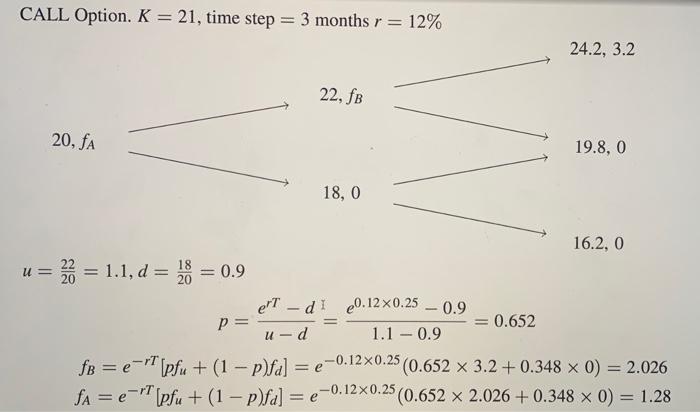

Question: do all the steps. I am including a problem and an example. do all the steps that the example problem have. Example question CALL Option.

CALL Option. K 21, time step = 3 months r 12% 24.2, 3.2 22, fB 20, SA 19.8, 0 18,0 U = 18 20 16.2, 0 = 2 = 1.1, d= = 0.9 eT - dI 20.12X0.25 - 0.9 p= 0.652 u - d 1.1 -0.9 fb = e-T [pfu + (1 - p)fa] = e-0.12X0.25 (0.652 x 3.2 +0.348 x 0) = 2.026 fa = e-'T [pfu + (1 - p)fa] = e =0,12x0.25 (0.652 x 2.026 + 0.348 x 0) = 1.28 Problem 3: A stock price is currently $100. Over each of the next two six-month periods it is expected to go up by 12% or down by 12%. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-year European call option with a strike price of $110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts