Question: Develop an S&OP plan by month for fiscal year 2020. Consider the use of several different production strategies. Which strategy do you recommend? Use Excel

- Develop an S&OP plan by month for fiscal year 2020. Consider the use of several different production strategies. Which strategy do you recommend? Use Excel to save time in making these plans.

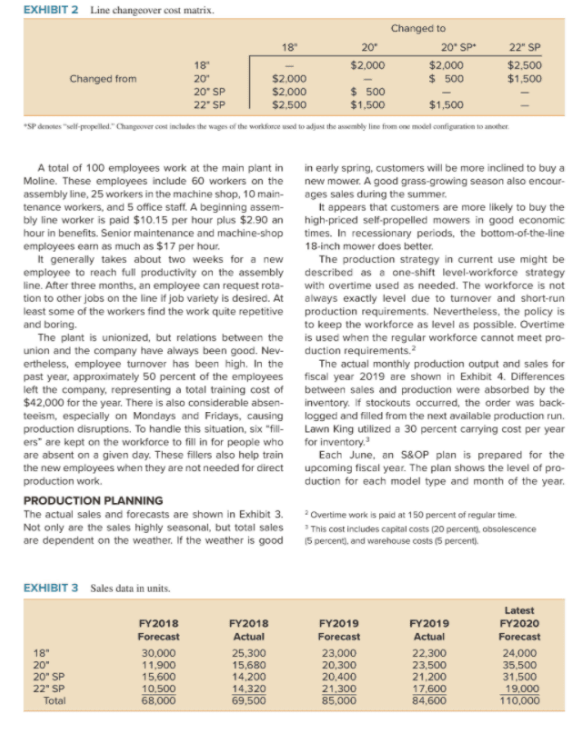

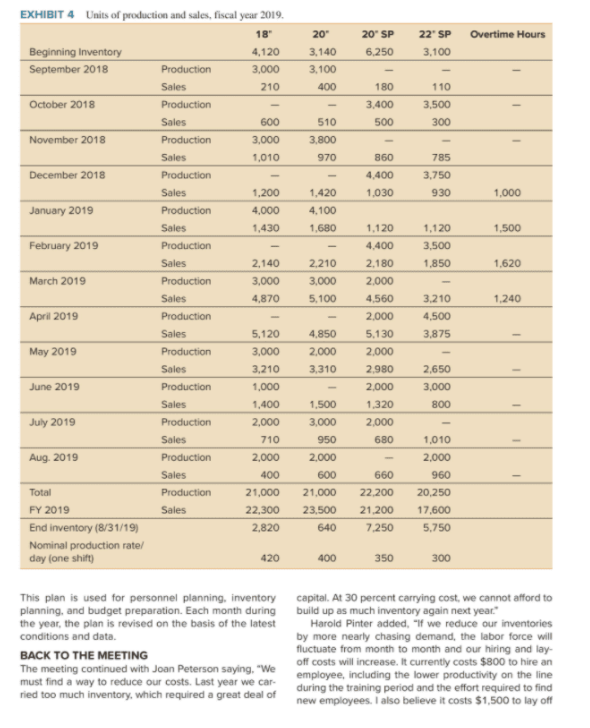

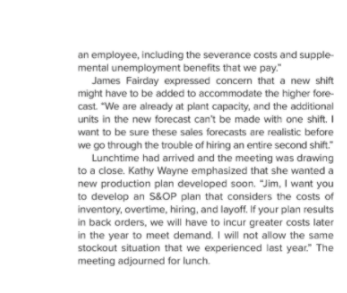

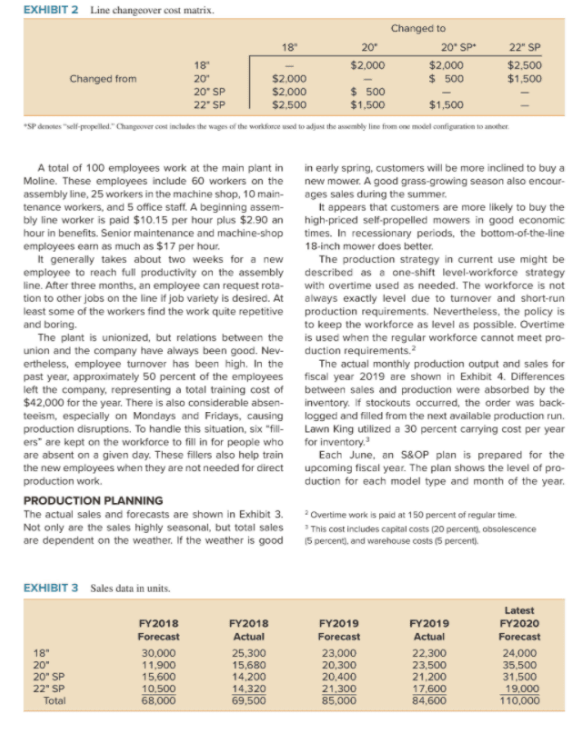

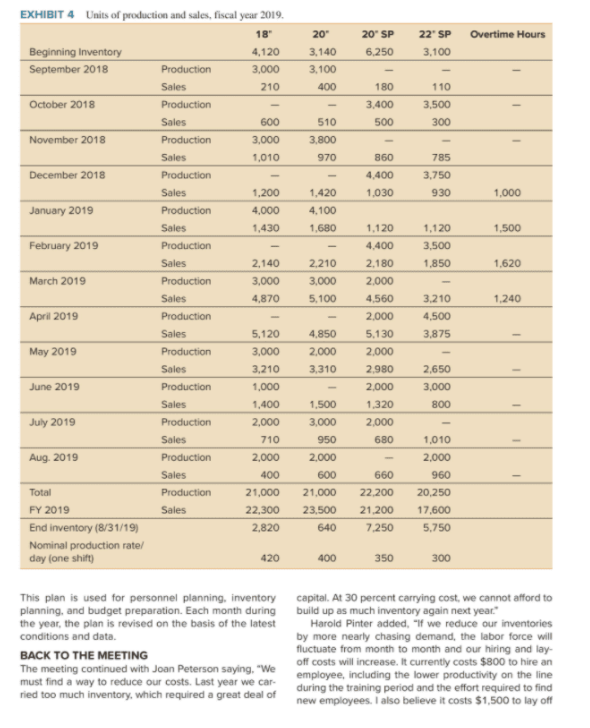

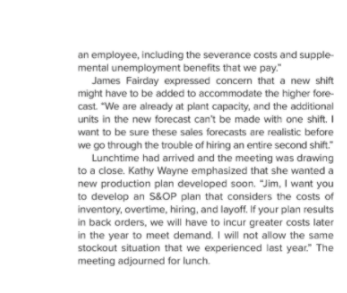

Case Study Lawn King, Inc.: Sales and Operations Planning excel John Conner, marketing manager for Lawn King, looked The changeover cost of the production line depends over the beautiful countryside as he drove to the cor on which type of mower is being produced and the next porate headquarters in Moline, Illinois. John had asked production model planned. For example, it is relatively his boss, Kathy Wayne, the general manager of Lawn easy to change over from the 20-inch push mower to the King. to call a meeting in order to review the latest fore 20-inch self-propelled mower, since the mower frame is cast figures for fiscal year 2020. When he arrived at the same. The self-propelled mower has a propulsion the plant, the meeting was ready to begin. Others in unit added and a slightly larger engine. The company attendance at the meeting were James Fairday, plant estimated the changeover costs as shown in Exhibit 2. manager, Joan Peterson, controller, and Harold Pinter Lawn King fabricates the metal frames and metal parts personnel officer for its lawn mowers in its own machine shop. These fabri- John started the meeting by reviewing the latest situ- cated parts are sent to the assembly line along with parts ation: I've just returned from our annual sales meeting, purchased directly from vendors. In the past year, approx- and I think we lost more sales last year than we thought, imately $8 million in parts and supplies were purchased, due to back-order conditions at the factory. We have including engines, bolts, paint, wheels, and sheet steel also reviewed the forecast for next year and feel that An inventory of $1 million in purchased parts is held to sales will be 110.000 units in fiscal year 2020. The supply the machine shop and the assembly line. When a marketing department feels this forecast is realistic and particular mower is running on the assembly line, only a could be exceeded if all goes well." few days of parts are kept at the plant, since supplies are At this point, James Fairday interrupted by saying, constantly coming into the factory. John, you've got to be kidding. Just three months ago we all sat in this same room and you predicted sales of 98,000 units for fiscal 2020. Now you've raised the forecast by 12 percent. How can we do a reasonable job of production planning when we have a moving target to shoot at?" Kathy interjected, "Jim, I appreciate your concern, but we have to be responsive to changing market condi tions. Here we are in September and we still haven't got a firm plan for fiscal 2020, which has just started. I want to use the new forecast and develop a Sales and Opera- tions Plan (S&OP) for next year as soon as possible." John added, "We've been talking to our best custom- ers, and they're complaining about back orders during the peak selling season. A few have threatened to drop our product line if they don't get better service next year. We have to produce not only enough product but also the right models to service the customer." Potavage fotostock MANUFACTURING PROCESS EXHIBIT 1 Profit and loss statement (5000). Lawn King is a small-sized producer of lawn mower FY2018 FY2019 equipment. Last year, sales were $14.5 million and pretax Sales $11.611 profits were $2 million, as shown in Exhibit 1. The com- $14,462 Cost of goods sold pany makes four lines of lawn mowers: an 18-inch push Materials 6,340 8,005 mower, a 20-inch push mower, a 20-inch self-propelled Direct labor 2.100 2,595 mower, and a 22-inch deluxe self-propelled mower. All Depreciation 743 962 these mowers are made on the same assembly line. Dur. Overhead 256 431 ing the year, the line is changed over from one mower to Total CGS 9.439 11,993 the next to meet the actual and projected demand. G&A expense 270 314 Selling expense 140 197 Total expenses 9.849 12,504 'The Lawn King 2020 fiscal year runs from September 1, 2019, 10 Pretax profit 1.762 1.958 August 31, 2020 This case was prepared by Roger G. Schroeder for class discussion. Copyright by Roger G. Schroeder, 2016, 2019. All rights are reserved. Reprinted with permission EXHIBIT 4 Units of production and sales, fiscal year 2019. 18" 20 20" SP 22" SP Overtime Hours 4,120 3,140 6,250 3,100 Beginning Inventory September 2018 Production 3,000 3,100 - 210 400 180 110 October 2018 Sales Production 3.400 3.500 - Sales 600 510 500 300 November 2018 Production 3,000 3.800 - Sales 1.010 970 860 785 December 2018 Production 4.400 3,750 Sales 1,200 1,420 1.030 930 1.000 January 2019 Production 4,000 4,100 Sales 1,430 1.680 1,120 1,120 1,500 February 2019 Production 4,400 3,500 Sales 2,140 2.210 2.180 1.850 1.620 March 2019 Production 3,000 3,000 2.000 Sales 4,870 5.100 4.560 3.210 1.240 April 2019 Production 2.000 4,500 Sales 5,120 4,850 5,130 3.875 1 May 2019 Production 3,000 2.000 2.000 Sales 3.210 3,310 2,980 2,650 - June 2019 Production 1,000 2.000 3,000 Sales 1,400 1.500 1,320 800 - July 2019 Production 2.000 3,000 2.000 710 950 680 1,010 - Sales Production Aug. 2019 2,000 2.000 2.000 Sales 400 600 660 960 Total Production 21,000 21.000 22.200 20,250 FY 2019 Sales 22.300 23,500 21,200 17,600 2.820 640 7.250 5.750 End inventory (8/31/19) Nominal production rate/ day (one shift 420 400 350 300 This plan is used for personnel planning, inventory planning, and budget preparation. Each month during the year, the plan is revised on the basis of the latest conditions and data BACK TO THE MEETING The meeting continued with Joan Peterson saying, "We must find a way to reduce our costs. Last year we car- ried too much inventory, which required a great deal of capital. At 30 percent carrying cost, we cannot afford to build up as much inventory again next year." Harold Pinter added, "If we reduce our inventories by more nearly chasing demand, the labor force will fluctuate from month to month and our hiring and lay- off costs will increase. It currently costs $800 to hire an employee, including the lower productivity on the line during the training period and the effort required to find new employees. I also believe it costs $1,500 to lay off an employee, including the severance costs and supple mental unemployment benefits that we pay." James Fairclay expressed concern that a new shift might have to be added to accommodate the higher fore cast. "We are already at plant capacity, and the additional units in the new forecast can't be made with one shift. want to be sure these sales forecasts are realistic before we go through the trouble of hiring an entire second shift." Lunchtime had arrived and the meeting was drawing to a close. Kathy Wayne emphasized that she wanted a new production plan developed soon. "Jim, I want you to develop an S&OP plan that considers the costs of inventory, overtime, hiring, and layoff. If your plan results in back orders, we will have to incur greater costs later in the year to meet demand. I will not allow the same stockout situation that we experienced last year. The meeting adjourned for lunch