Question: Directly copy and paste will not receive thumb up. That's the investment science problem. 11. (Risk analysis) Assume the market portfolio has expected rate of

Directly copy and paste will not receive thumb up. That's the investment science problem.

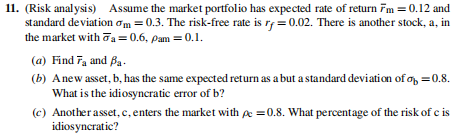

11. (Risk analysis) Assume the market portfolio has expected rate of return im = 0.12 and standard deviation om=0.3. The risk-free rate is rp=0.02. There is another stock, a, in the market with Ta=0.6, Pam = 0.1. (a) Find Fa and Ba. (b) Anew asset, b, has the same expected return as a but a standard deviation of b=0.8. What is the idiosyncratic error of b? (c) Another asset, c, enters the market with pe =0.8. What percentage of the risk of cis idiosyncratic? =

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock