Question: Developments since the initial penalty In 2016 MTN recorded its first ever annual loss, The loss amounted to R1 103 million. (This was on the

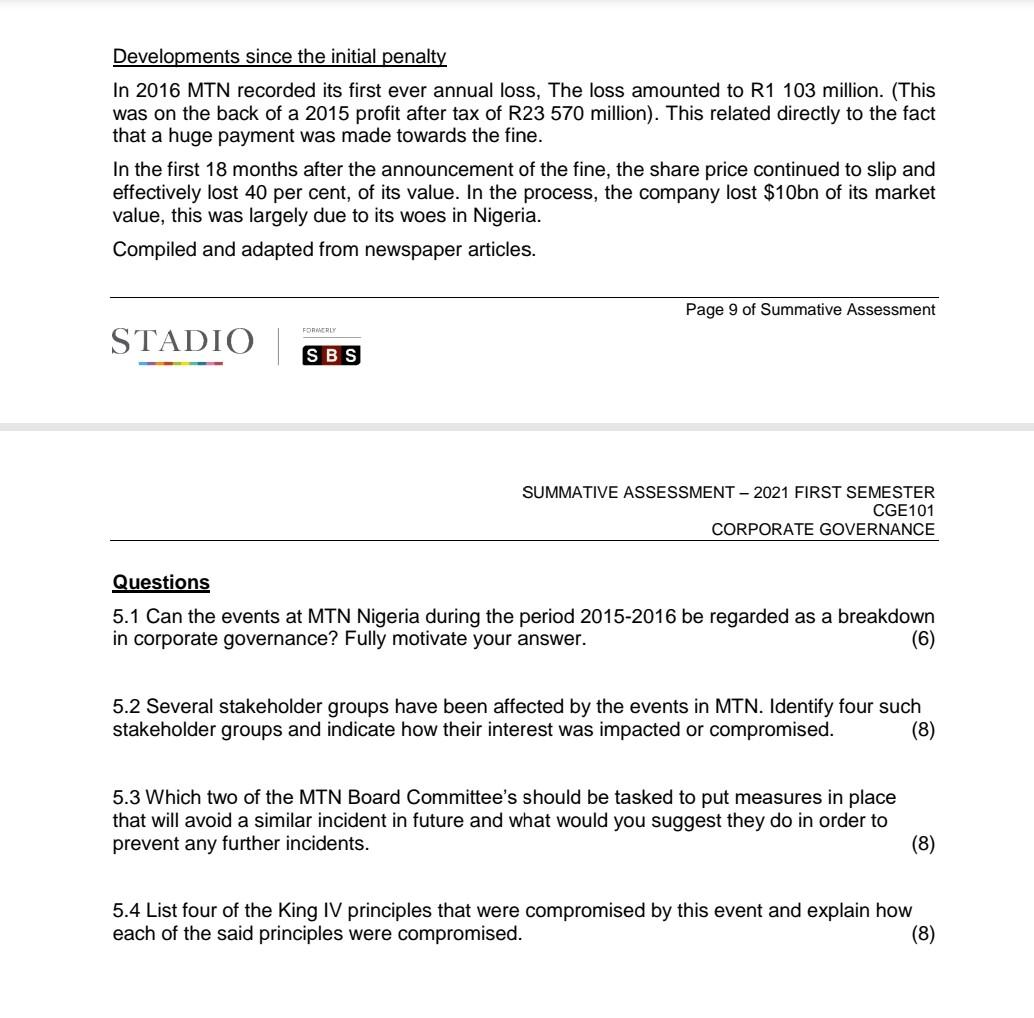

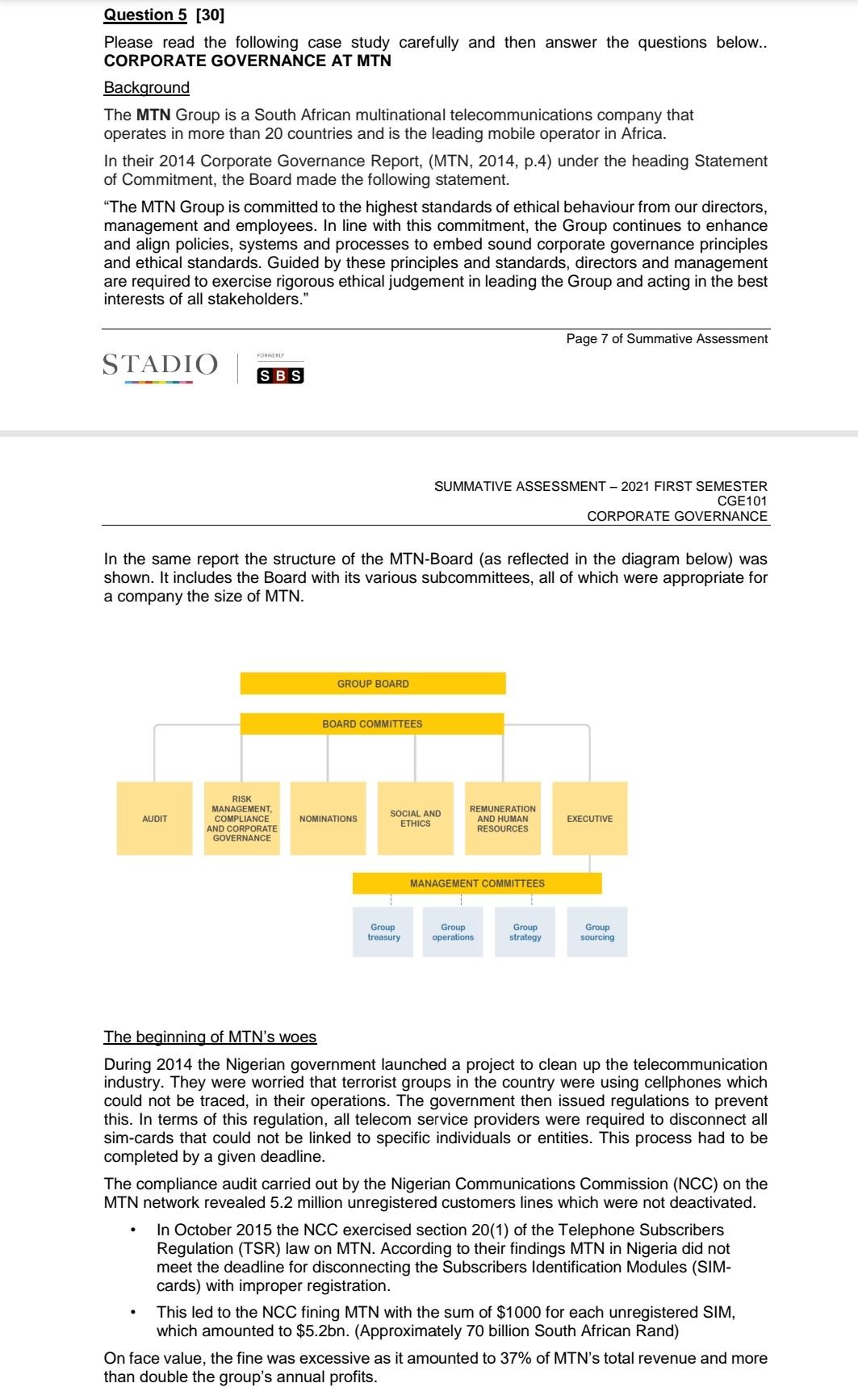

Developments since the initial penalty In 2016 MTN recorded its first ever annual loss, The loss amounted to R1 103 million. (This was on the back of a 2015 profit after tax of R23 570 million). This related directly to the fact that a huge payment was made towards the fine. In the first 18 months after the announcement of the fine, the share price continued to slip and effectively lost 40 per cent, of its value. In the process, the company lost $10bn of its market value, this was largely due to its woes in Nigeria. Compiled and adapted from newspaper articles. Page 9 of Summative Assessment FORMER STADIO SBS SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER CGE101 CORPORATE GOVERNANCE Questions 5.1 Can the events at MTN Nigeria during the period 2015-2016 be regarded as a breakdown in corporate governance? Fully motivate your answer. (6) 5.2 Several stakeholder groups have been affected by the events in MTN. Identify four such stakeholder groups and indicate how their interest was impacted or compromised. (8) 5.3 Which two of the MTN Board Committee's should be tasked to put measures in place that will avoid a similar incident in future and what would you suggest they do in order to prevent any further incidents. (8) 5.4 List four of the King IV principles that were compromised by this event and explain how each of the said principles were compromised. (8) Question 5 [30] Please read the following case study carefully and then answer the questions below.. CORPORATE GOVERNANCE AT MTN Background The MTN Group is a South African multinational telecommunications company that operates in more than 20 countries and is the leading mobile operator in Africa. In their 2014 Corporate Governance Report, (MTN, 2014, p.4) under the heading Statement of Commitment, the Board made the following statement. "The MTN Group is committed to the highest standards of ethical behaviour from our directors, management and employees. In line with this commitment, the Group continues to enhance and align policies, systems and processes to embed sound corporate governance principles and ethical standards. Guided by these principles and standards, directors and management are required to exercise rigorous ethical judgement in leading the Group and acting in the best interests of all stakeholders." Page 7 of Summative Assessment STADIO SBS SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER CGE101 CORPORATE GOVERNANCE In the same report the structure of the MTN-Board (as reflected in the diagram below) was shown. It includes the Board with its various subcommittees, all of which were appropriate for a company the size of MTN. GROUP BOARD BOARD COMMITTEES AUDIT RISK MANAGEMENT, COMPLIANCE AND CORPORATE GOVERNANCE NOMINATIONS SOCIAL AND ETHICS REMUNERATION AND HUMAN RESOURCES EXECUTIVE MANAGEMENT COMMITTEES Group Group treasury Group operations Group strategy sourcing The beginning of MTN's woes During 2014 the Nigerian government launched a project to clean up the telecommunication industry. They were worried that terrorist groups in the country were using cellphones which could not be traced, in their operations. The government then issued regulations to prevent this. In terms of this regulation, all telecom service providers were required to disconnect all sim-cards that could not be linked to specific individuals or entities. This process had to be completed by a given deadline. The compliance audit carried out by the Nigerian Communications Commission (NCC) on the MTN network revealed 5.2 million unregistered customers lines which were not deactivated. In October 2015 the NCC exercised section 20(1) of the Telephone Subscribers Regulation (TSR) law on MTN. According to their findings MTN in Nigeria did not meet the deadline for disconnecting the Subscribers Identification Modules (SIM- cards) with improper registration. This led to the NCC fining MTN with the sum of $1000 for each unregistered SIM, which amounted to $5.2bn. (Approximately 70 billion South African Rand) On face value, the fine was excessive as it amounted to 37% of MTN's total revenue and more than double the group's annual profits. . The subsequent fallout and market response As expected, the news of this massive fine was not received well with shareholders nor with the investor market in general. This resulted in a sell-off of MTN shares and the resultant drop in the share price. See the diagram below. STILL KEEN ON NIGERIA MTN Group share price (R) - Weekly 190 175 160 145 130 115 100 85 waam 70 2015 | Source: Iress 2016 1 2017 1 2018 Dividend The first direct fallout was that the MTN CEO in South Africa, Sifiso Dabengwa, resigning in November. When he announced his resignation, he made the following comment: "Due to the most unfortunate prevailing circumstances occurring at MTN Nigeria, I, in the interest of the company and its shareholders, have tendered my resignation with immediate effect.". The CEO's resignation was followed by that of the CEO of MTN Nigeria, Michael Ikpoki, and regulatory head Akinwale Goodluck. MTN then embarked on a process to try and reduce the size of the fine through negotiation with Nigerian Authorities. On 24 February 2016, MTN announced the payment of $250 million as an advance- payment towards a reduced settlement, which was yet to be finalized. The fine was later reduced to $1.7 billion after a series of negotiations with the Nigerian government. They further agreed that the reduced fine must be fully paid within a period of three years. The telecommunication company also promised to list its stock on the Nigeria Stock Exchange. In line with the agreement, the last tranche of the penalty became payable on 31 May 2019. . Developments since the initial penalty In 2016 MTN recorded its first ever annual loss, The loss amounted to R1 103 million. (This was on the back of a 2015 profit after tax of R23 570 million). This related directly to the fact that a huge payment was made towards the fine. In the first 18 months after the announcement of the fine, the share price continued to slip and effectively lost 40 per cent, of its value. In the process, the company lost $10bn of its market value, this was largely due to its woes in Nigeria. Compiled and adapted from newspaper articles. Page 9 of Summative Assessment FORRER STADIO SBS SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER CGE101 CORPORATE GOVERNANCE Questions 5.1 Can the events at MTN Nigeria during the period 2015-2016 be regarded as a breakdown in corporate governance? Fully motivate your answer. (6) 5.2 Several stakeholder groups have been affected by the events in MTN. Identify four such stakeholder groups and indicate how their interest was impacted or compromised. (8) 5.3 Which two of the MTN Board Committee's should be tasked to put measures in place that will avoid a similar incident in future and what would you suggest they do in order to prevent any further incidents. (8) 9 of 10 5.4 List four of the King IV principles that were compromised by this event and explain how each of the said principles were compromised. (8) Developments since the initial penalty In 2016 MTN recorded its first ever annual loss, The loss amounted to R1 103 million. (This was on the back of a 2015 profit after tax of R23 570 million). This related directly to the fact that a huge payment was made towards the fine. In the first 18 months after the announcement of the fine, the share price continued to slip and effectively lost 40 per cent, of its value. In the process, the company lost $10bn of its market value, this was largely due to its woes in Nigeria. Compiled and adapted from newspaper articles. Page 9 of Summative Assessment FORMER STADIO SBS SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER CGE101 CORPORATE GOVERNANCE Questions 5.1 Can the events at MTN Nigeria during the period 2015-2016 be regarded as a breakdown in corporate governance? Fully motivate your answer. (6) 5.2 Several stakeholder groups have been affected by the events in MTN. Identify four such stakeholder groups and indicate how their interest was impacted or compromised. (8) 5.3 Which two of the MTN Board Committee's should be tasked to put measures in place that will avoid a similar incident in future and what would you suggest they do in order to prevent any further incidents. (8) 5.4 List four of the King IV principles that were compromised by this event and explain how each of the said principles were compromised. (8) Question 5 [30] Please read the following case study carefully and then answer the questions below.. CORPORATE GOVERNANCE AT MTN Background The MTN Group is a South African multinational telecommunications company that operates in more than 20 countries and is the leading mobile operator in Africa. In their 2014 Corporate Governance Report, (MTN, 2014, p.4) under the heading Statement of Commitment, the Board made the following statement. "The MTN Group is committed to the highest standards of ethical behaviour from our directors, management and employees. In line with this commitment, the Group continues to enhance and align policies, systems and processes to embed sound corporate governance principles and ethical standards. Guided by these principles and standards, directors and management are required to exercise rigorous ethical judgement in leading the Group and acting in the best interests of all stakeholders." Page 7 of Summative Assessment STADIO SBS SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER CGE101 CORPORATE GOVERNANCE In the same report the structure of the MTN-Board (as reflected in the diagram below) was shown. It includes the Board with its various subcommittees, all of which were appropriate for a company the size of MTN. GROUP BOARD BOARD COMMITTEES AUDIT RISK MANAGEMENT, COMPLIANCE AND CORPORATE GOVERNANCE NOMINATIONS SOCIAL AND ETHICS REMUNERATION AND HUMAN RESOURCES EXECUTIVE MANAGEMENT COMMITTEES Group Group treasury Group operations Group strategy sourcing The beginning of MTN's woes During 2014 the Nigerian government launched a project to clean up the telecommunication industry. They were worried that terrorist groups in the country were using cellphones which could not be traced, in their operations. The government then issued regulations to prevent this. In terms of this regulation, all telecom service providers were required to disconnect all sim-cards that could not be linked to specific individuals or entities. This process had to be completed by a given deadline. The compliance audit carried out by the Nigerian Communications Commission (NCC) on the MTN network revealed 5.2 million unregistered customers lines which were not deactivated. In October 2015 the NCC exercised section 20(1) of the Telephone Subscribers Regulation (TSR) law on MTN. According to their findings MTN in Nigeria did not meet the deadline for disconnecting the Subscribers Identification Modules (SIM- cards) with improper registration. This led to the NCC fining MTN with the sum of $1000 for each unregistered SIM, which amounted to $5.2bn. (Approximately 70 billion South African Rand) On face value, the fine was excessive as it amounted to 37% of MTN's total revenue and more than double the group's annual profits. . The subsequent fallout and market response As expected, the news of this massive fine was not received well with shareholders nor with the investor market in general. This resulted in a sell-off of MTN shares and the resultant drop in the share price. See the diagram below. STILL KEEN ON NIGERIA MTN Group share price (R) - Weekly 190 175 160 145 130 115 100 85 waam 70 2015 | Source: Iress 2016 1 2017 1 2018 Dividend The first direct fallout was that the MTN CEO in South Africa, Sifiso Dabengwa, resigning in November. When he announced his resignation, he made the following comment: "Due to the most unfortunate prevailing circumstances occurring at MTN Nigeria, I, in the interest of the company and its shareholders, have tendered my resignation with immediate effect.". The CEO's resignation was followed by that of the CEO of MTN Nigeria, Michael Ikpoki, and regulatory head Akinwale Goodluck. MTN then embarked on a process to try and reduce the size of the fine through negotiation with Nigerian Authorities. On 24 February 2016, MTN announced the payment of $250 million as an advance- payment towards a reduced settlement, which was yet to be finalized. The fine was later reduced to $1.7 billion after a series of negotiations with the Nigerian government. They further agreed that the reduced fine must be fully paid within a period of three years. The telecommunication company also promised to list its stock on the Nigeria Stock Exchange. In line with the agreement, the last tranche of the penalty became payable on 31 May 2019. . Developments since the initial penalty In 2016 MTN recorded its first ever annual loss, The loss amounted to R1 103 million. (This was on the back of a 2015 profit after tax of R23 570 million). This related directly to the fact that a huge payment was made towards the fine. In the first 18 months after the announcement of the fine, the share price continued to slip and effectively lost 40 per cent, of its value. In the process, the company lost $10bn of its market value, this was largely due to its woes in Nigeria. Compiled and adapted from newspaper articles. Page 9 of Summative Assessment FORRER STADIO SBS SUMMATIVE ASSESSMENT - 2021 FIRST SEMESTER CGE101 CORPORATE GOVERNANCE Questions 5.1 Can the events at MTN Nigeria during the period 2015-2016 be regarded as a breakdown in corporate governance? Fully motivate your answer. (6) 5.2 Several stakeholder groups have been affected by the events in MTN. Identify four such stakeholder groups and indicate how their interest was impacted or compromised. (8) 5.3 Which two of the MTN Board Committee's should be tasked to put measures in place that will avoid a similar incident in future and what would you suggest they do in order to prevent any further incidents. (8) 9 of 10 5.4 List four of the King IV principles that were compromised by this event and explain how each of the said principles were compromised. (8)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock