Question: Develop a sample public company disclosure for segment reporting. A segment note disclosure should be prepared, for a fictional company Canyon Incorporated that will be

Develop a sample public company disclosure for segment reporting.

A segment note disclosure should be prepared, for a fictional company "Canyon Incorporated" that will be similar to those of a public company.

It is recommended to review at least two Form 10-Ks from publicly traded companies within the same industry. Review the segment reporting disclosure and use the public companies' disclosures as a guide to develop a segment note disclosure for Canyon Incorporated. Determine the industry for Canyon Incorporated for preparation of the segment discloser note. Include the links to the two companies' 10-Ks that you utilize as a guide. As a reminder, paraphrase and use your own way to develop a unique reporting note discloser.

The segment note disclosure should include the following:

- Summary of the operating segment (location, product, or service).

- Statement of other information included in the segment, such as corporate structure.

- Discussion of the business industry and why the segment data are by location, product, or service.

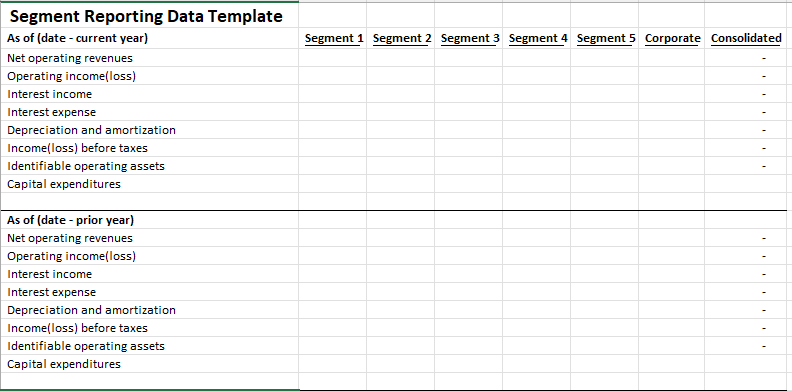

- Use the "Segment Reporting Data Template" Excel spreadsheet as a guide to develop tables with fictitious data to include in the segment disclosure. You will include the data tables in the written report for final submission.

- Use the fictitious data you developed to explain how the segments were determined (include all three tests: net revenue, net assets, and operating profit).

Segment Reporting Data Template As of (date - current year) Net operating revenues Operating income(loss) Interest income Interest expense Depreciation and amortization Income(loss) before taxes Identifiable operating assets Capital expenditures As of (date - prior year) Net operating revenues Operating income(loss) Interest income Interest expense Depreciation and amortization Income(loss) before taxes Identifiable operating assets Capital expenditures Segment 1 Segment 2 Segment 3 Segment 4 Segment 5 Corporate Consolidated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts