Question: Do ALL 5 questions (65 marks) - 15% Question 1 (12 marks) Consider a hypothetical economy in which commercial banks are required to maintain a

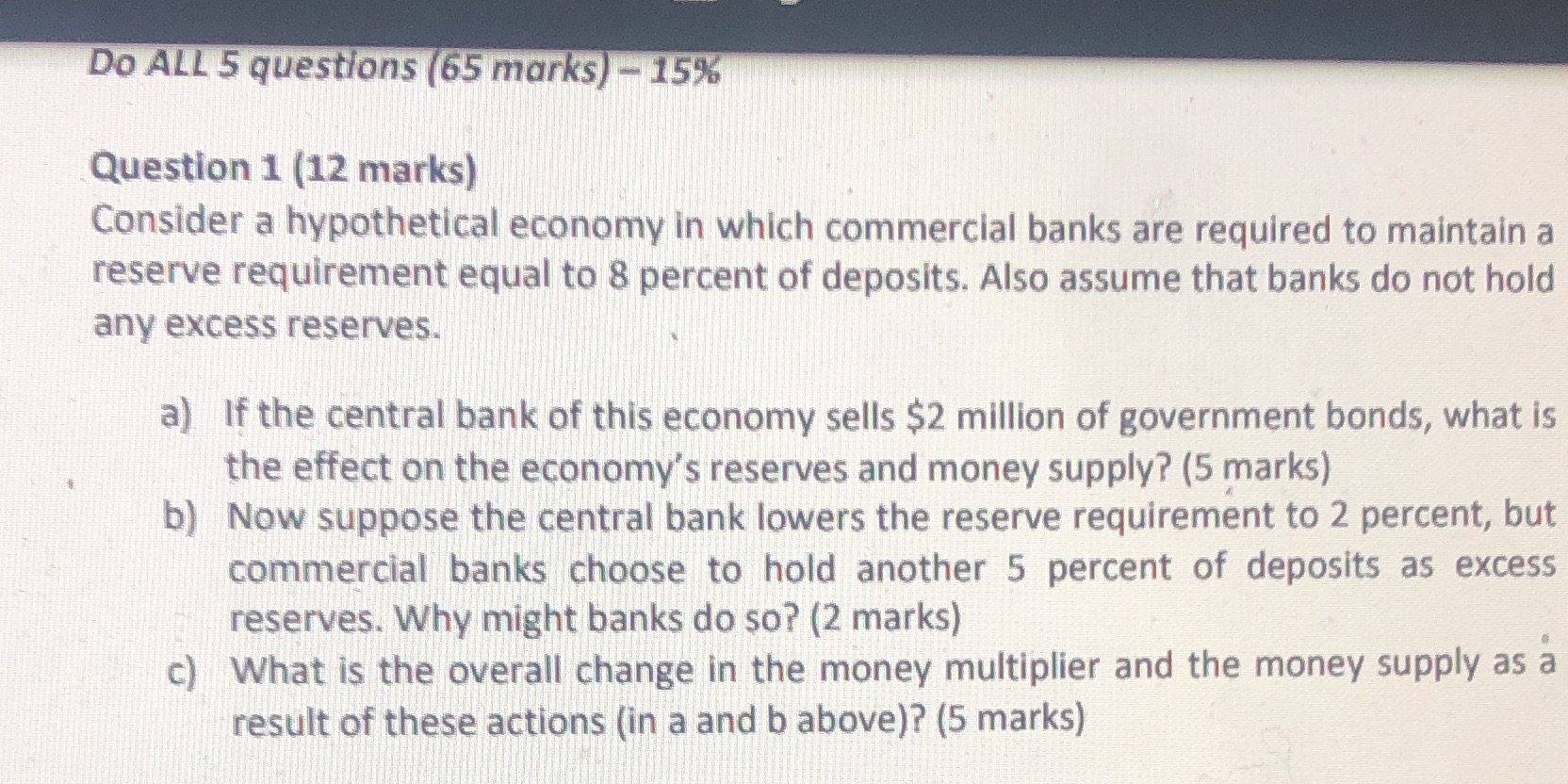

Do ALL 5 questions (65 marks) - 15% Question 1 (12 marks) Consider a hypothetical economy in which commercial banks are required to maintain a reserve requirement equal to 8 percent of deposits. Also assume that banks do not hold any excess reserves. a) If the central bank of this economy sells $2 million of government bonds, what is the effect on the economy's reserves and money supply? (5 marks) b) Now suppose the central bank lowers the reserve requirement to 2 percent, but commercial banks choose to hold another 5 percent of deposits as excess reserves. Why might banks do so? (2 marks) c) What is the overall change in the money multiplier and the money supply as a result of these actions (in a and b above)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts