Question: Dn December 3 1 , 2 0 1 5 , Fredericksburg, Inc. had no temporary differences that created deferred income Dn January 2 , 2

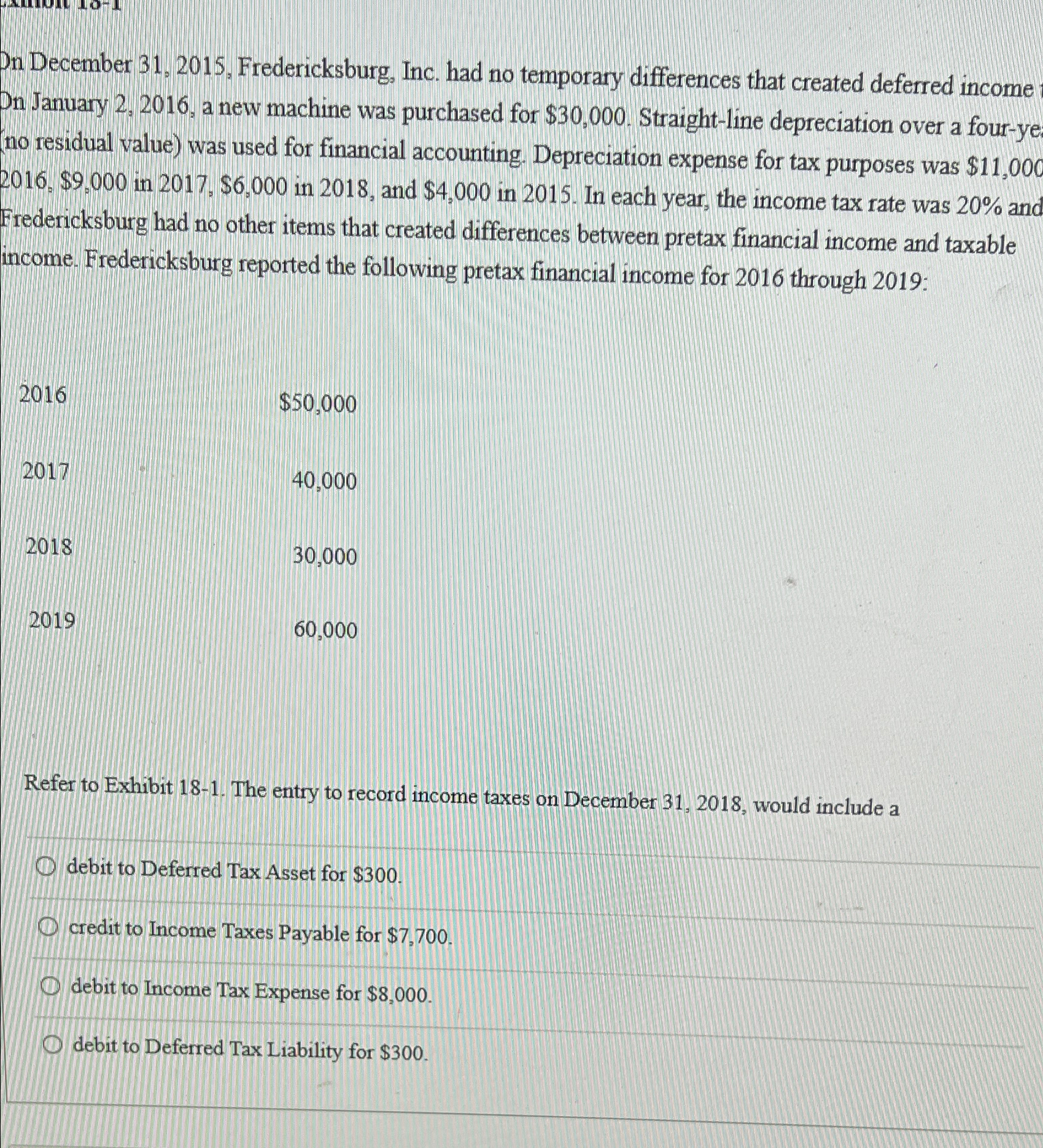

Dn December Fredericksburg, Inc. had no temporary differences that created deferred income Dn January a new machine was purchased for $ Straightline depreciation over a fourye no residual value was used for financial accounting. Depreciation expense for tax purposes was $$ in $ in and $ in In each year, the income tax rate was anc Fredericksburg had no other items that created differences between pretax financial income and taxable income. Fredericksburg reported the following pretax financial income for through :

table$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock