to bank F8 Token Auth Authenticated one-time token generated at the beginning of the transaction is decrypted and payment accepted if verified F9 Token Confirm Transaction is decrypted and if accepted, is sent back to Payment Network F10 Issuer Bank Finalizing verification with the issuer bank F11 Payment Cnfim Transaction authorized by bank and sent back to Payment Network

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts