Question: do all the steps. I am including a problem and an example. do all the steps that the example problem have. example problem Question problem

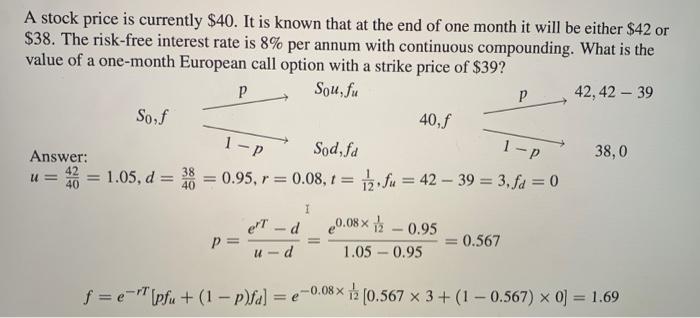

A stock price is currently $40. It is known that at the end of one month it will be either $42 or $38. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-month European call option with a strike price of $39? Sou, fu 42,42 - 39 So,f 40,5 Sod, fd 38,0 Answer: 1.05, d = 28 = 0.95, r = 0.08,1 = 12 fu = 42 39 = 3, fd = 0 1-p 1-P U= 40 1 eT - d p = 20.08x12 -0.95 1.05 -0.95 0.567 u-d f = e-"" [pfu + (1 - p)fal=e0.08x pz (0.567 x 3 + (1 - 0.567) > 0) = 1.69 Problem 1: A stock price is currently $45. It is known that at the end of one month it will be either $42 or $38. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-month European call option with a strike price of $39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts